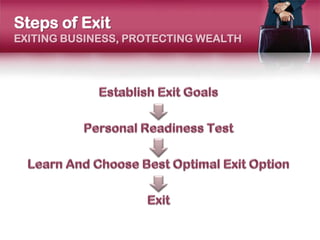

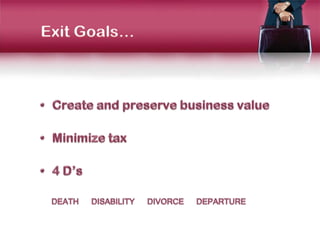

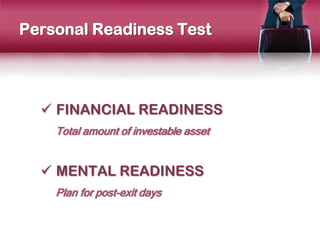

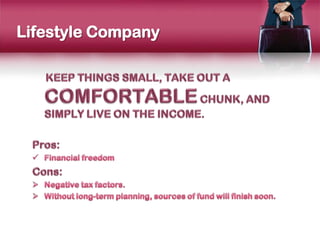

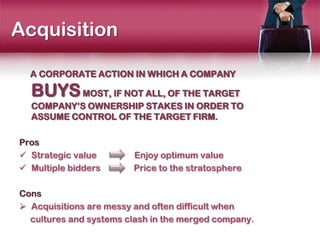

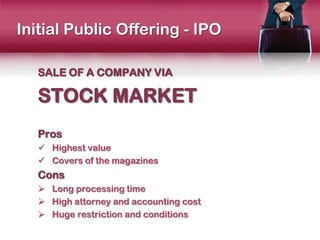

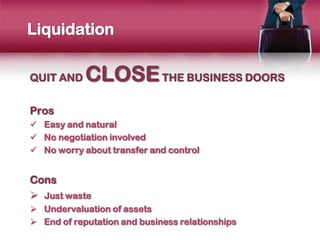

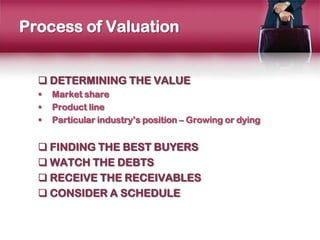

The document discusses different exit strategies for business owners looking to transition out of ownership of their company. It outlines several options for exiting a business, including transitioning the company to become a lifestyle business, selling the company through an acquisition, transferring ownership to a family member or emotional partner, pursuing an initial public offering to sell shares on the stock market, or liquidating the company's assets. For each option, it provides brief highlights of potential pros and cons to consider when selecting an exit strategy.