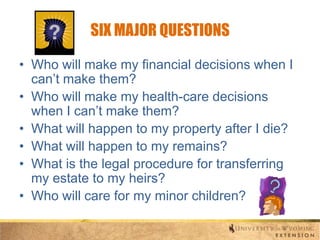

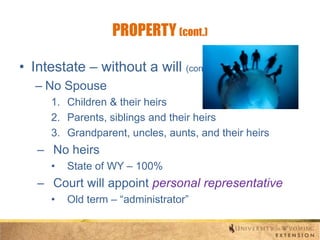

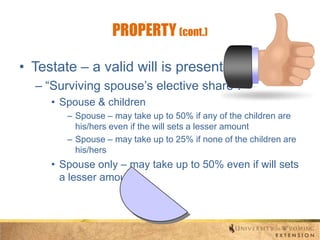

This document provides an introduction to estate planning. It discusses key estate planning tools like wills, durable powers of attorney, healthcare directives, trusts, and beneficiary designations. The document outlines how property is transferred when a person dies with or without a will, and explains important legal requirements for wills in Wyoming. It also summarizes procedures for probate, appointing guardians, and distributing remains. The document aims to explain major considerations and options for estate planning.