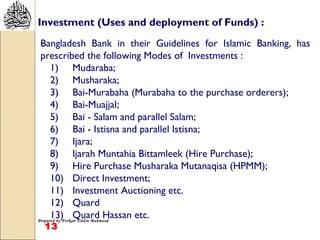

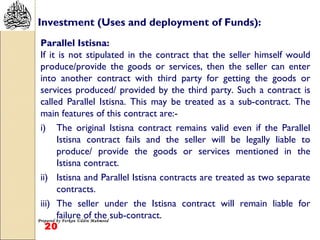

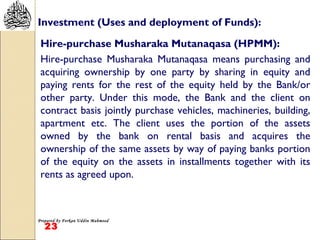

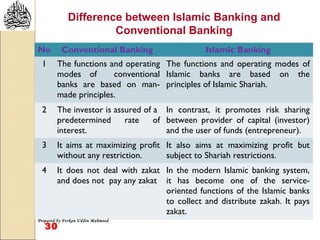

Islamic banking provides banking services according to Islamic law and avoids interest. It defines key concepts like riba (interest), mudaraba deposits, and principles of permissible investments. Some major principles discussed are prohibition of riba, risk sharing between depositors and banks, social justice, and sharia compliance. Permissible modes of investment discussed include mudaraba, musharaka, murabaha, ijara, istisna and direct investment. Deposits can be accepted through al-wadeeah or mudaraba contracts.