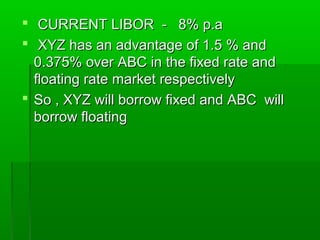

An interest rate swap involves the exchange of interest payment streams between two parties, where one pays a fixed rate of interest and receives a floating rate, and vice versa. It allows parties to hedge against interest rate risk and borrow at more advantageous rates. A coupon swap specifically refers to an interest rate swap where only the interest payments are exchanged and not the principal. It provides benefits to both parties by allowing each to borrow at a lower rate in their preferred market.