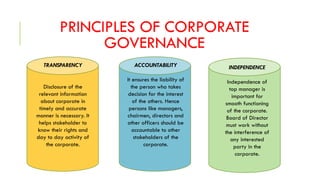

Corporate governance refers to the set of principles and guidelines by which a corporation is directed and controlled, ensuring accountability to shareholders and other stakeholders. The need for corporate governance in India has grown due to issues like corporate scandals, widespread shareholder expectations, and the complexities of globalization. Key principles include transparency, accountability, and independence of management, with the Securities and Exchange Board of India (SEBI) establishing guidelines to promote good governance practices.