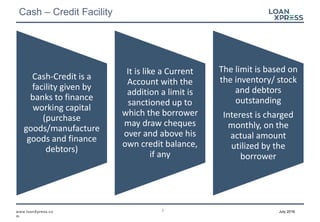

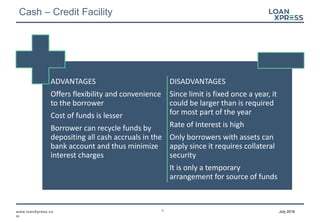

The document discusses a cash-credit facility provided by banks to finance working capital needs like purchasing goods and financing debtors. A cash-credit limit is sanctioned based on a company's inventory, stock, and debtors outstanding, up to which they can draw checks over their account balance. Interest is charged monthly on the actual amount utilized. The facility offers flexibility but charges high interest rates. It requires collateral like hypothecating stocks and debtors and is a temporary arrangement for funds.