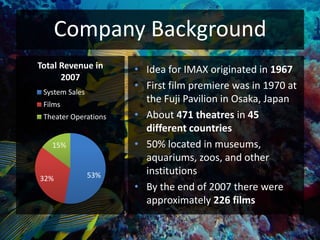

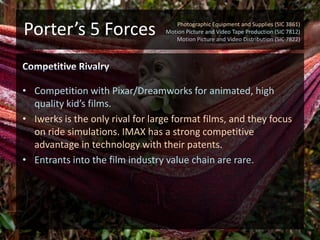

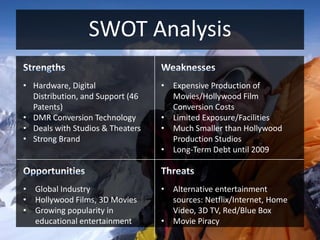

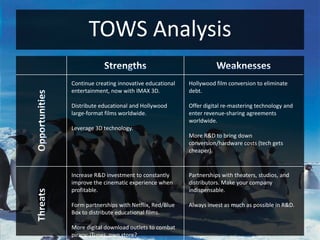

IMAX originated in 1967 and premiered its first film in 1970. It now has over 400 theaters in 45 countries, half of which are located in institutions. The film industry is highly competitive with few large format film companies. IMAX resolved its debt issues from the 1990s by digitally remastering Hollywood films for its theaters and forming revenue-sharing partnerships with theater chains. These strategies helped IMAX thrive as a niche player in the large format film industry and lower its long-term debt.