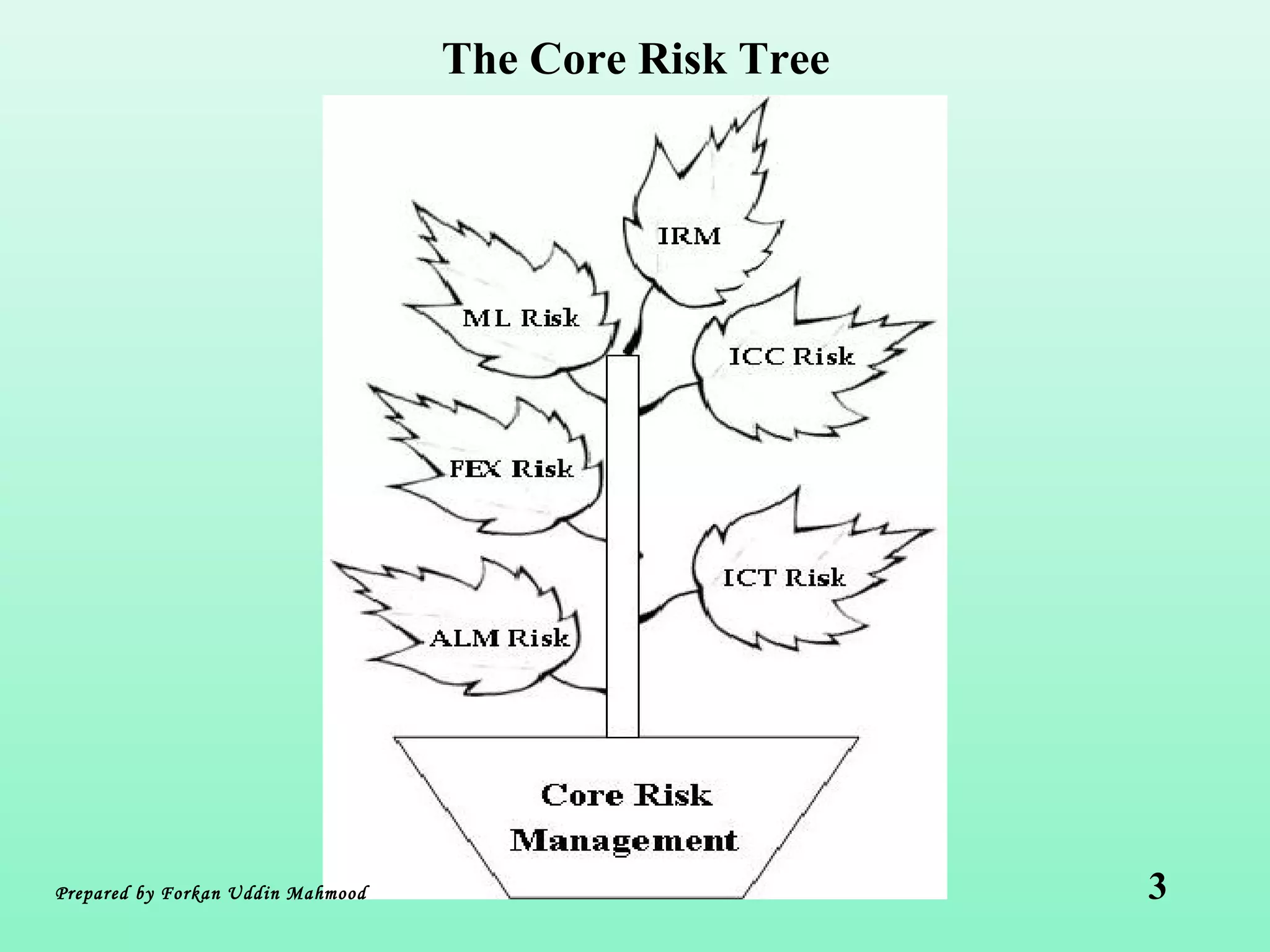

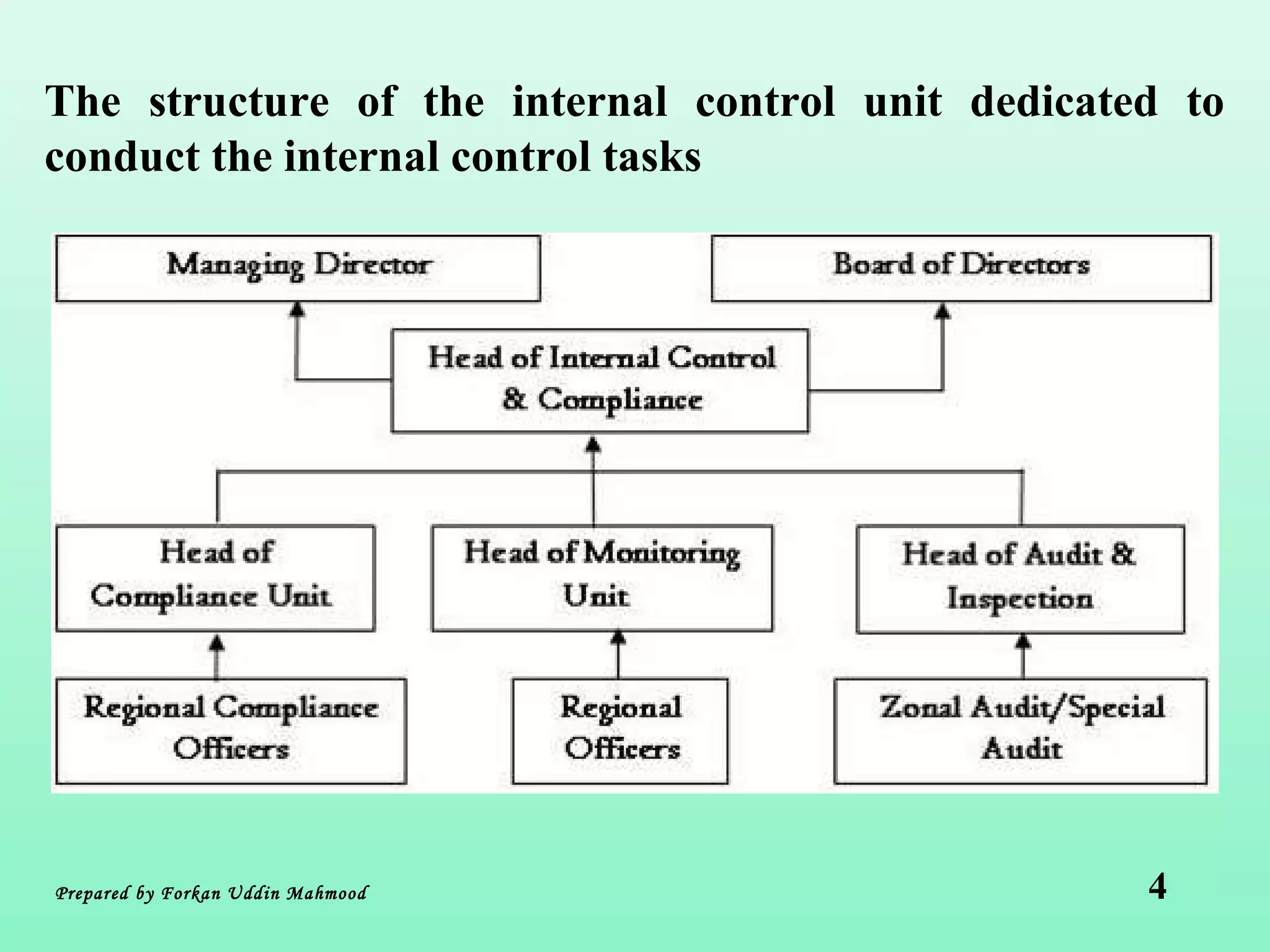

The document discusses internal control and compliance mechanisms in Islamic banks. It notes that modern banking activities involve high risks, so effective internal control systems and corporate governance are important. Bangladesh Bank has introduced six core risk areas for the banking sector. The document outlines the structure of an internal control unit and defines internal control. It discusses key factors like the board of directors, audit committee, and management committee. It also describes the functions of various internal control and compliance departments, including auditing, monitoring, and ensuring regulatory compliance. Finally, it identifies some reasons why controls may not always work as intended.