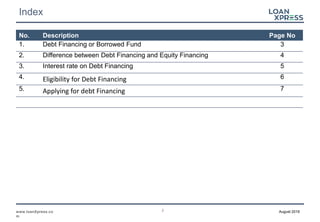

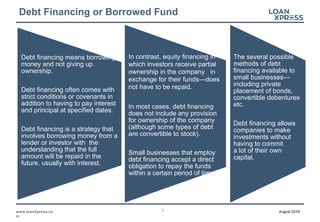

The document introduces various types of debt financing available to small businesses, including loans, bonds, and convertible debentures. It explains how debt financing works, the differences between debt and equity financing, factors considered in debt financing eligibility like credit ratings and collateral, and tips for applying for debt financing like comparing interest rates and checking prepayment terms. The document is published by LoanXpress, a company that provides corporate financing services.