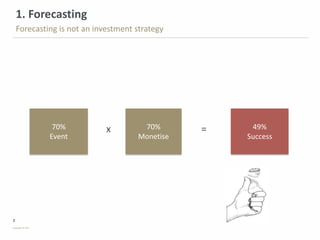

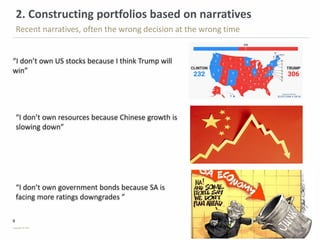

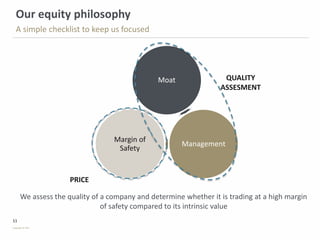

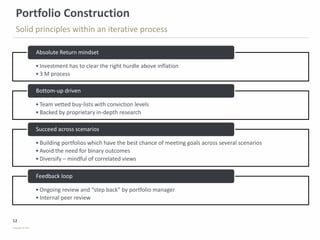

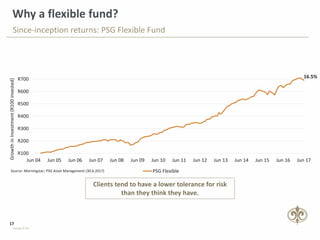

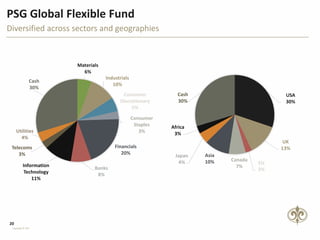

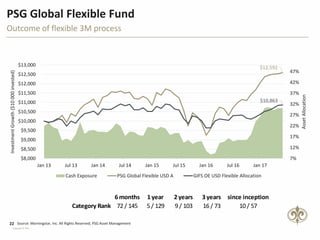

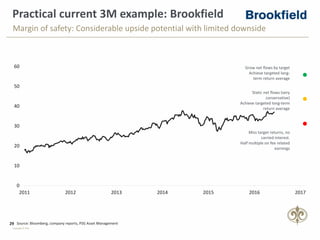

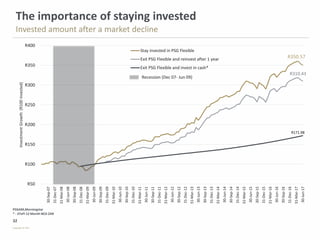

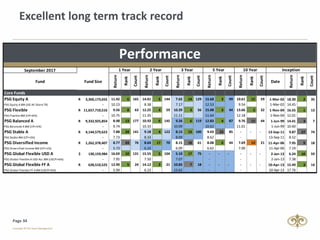

This document provides an overview of PSG Asset Management's investment philosophy and process. It discusses the dangers of forecasting and narrative-based investing. It emphasizes the importance of bottom-up, valuation-driven stock picking and portfolio construction based on quality assessment, price, and margin of safety. It highlights the benefits of a flexible mandate and staying invested for the long term. Examples of current investments in Discovery, Brookfield, and others are discussed in the context of applying PSG's investment criteria. Long term performance results of PSG funds are also presented.