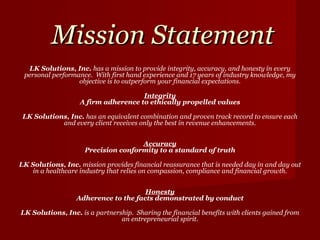

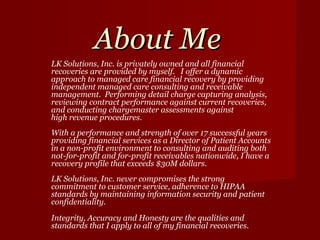

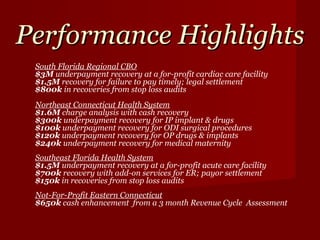

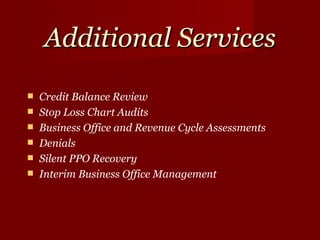

LK Solutions, Inc. provides integrity, accuracy, and honesty in financial performance and recovery services. With over 17 years of experience, LK Solutions aims to outperform financial expectations through proven methods. Services include contingency-based underpayment recoveries, contract reviews, revenue code enhancements, and executive summaries to maximize reimbursement. LK Solutions has achieved over $30 million in recoveries for various health systems across the country through specialized services in areas like cardiac care, orthopedics, and pharmacy.

![Contact Information Kim M. Giraldo, CPAT Owner and President 710 West Broward Street Suite #2 Lantana, FL 33462 (561) 632-8301 [email_address] www.lksolutionsinc.org](https://image.slidesharecdn.com/presentationmaternialforlinkedin-12795044258972-phpapp02/85/Hospital-Financial-Solutions-9-320.jpg)