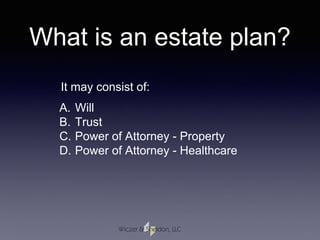

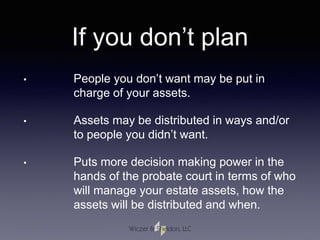

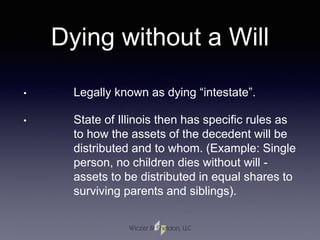

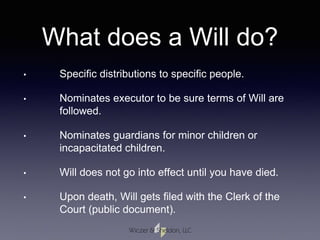

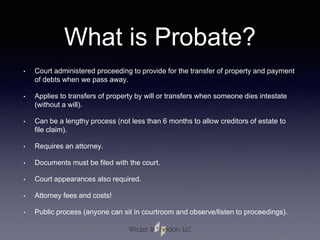

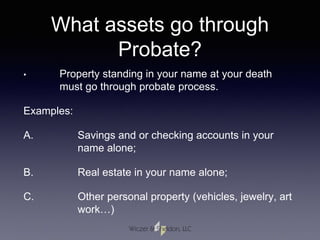

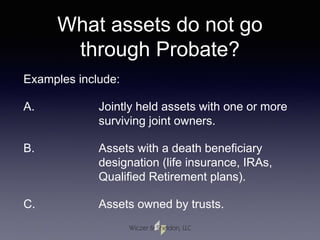

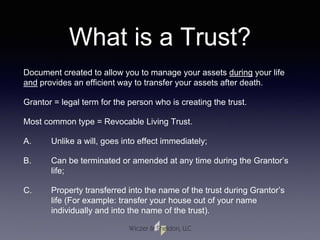

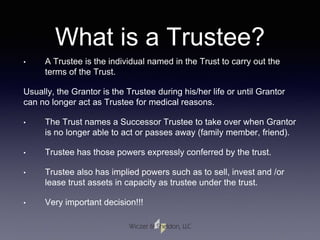

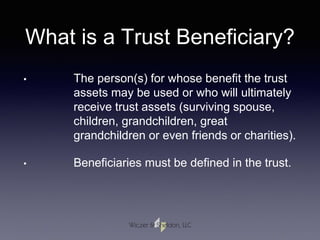

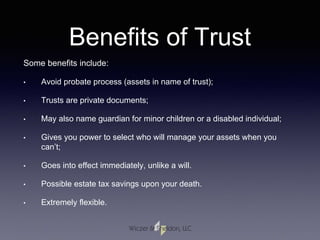

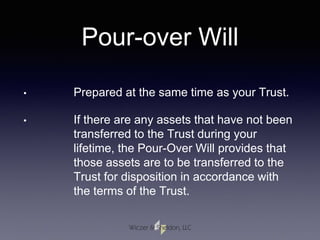

This document outlines the basics of estate planning, highlighting the importance of having a will, trust, and powers of attorney to manage personal and financial matters. It explains the probate process, including what assets go through probate, and discusses trusts' benefits, such as avoiding probate and providing privacy. The document also emphasizes the roles of trustees and beneficiaries in trust management and the significance of health and property power of attorney.