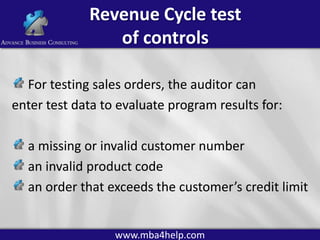

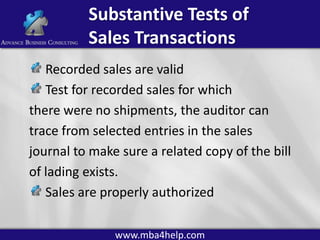

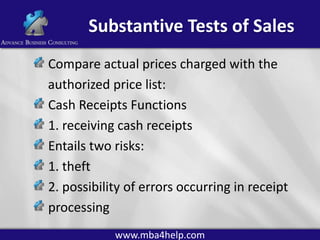

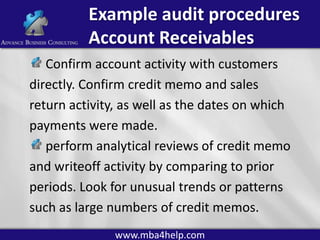

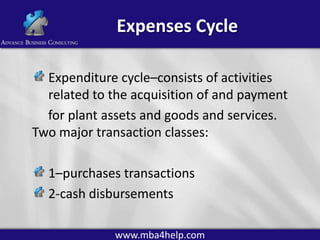

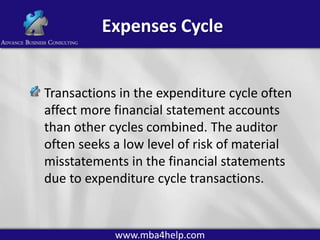

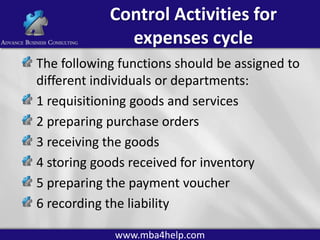

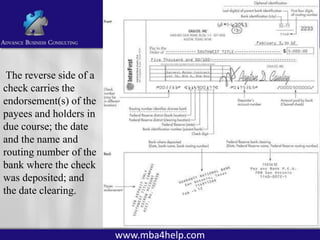

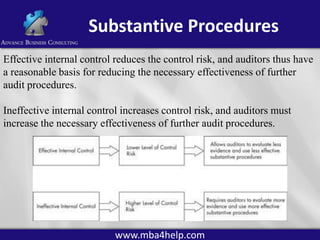

The document discusses various audit procedures related to testing cash, revenue, expenses, investments, financing, and other cycles. It provides examples of substantive tests that can be performed for balances such as plant assets, long-term debt, and cash. It also describes audit evidence that can be used, including cash disbursement journals, bank reconciliations, canceled checks, and confirmations with customers, lenders, and banks. The document is a reference guide for auditors, outlining the types of tests and evidence applicable for different financial statement line items and cycles.