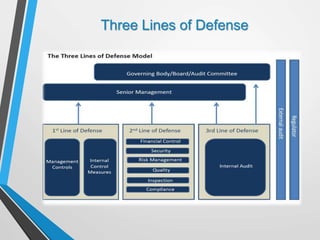

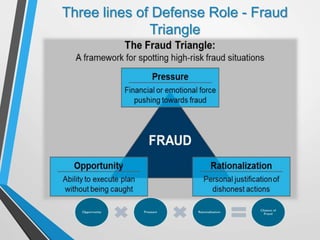

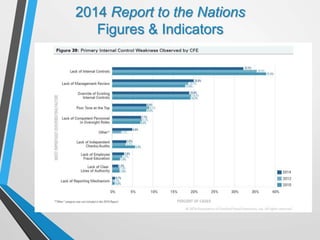

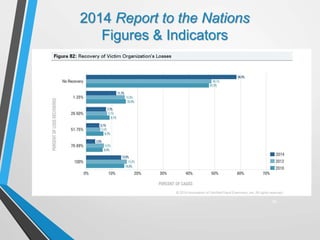

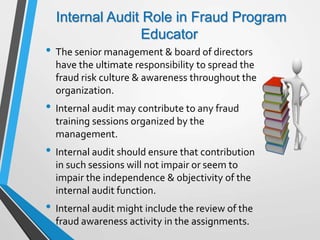

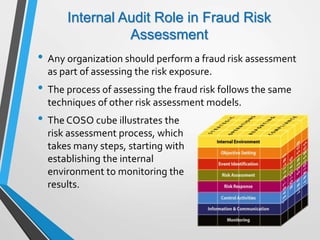

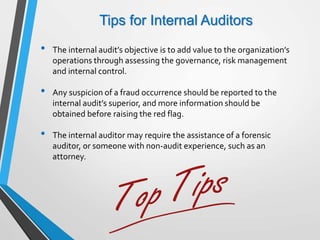

The document discusses the role of internal audit in preventing and detecting fraud. It covers topics like corporate governance, the three lines of defense model, fraud risk assessment, and internal audit standards. The objectives are to understand governance tools, the nature of internal audit regarding fraud, and tips for internal auditors to increase fraud awareness and detection.