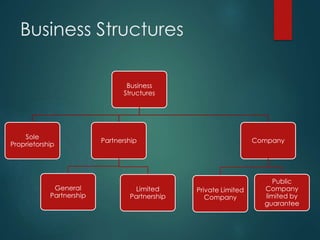

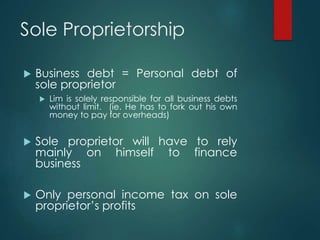

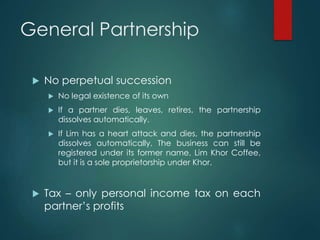

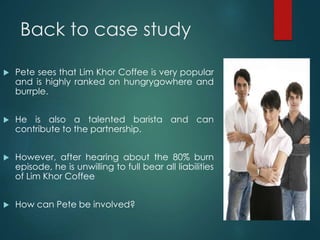

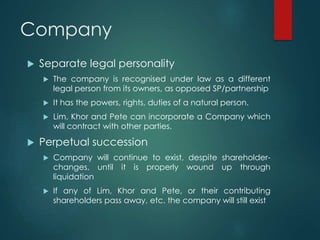

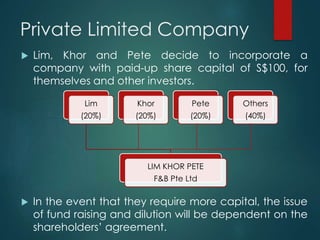

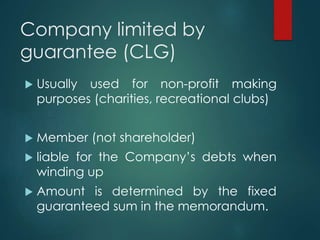

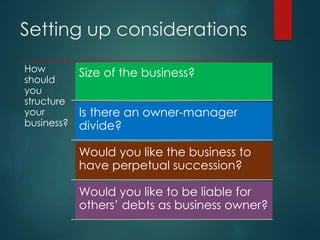

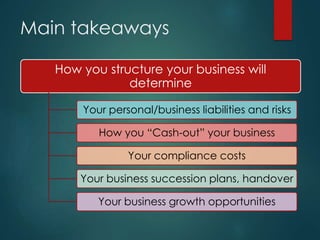

The document discusses how to structure a business by exploring different business forms, including sole proprietorships, partnerships, and limited partnerships, while explaining the financial and legal implications of each structure. It provides a case study of 'Lim Coffee Shop' transitioning from a sole proprietorship to a general partnership involving additional partners and considerations for limited partnerships and private limited companies. Key factors to consider for business owners include liability, succession, compliance costs, and the growth potential of their business.