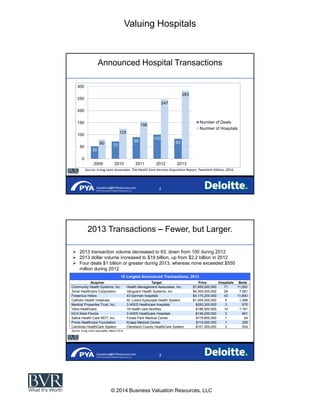

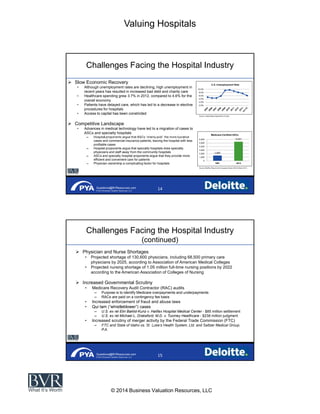

The document discusses the rebound in hospital transaction activity following healthcare reform and the credit crisis, highlighting trends such as fewer but larger transactions. It also outlines the challenges facing the hospital industry, including increased regulatory compliance costs and operational pressures from value-based care under the Affordable Care Act. Furthermore, it provides insights into the future outlook for hospital consolidation and financial performance amidst ongoing healthcare changes.