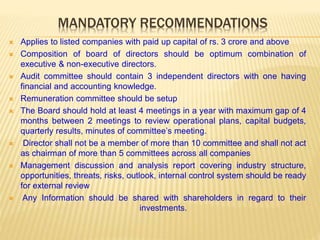

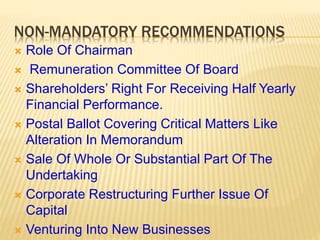

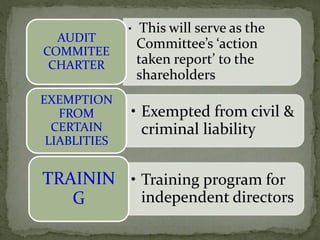

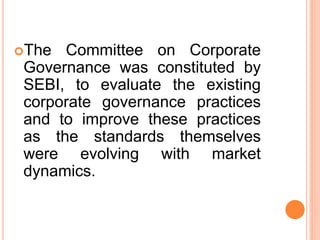

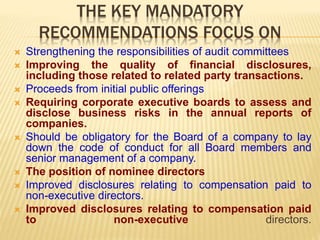

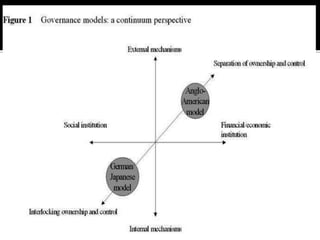

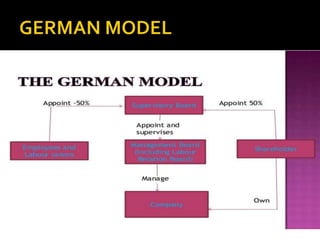

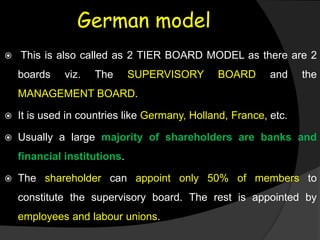

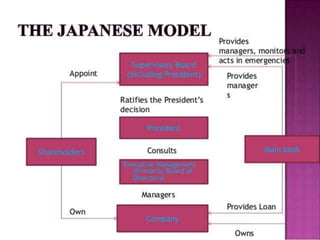

The document discusses various models of corporate governance in India including the Business House Model, Anglo-American Model, German Model, Japanese Model, Indian Model, and Open Enterprise Model. It then summarizes key reports on corporate governance reforms in India, including recommendations from the Kumar Mangalam Birla Committee (2000), Naresh Chandra Committee (2002), and Narayana Murthy Committee (2003). The reports focused on strengthening audit committees, improving financial disclosures, assessing business risks, and other measures to improve corporate governance practices in India.

![ KUMAR MANGALAM BIRLA COMMITTEE

REPORT [2000]

NARESH CHANDRA COMMITTEE REPORT

[2002]

NARAYANA MURTHY COMMITTEE REPORT

[2003]](https://image.slidesharecdn.com/indiancg-160423072814/85/Indian-cg-18-320.jpg)

![KUMAR MANGALAM BIRLA COMMITTEE

REPORT [2000] –

• The primary objective of the committee was to view

corporate governance from the perspective of the

investors and shareholders and to prepare a ‘Code’ to

suit the Indian corporate environment.

• The three key constituents, their roles and

responsibilities, their rights in the context of good

corporate governance are recognized by the

committee.

The Shareholders

The Board of Directors

The Management](https://image.slidesharecdn.com/indiancg-160423072814/85/Indian-cg-20-320.jpg)