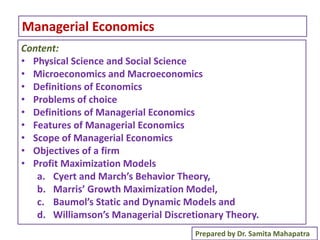

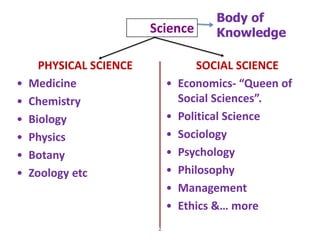

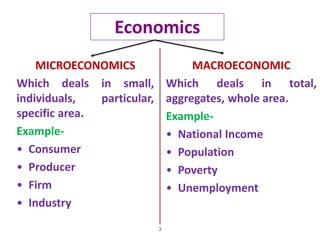

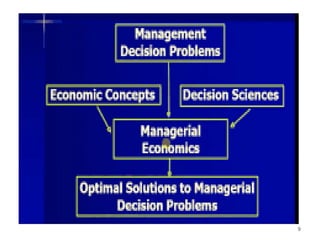

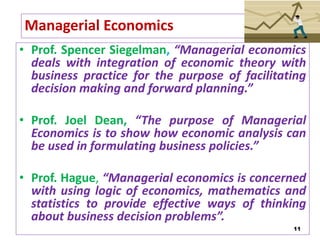

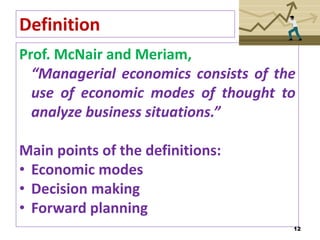

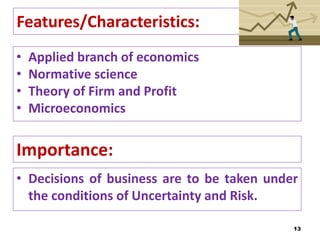

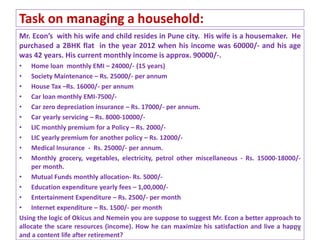

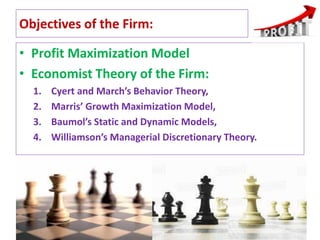

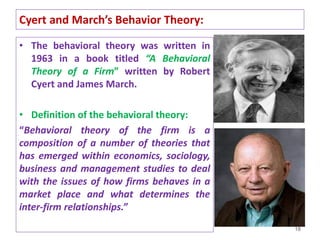

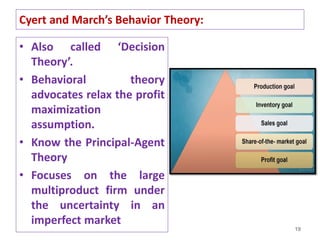

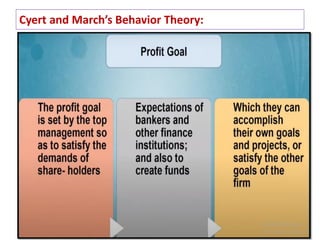

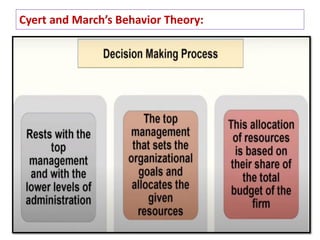

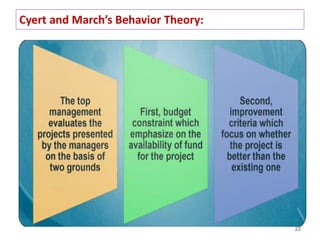

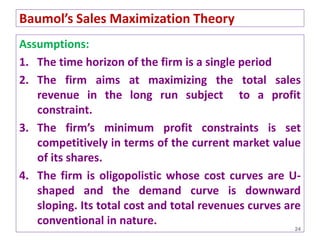

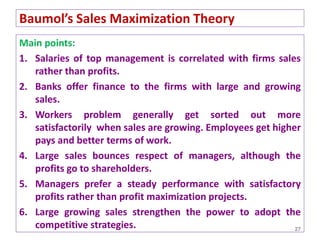

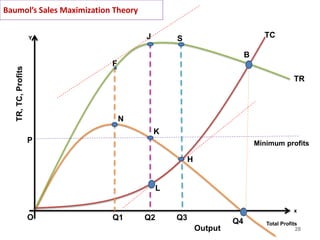

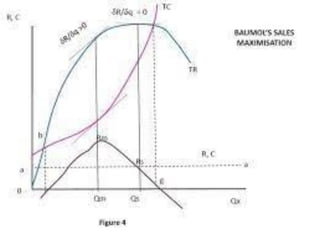

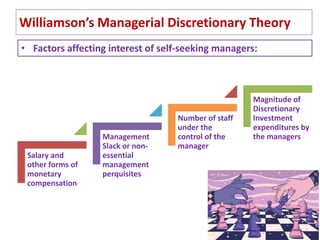

