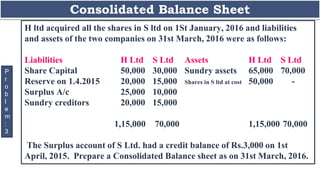

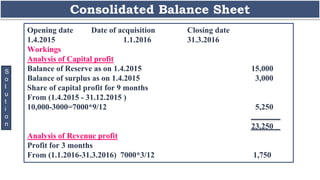

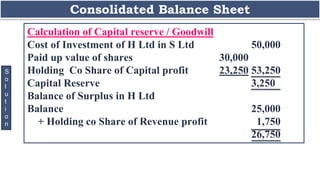

1) H Ltd acquired all shares of S Ltd on January 1, 2016 at a cost of Rs. 50,000.

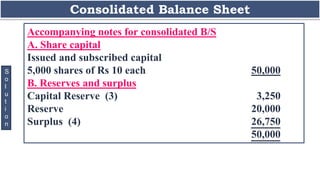

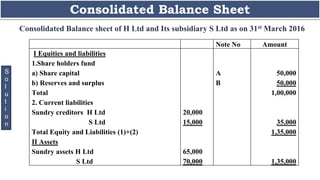

2) The consolidated balance sheet as of March 31, 2016 shows total equity and liabilities of Rs. 1,35,000, including shareholder's fund of Rs. 1,00,000 and current liabilities of Rs. 35,000.

3) On the assets side, sundry assets of H Ltd and S Ltd total Rs. 1,35,000.