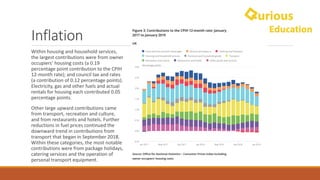

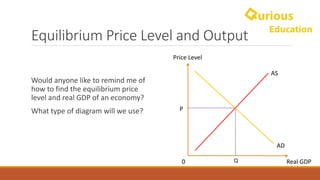

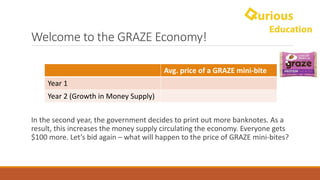

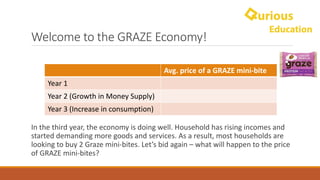

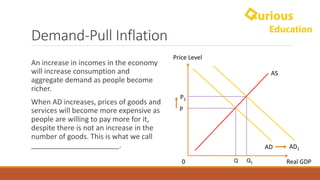

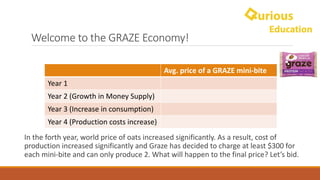

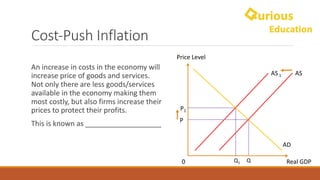

The document outlines the structure of a lesson on inflation for A-level and IB economics, detailing methods of measuring inflation and its causes, including demand-pull and cost-push inflation. It discusses the Consumer Price Index (CPI) and its limitations, as well as the impacts of money supply and increased consumption on inflation. Additionally, it involves interactive discussions on real-life examples of inflation and its contributors.