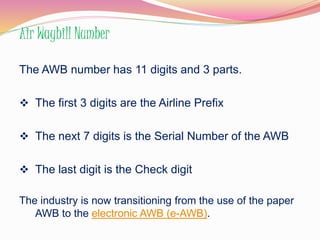

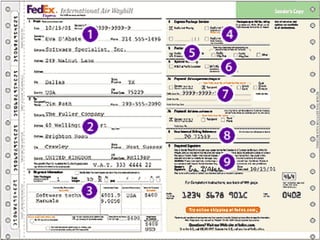

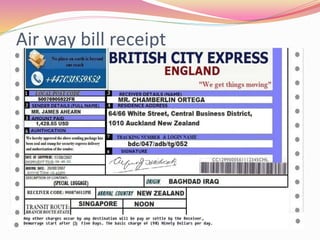

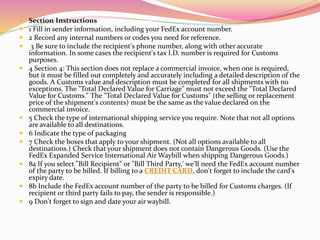

The air waybill (AWB) is a receipt issued by an airline to acknowledge carriage of goods. It serves several purposes: as a contract of carriage, evidence of receipt of goods, freight bill, certificate of insurance, and customs declaration. The AWB number contains three parts - airline prefix, serial number, and check digit. The industry is transitioning from paper to electronic AWBs.