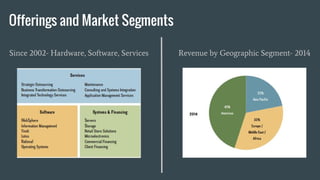

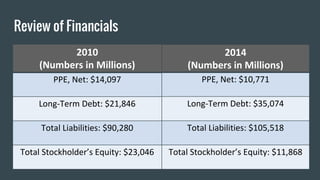

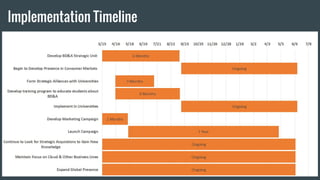

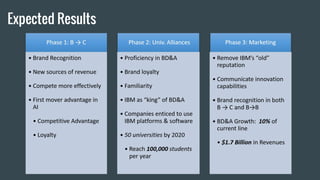

IBM is at a crossroads due to declining international sales and a decade of flat revenue. The document analyzes IBM's issues and recommends expanding into big data and analytics using Watson's cognitive computing capabilities. It suggests developing B2C operations and strategic alliances to increase revenues and compete more effectively on a global scale. A three-phase implementation plan includes developing B2C partnerships, forming strategic university alliances, and launching a global marketing campaign to transform IBM's image and enhance its brand. The goal is to position IBM as an innovative leader in big data and analytics.