There are three main managerial theories described in the document:

1. Baumol's Model of Sales Revenue Maximization suggests that managers pursue sales maximization over profit maximization to boost their prestige, power, and job security.

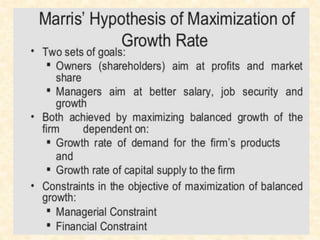

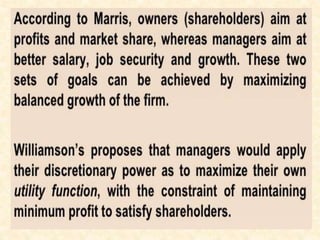

2. Marris's Theory of Managerial Enterprise notes the separation of ownership and management allows managers to set goals that benefit themselves rather than owners, such as prioritizing growth over profits.

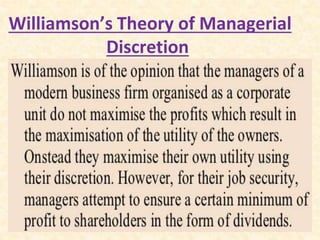

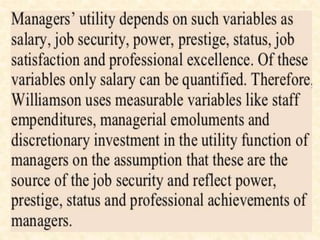

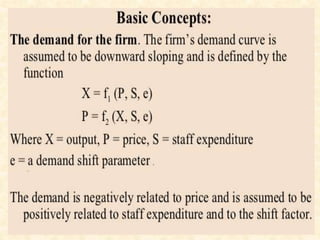

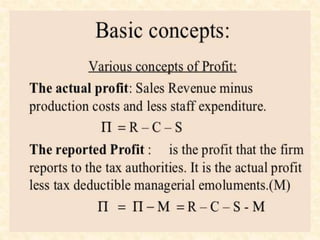

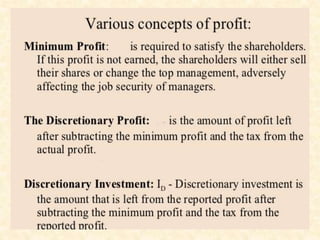

3. Williamson's Theory of Managerial Discretion discusses how managers have discretion over decisions and may not always act in the owners' best interests.