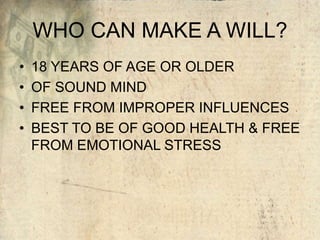

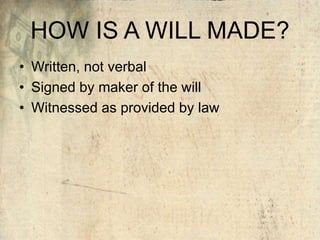

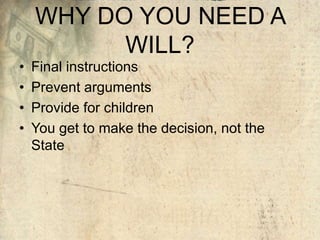

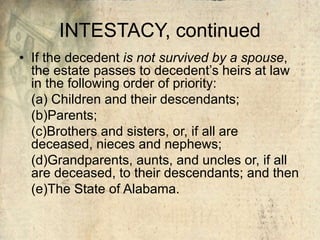

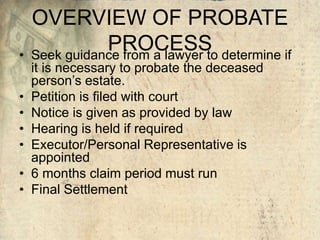

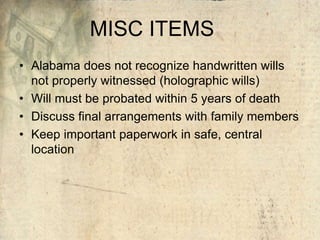

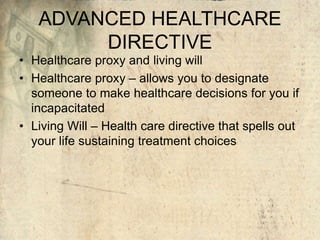

This document provides an overview of basic estate planning tools including wills, powers of attorney, healthcare directives, trusts, and life insurance. It discusses the three main legal documents involved in estate planning - a last will and testament, power of attorney, and advanced healthcare directive. It also describes what happens if a person dies without a will, defines some common legal terms, and provides brief descriptions of term and whole life insurance.