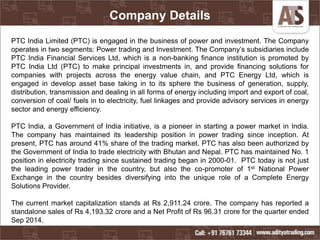

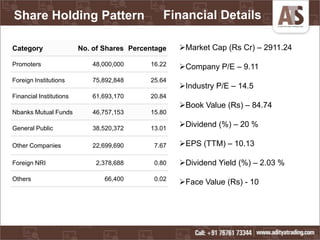

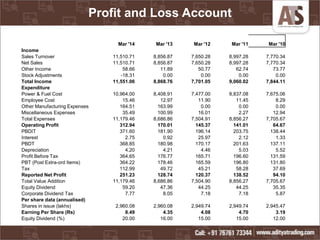

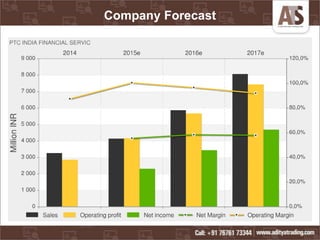

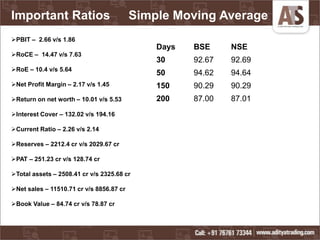

PTC India Limited is a key player in power trading and investment, holding a 41% market share in electricity trading since its inception. The company has subsidiaries that provide financing solutions within the energy sector and has maintained a strong financial position, with a current market capitalization of Rs 2,911.24 crore and a reported net profit of Rs 96.31 crore for Q3 2014. PTC India is recommended for investment due to its sound financials, growth potential in the industry, and zero debt status.