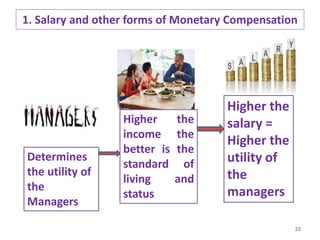

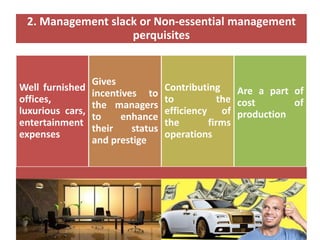

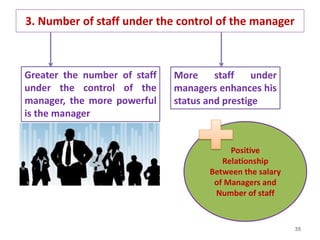

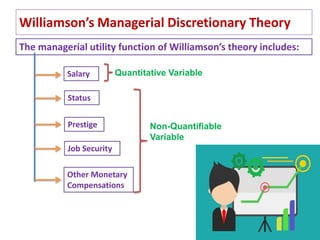

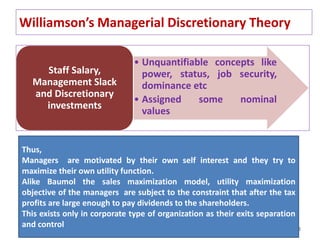

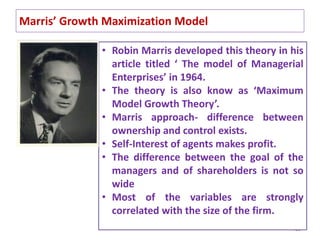

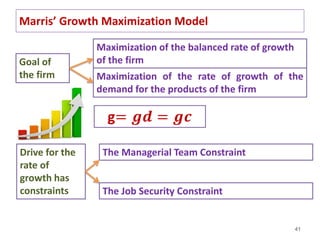

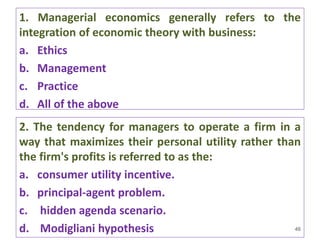

The document discusses managerial economics, integrating economic theory with business practice to facilitate decision-making in firms. It covers various models for profit and growth maximization, such as Cyert and March's behavior theory, Baumol's sales maximization theory, and Williamson's managerial discretionary theory. Additionally, it emphasizes the importance of understanding firm objectives, uncertainty in business decisions, and household resource allocation.