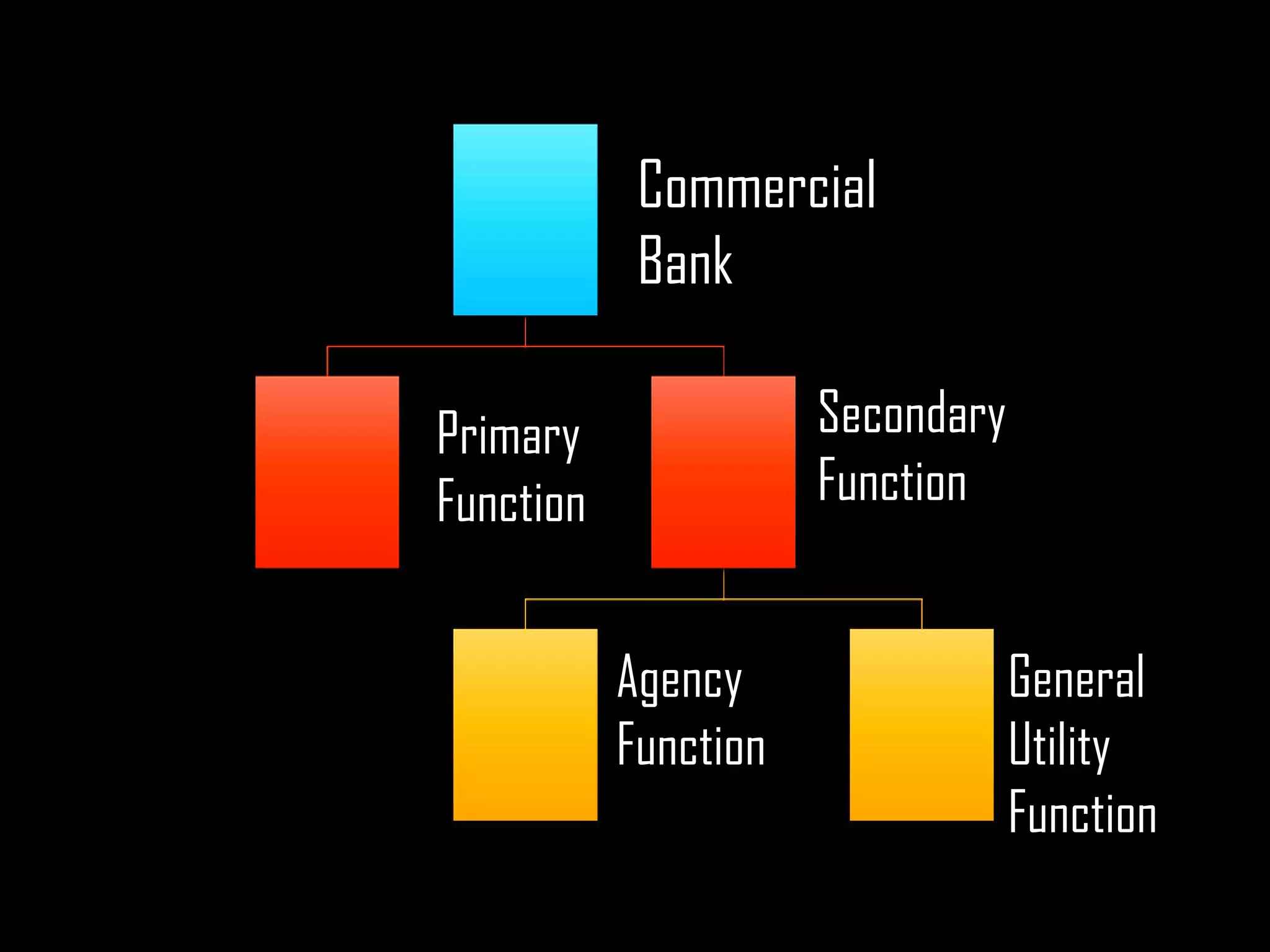

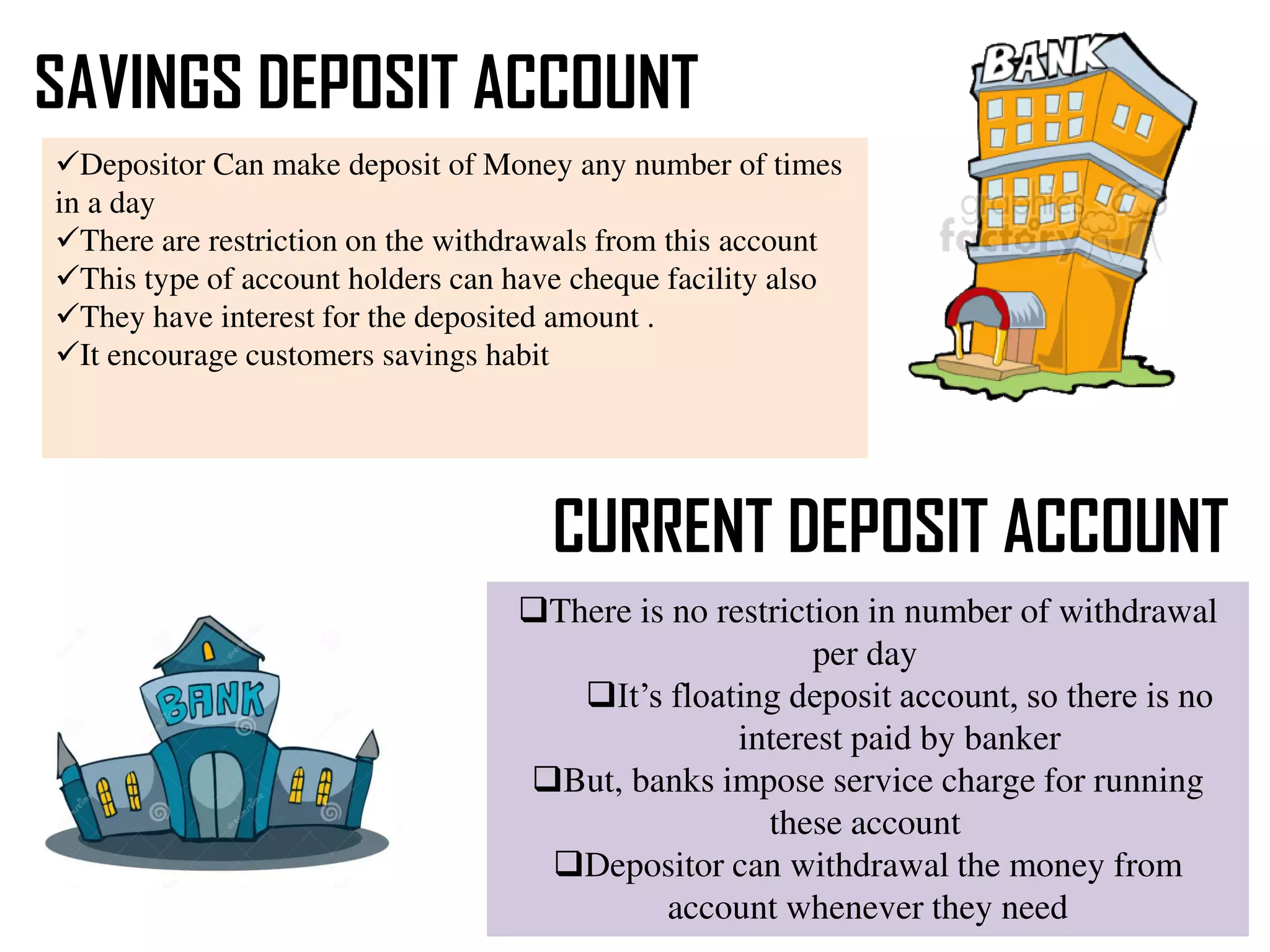

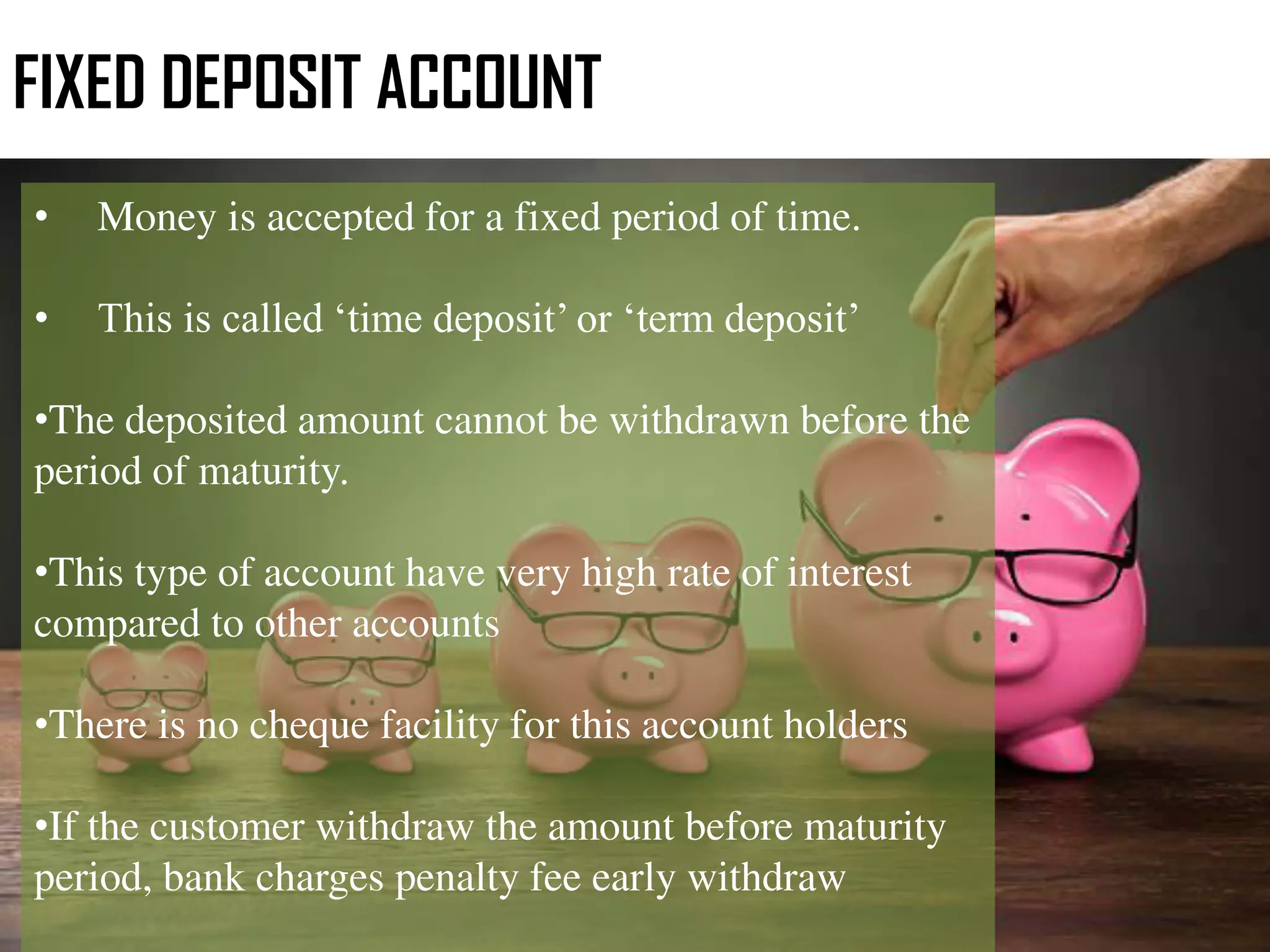

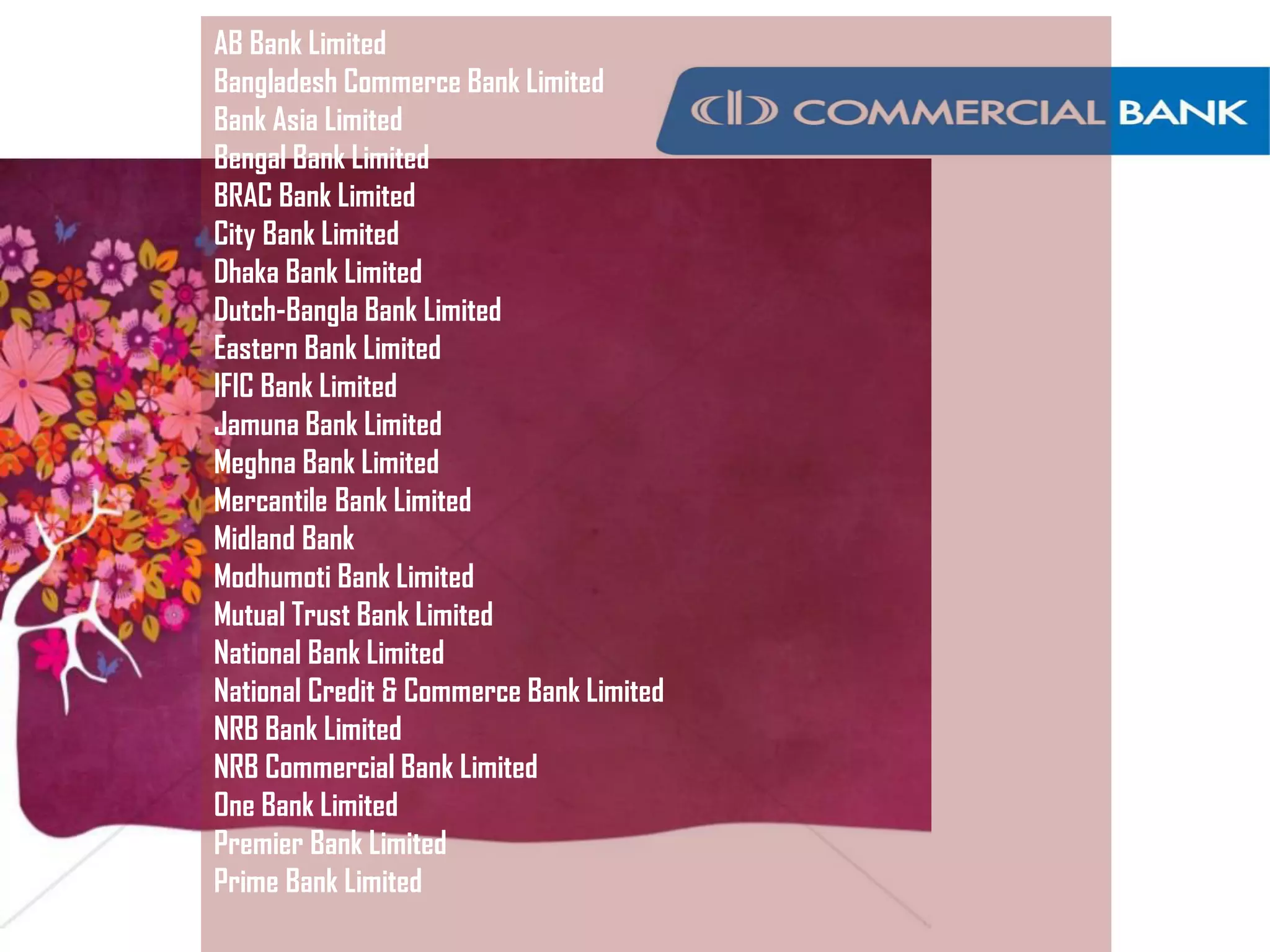

This document outlines the key functions of commercial banks which include accepting deposits, advancing loans, credit collection, investing funds, and providing agency services. It describes the primary, secondary, and general utility functions of banks. The primary functions are accepting deposits through savings, current, and fixed deposit accounts, and advancing loans through various types of loans like cash credit, overdraft, demand loans, and bill discounting. Secondary functions involve credit collection, foreign exchange dealings, and acting as trustees. General utility services include locker facilities, traveler's checks, credit information, and underwriting services.