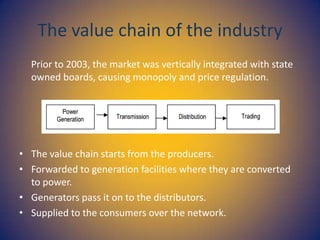

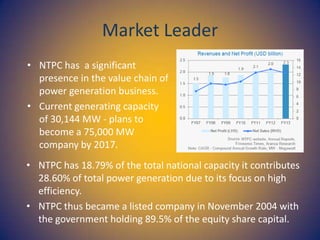

The document analyzes the Indian power sector, highlighting key success factors such as market positioning, regulatory compliance, cost management, and diversification. It emphasizes the impact of governmental policies, economic growth, technological challenges in CO2 reduction, and social issues affecting power demand. Additionally, it discusses market leaders like NTPC and Tata Power, detailing their capacities, roles in the value chain, and growth strategies.