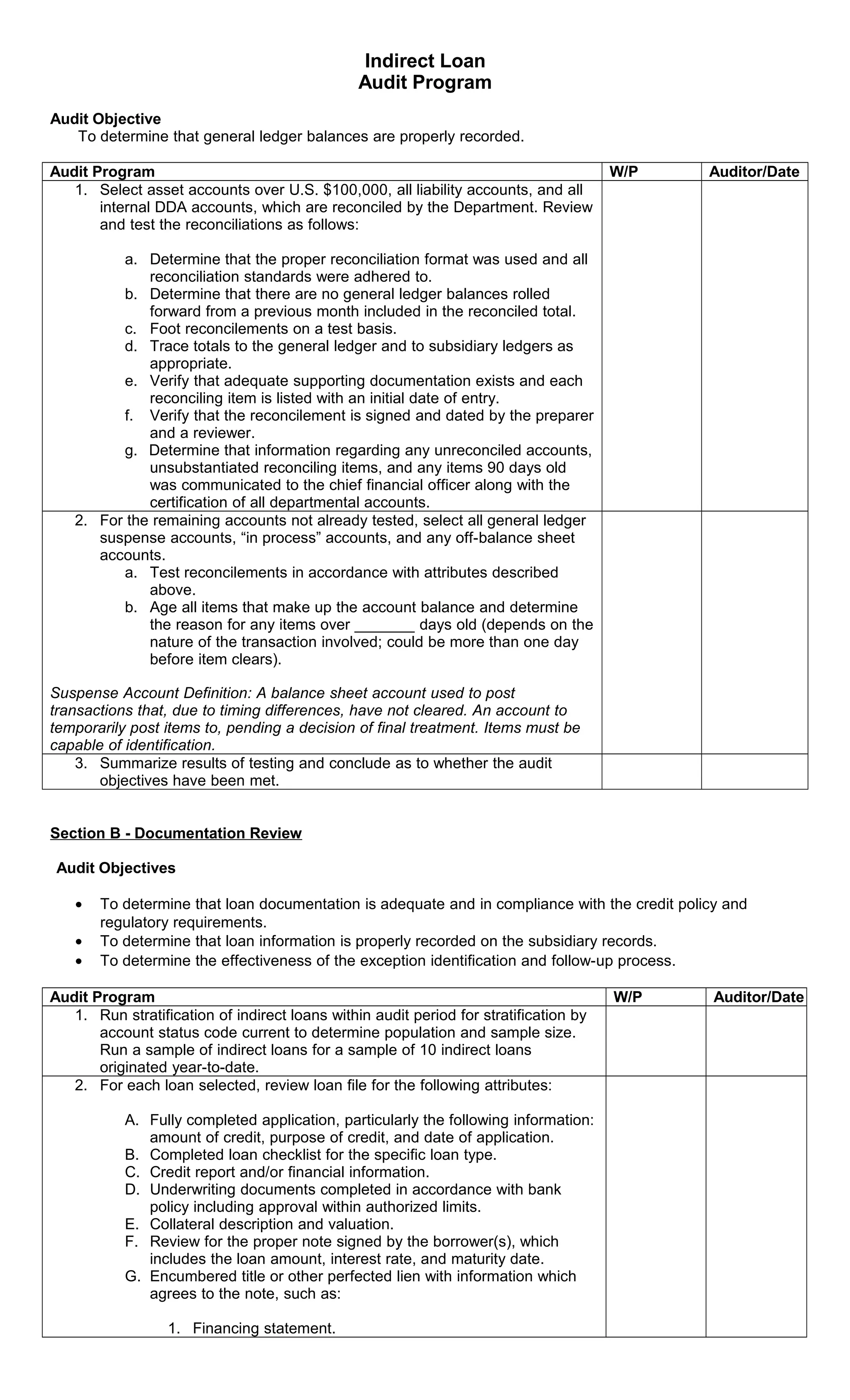

This audit program summarizes procedures to audit an indirect loan portfolio in four sections:

1) Ensuring general ledger balances are properly recorded by testing reconciliations of selected accounts.

2) Verifying loan documentation complies with credit policy and regulations by reviewing a sample of loan files.

