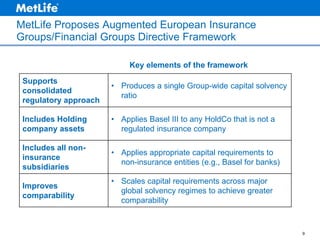

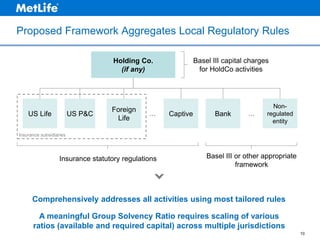

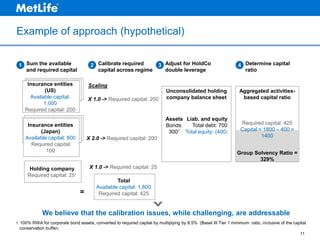

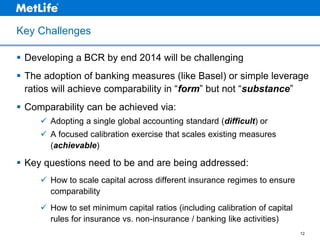

This document discusses insurance regulatory risk from the perspective of a large U.S. life insurer. It makes three key points: 1) Life insurance did not cause the financial crisis and is not inherently systemic, 2) Applying bank-centric rules to insurers would have unintended consequences, and 3) Regulation should focus on systemically risky activities rather than entities. It argues that imposing high capital standards designed for banks would harm consumers and create an unlevel playing field. Instead, the document proposes calibrating existing insurance capital regimes to ensure comparability across jurisdictions.