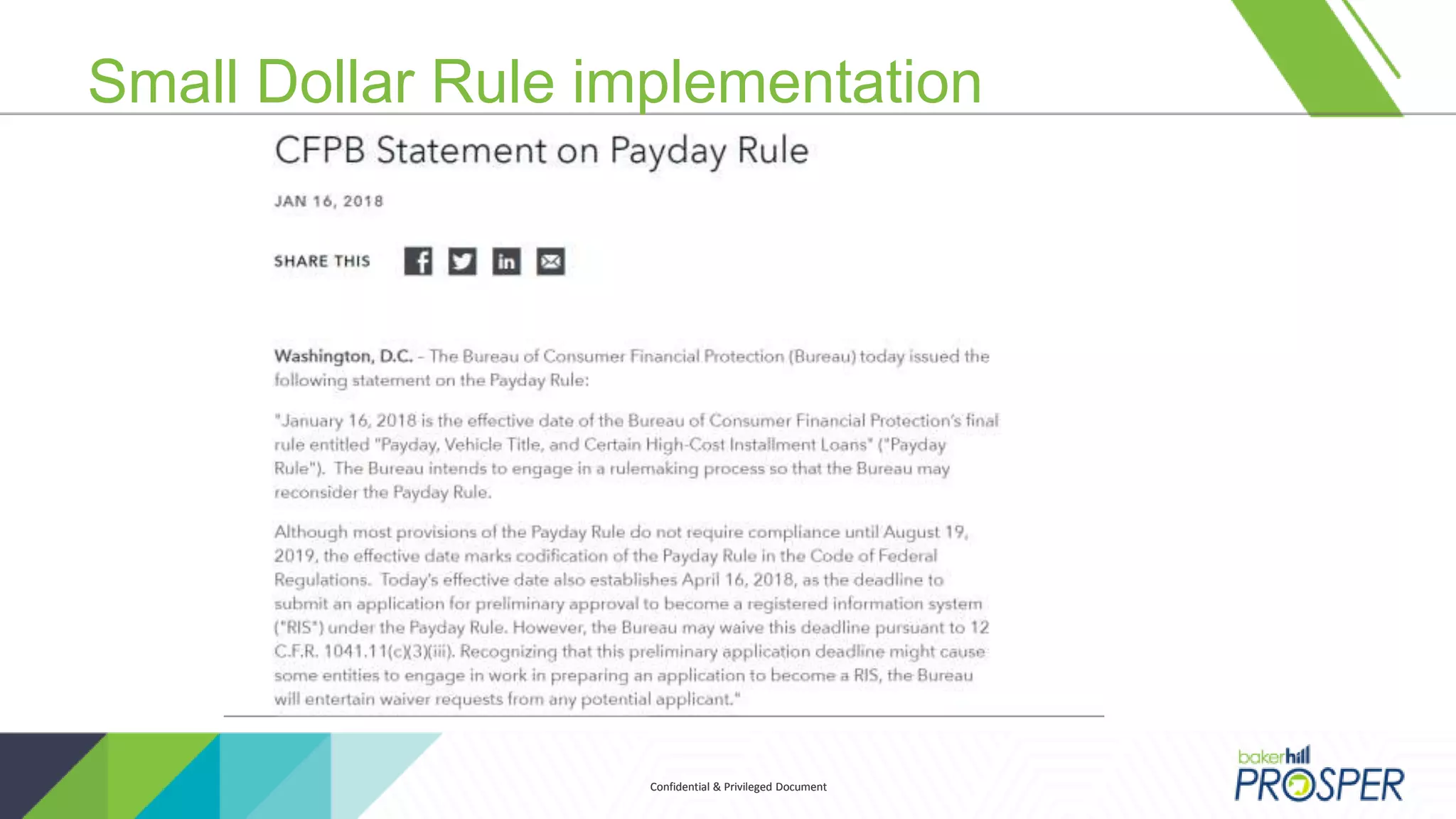

This document summarizes a presentation on 2018 regulatory updates given by Doug Johnson and Melissa Sewell. The presentation covered new HMDA and small dollar lending regulations, including key data fields examiners will focus on and new transaction testing guidelines. It also discussed upcoming regulatory hot topics like CECL accounting standards and electronic signatures.