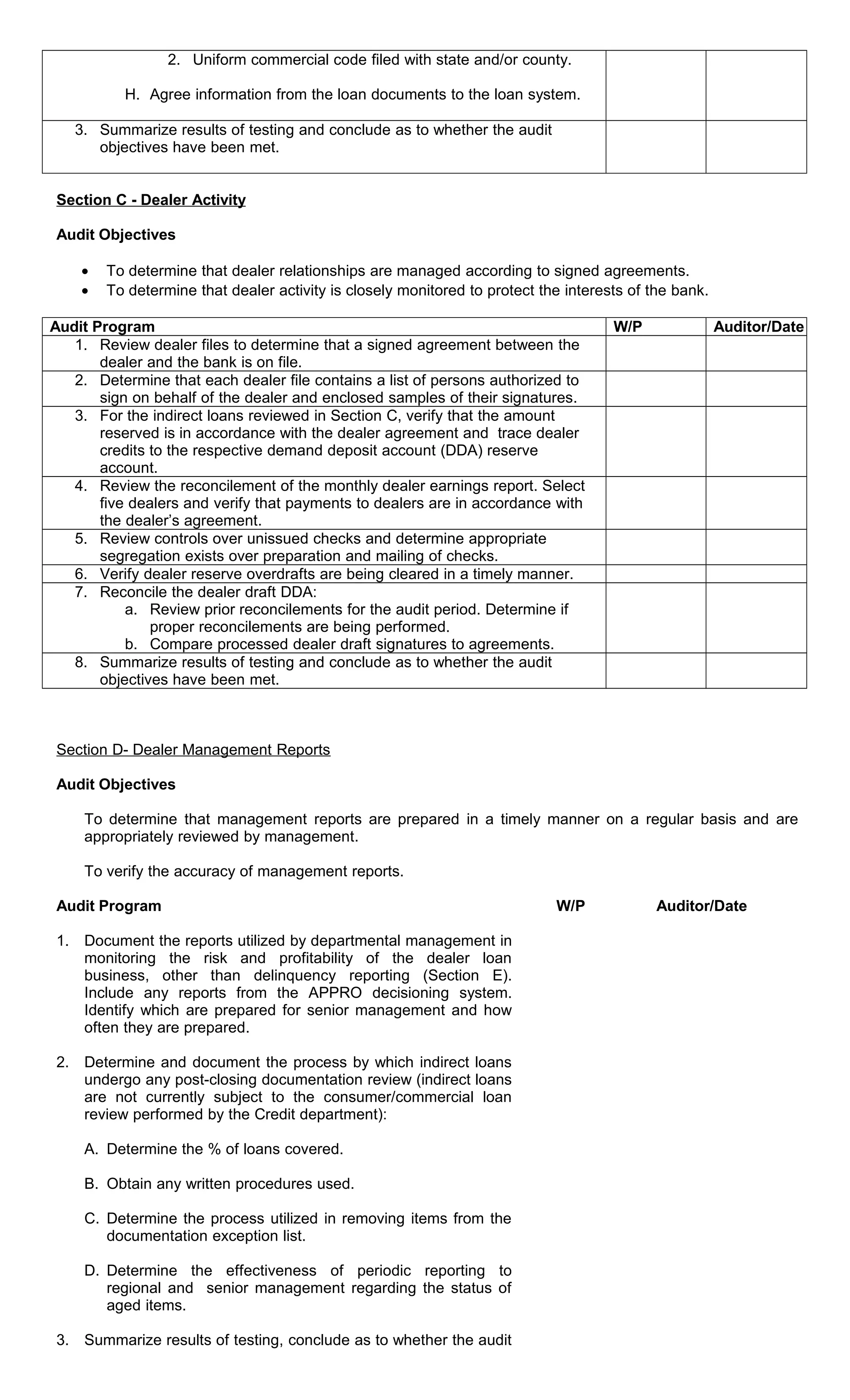

3) Confirming dealer relationships are properly managed and monitored by reviewing dealer agreements and activity.

4) Determining timely and accurate management reports are prepared and reviewed by documenting reports used and the post-closing loan review process.