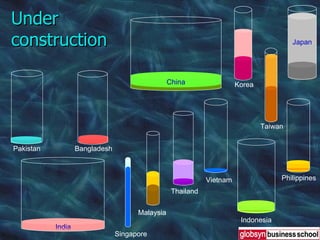

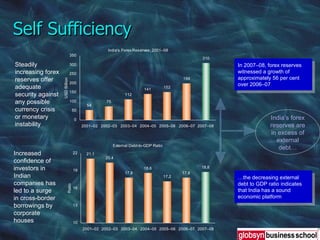

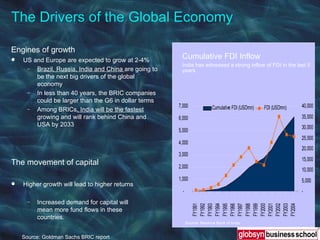

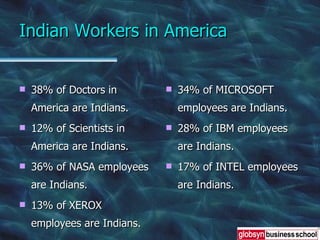

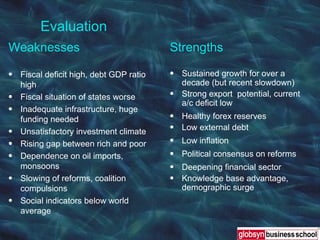

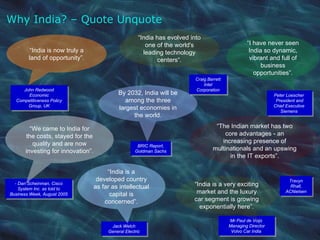

Indian's position in the globalized world has strengthened over time. India has experienced strong and sustained GDP growth averaging around 8-9% annually since the early 2000s. This growth has been driven by increased foreign investment, a growing services sector, and economic reforms that have opened India's economy and attracted multinational corporations. While India still faces challenges like infrastructure bottlenecks and social issues, reports project that India will become one of the top three largest economies in the world by 2032 as globalization and the knowledge-based economy play to India's strengths.