- A corporation is an organization created by shareholders who own the company. The board of directors oversees management.

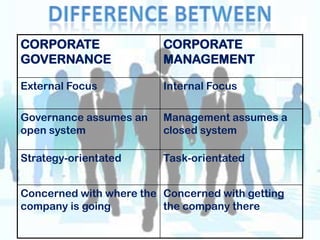

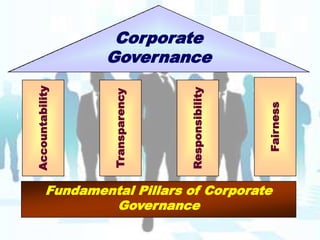

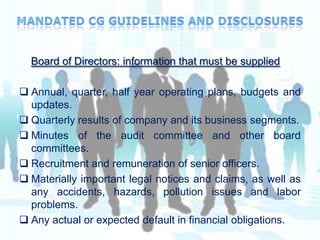

- Corporate governance deals with how organizations are directed and controlled. It ensures accountability, fairness, transparency and responsibility within corporations.

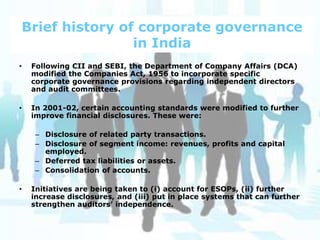

- In India, corporate governance initiatives began in the 1990s led by industry groups and regulators. Key milestones included voluntary codes in the late 90s and mandatory codes introduced by SEBI in 2000 for listed companies.