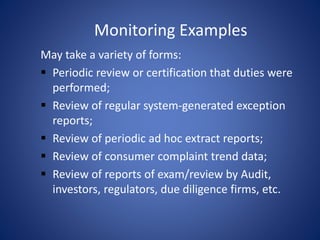

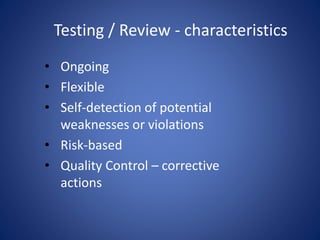

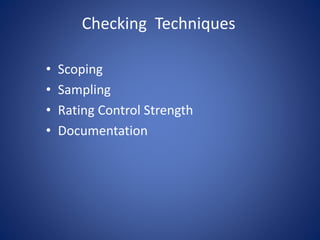

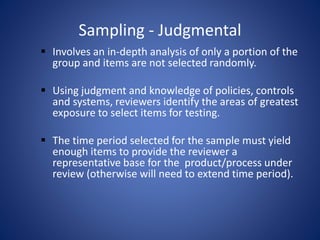

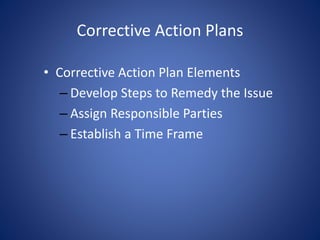

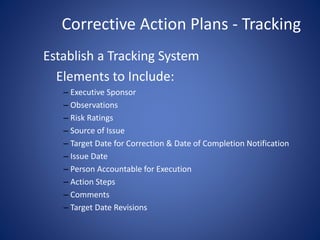

The document discusses the continuous program cycle for internal audit and monitoring compliance programs. It describes designing, implementing, checking, correcting, and reporting as the ongoing cycle. Key aspects discussed include establishing an annual monitoring plan, defining monitoring, testing, quality control and auditing. The presentation provides guidance on sampling techniques, rating control strength, documentation, corrective action plans, and reporting findings.