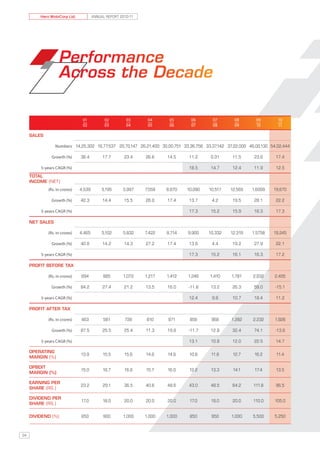

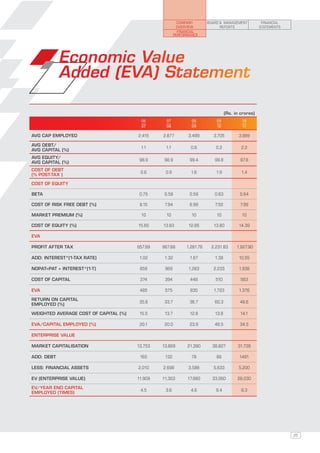

This document is the annual report of Hero MotoCorp for fiscal year 2010-2011. It discusses Hero MotoCorp's transition from being a partnership with Honda to becoming an independent company. It highlights the company's new corporate identity and vision to become a global leader in motorcycle mobility solutions. It also briefly outlines the company's financial performance for the year, including record sales of over 5.4 million two-wheelers and total net income of Rs. 19,670 crore, representing strong 5-year growth rates.

![COMPANY BOARD & MANAGEMENT FINANCIAL

OVERVIEW REPORTS STATEMENTS

DIRECTORS’ REPORT

MANAGEMENT DISCUSSION & ANALYSIS The Company also has an Audit Committee, comprising four

REPORT Non-Executive & Independent and professionally qualified

Directors, who interact with the Statutory Auditors, Internal

A detailed chapter on, ‘Management Discussion and Analysis’

Auditors, Cost Auditors and Auditees in dealing with matters

(MDA), pursuant to Clause 49 of the Listing Agreement is

within its terms of reference. The Committee mainly deals

annexed and forms part of this Annual Report.

with accounting matters, financial reporting and internal

controls. During the year under review, the Committee met

CORPORATE SOCIAL RESPONSIBILITY 4 (four) times.

Corporate Social Responsibility (CSR) is an integral part of AUDIT COMMITTEE RECOMMENDATION

the Company ethos. The Company supports the Raman Kant

During the year there was no such recommendation of the

Munjal Foundation, which in turn runs a school and a hospital.

Audit Committee which was not accepted by the Board. Hence,

The Foundation also conducts various outreach programs in

there is no need for the disclosure of the same in this Report.

the villages around the Company’s factories. These programs

are conducted in partnership with leading NGOs, and over the

years, there have been significant spinoffs. RISK MANAGEMENT SYSTEM

Your Company follows a comprehensive system of Risk

CORPORATE GOVERNANCE Management. Your Company has adopted a procedure for risk

At Hero MotoCorp, it is our firm belief that the essence of assessment and its minimisation. It ensures that all the Risks

Corporate Governance lies in the phrase ‘Your Company’. It is are timely defined and mitigated in accordance with the well

‘Your’ Company because it belongs to you – the shareholders. structured Risk Management Process. The Audit Committee

The Chairman and Directors are ‘Your’ fiduciaries and trustees. and Board reviews periodically the Risk Management Process.

Their objective is to take the business forward in such a way

that it maximises ‘Your’ long-term value. RATINGS

Your Company is committed to benchmarking itself with The rating agency ICRA Limited, has reviewed and reaffirmed

global standards for providing good Corporate Governance. the rating assigned to the Company for its Non-convertible

It has put in place an effective Corporate Governance System Debenture Programme as LAAA [pronounced “L triple A”]

which ensures that the provisions of Clause 49 of the Listing indicating the highest credit quality and A1+ [pronounced

Agreement are duly complied with. “A one Plus”] for its Non-fund based facilities and LAAA

The Board has also evolved and adopted a Code of Conduct [pronounced “L triple A”] to Fund based facilities indicating

based on the principles of Good Corporate Governance the highest credit quality rating carrying lowest credit risk.

and best management practices being followed globally. ICRA also has LRAAA [pronounced “L R triple A”] issuer rating

The Code is available on the website of the Company assigned for the Company.

www.heromotocorp.com. A Report on Corporate Governance The rating agency CRISIL, during the year under review,

along with the Auditors’ Certificate on its compliance is annexed assigned the bank loan ratings of “AAA/Stable” and P1+ to the

hereto as Annexure - I.

Cash Credit Limit & Letter of Credit Limit Facility respectively to

the Company.

INTERNAL CONTROL SYSTEMS

The Company has a proper and adequate system of internal FIXED DEPOSITS

controls. This ensures that all assets are safeguarded and

During the year under review, the Company has not accepted

protected against loss from unauthorised use or disposition

any deposit under Section 58A and 58AA of the Companies

and those transactions are authorised, recorded and reported

Act, 1956 read with the Companies (Acceptance of Deposits)

correctly.

