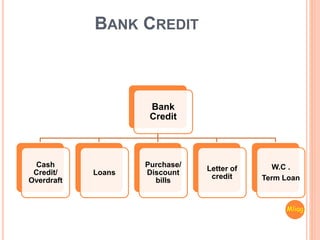

Debt financing involves borrowing money that must be paid back over time. There are several sources of debt financing for both working capital in the short-term and long-term needs. Sources of short-term working capital include trade credit, bank loans, commercial paper, and factoring. Sources of long-term financing include debentures, term loans, and securitization, with debentures being long-term securities that pay a fixed interest rate. Proper debt financing allows companies to augment resources and meet both short and long-term capital requirements.