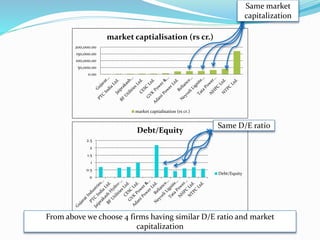

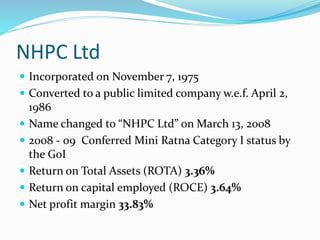

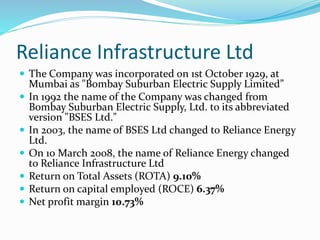

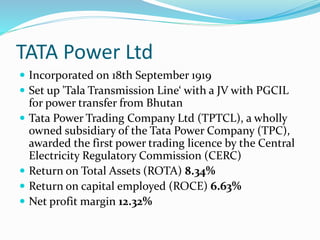

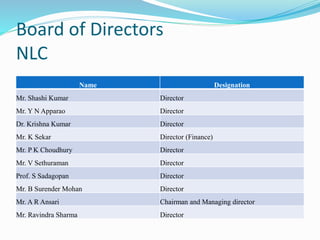

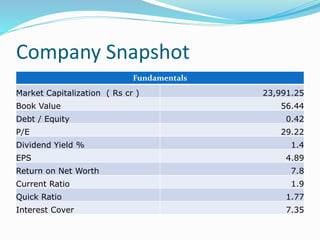

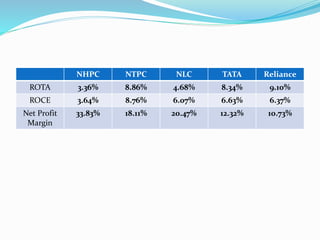

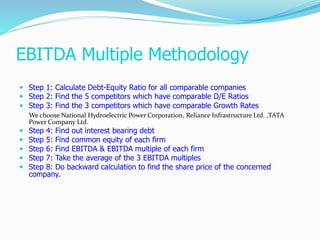

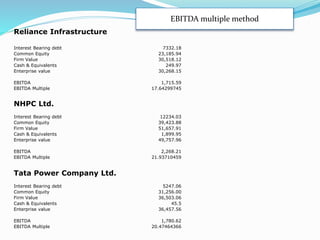

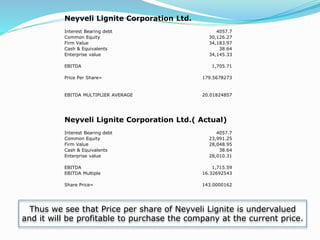

This document analyzes four power generation and distribution companies in India - National Hydroelectric Power Corporation, Reliance Infrastructure Ltd., TATA Power Company Ltd., and Neyveli Lignite Corporation Ltd. It compares their financial metrics like return on assets, return on capital employed, and net profit margins. Using the EBITDA multiple method, it values Neyveli Lignite Corporation and finds it to be undervalued compared to its peers, suggesting it would be profitable to purchase the company at its current price.