Rules, 1975.

An extensive programme of internal audits and management

reviews supplements the process of internal control. Properly

documented policies, guidelines and procedures are laid down AUDITORS

for this purpose. The internal control system has been designed M/s. A. F. Ferguson & Co., Chartered Accountants, New Delhi,

to ensure that the financial and other records are reliable for Auditors of the Company will retire at the conclusion of

preparing financial and other statements and for maintaining the ensuing Annual General Meeting and being eligible,

accountability of assets.

61](https://image.slidesharecdn.com/heromotocorp-120404114628-phpapp02/85/Hero-motocorp-63-320.jpg)

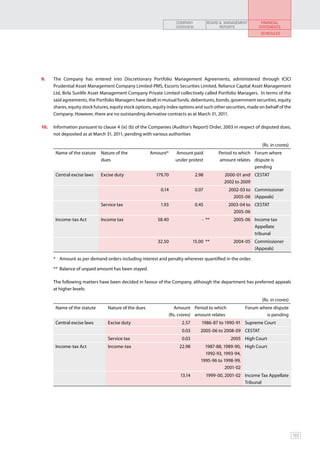

![Hero MotoCorp Ltd. ANNUAL REPORT 2010-11

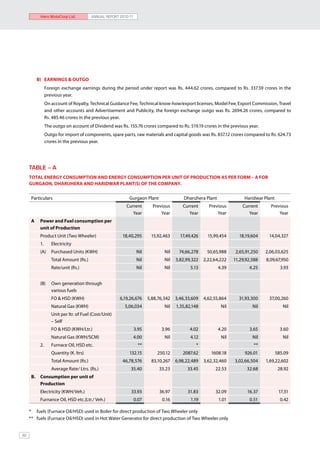

ANNEXURE - II TO DIRECTORS’ REPORT

Information Under Section 217(1)(e) of the Companies Act, 1956 c) Impact of measures at a) and b) for reduction of energy

read with Companies (Disclosure of Particulars in the Report consumption and consequent impact on the cost of

of Board of Directors) Rules, 1988 and forming part of the production of goods.

Directors’ Report for the year ended March 31, 2011 ; For FY 2010-11 : Approx. Annual Saving on Vehicles

Produced - Rs. 21 million For FY 2011-12 : Expected approx.

I. CONSERVATION OF ENERGY Annual Saving on Veh. Produced - Rs. 35 million.

a) Techno-economic viability of few energy saving

proposals are being carried out and few proposals have d) Total energy consumption and energy consumption per

been already implemented unit of production as per Form - A is given in Table - A

Energy conservation measures taken and their impact

II. PARTICULARS AS PER FORM B

1. As our long term initiative for “Green Technology”,

(A) RESEARCH & DEVELOPMENT (R&D)

Natural Gas has been introduced as source in Captive

Power Generation as well as in critical processes of Paint 1. Specific areas in which R & D carried out by the

shop and Heat treatment at Dharuhera and Gurgaon Company

plants. New Model Technology Absorption

2. “Resource Conservation” has been the prime focus in Indigenisation of CKD Parts

the plants and initiatives like Waste Heat Recovery /

Multi Source Approval

Air loss optimisation / Advanced Rain Water harvesting

technology etc. are being continuously taken to realise Meeting Legislative Norms

the benefits.

Active Participation in deciding the needs of

3. Energy efficiency measures have been taken in terms future Automobile Regulations in India

of switchover from conventional to energy efficient

2. Benefits derived as a result of the above R & D

lighting systems / Advanced VFD’s for various critical

activities

process applications etc. This has led to annual savings

of approx. Launched HunkPro (150 cc - 4 stroke), Splendor+/

Splendor Pro (100cc – 4 Stroke), Achiever (New

b) Additional Investments and Proposals being Aesthetic), Super Splendor (125 cc – 4 stroke),

implemented for reduction of consumption of energy Glamour Carb./FI (New Aesthetic), Glamour

FI (New Aesthetic), Karizma (New Aesthetic),

Approx. investment of Rs. 150 million is proposed in areas

Karizma ZMR (New Aesthetic), Passion Pro

of:

(Special Edition), CBZ Extreme (150cc – 4 stroke)

1. Green initiatives - Natural Gas based Gensets / Pilot

619 Multi source Components added;

project of solar based Power plant.

2. Resource conservation – VAM / HRU’s 24 new sources added for existing models;

3. Energy Efficiency – Conventional to CFL / Advanced Air Indigenisation done for 8 items;

Dryers / Optimisation of Pump running in critical areas /

Compliance to the Regulations

Advanced Chillers for Process plants.

- E-10 Compliance [Material Compatibility]

Note: The additional investment cannot be precisely

(on-going)

ascertained, and is part of the Repairs and Maintainence;

consumables expenditure and investments in fixed assets. - BS-III Compliance ground work

- EMC Compliance (Pre-implementation

verification)

80](https://image.slidesharecdn.com/heromotocorp-120404114628-phpapp02/85/Hero-motocorp-82-320.jpg)