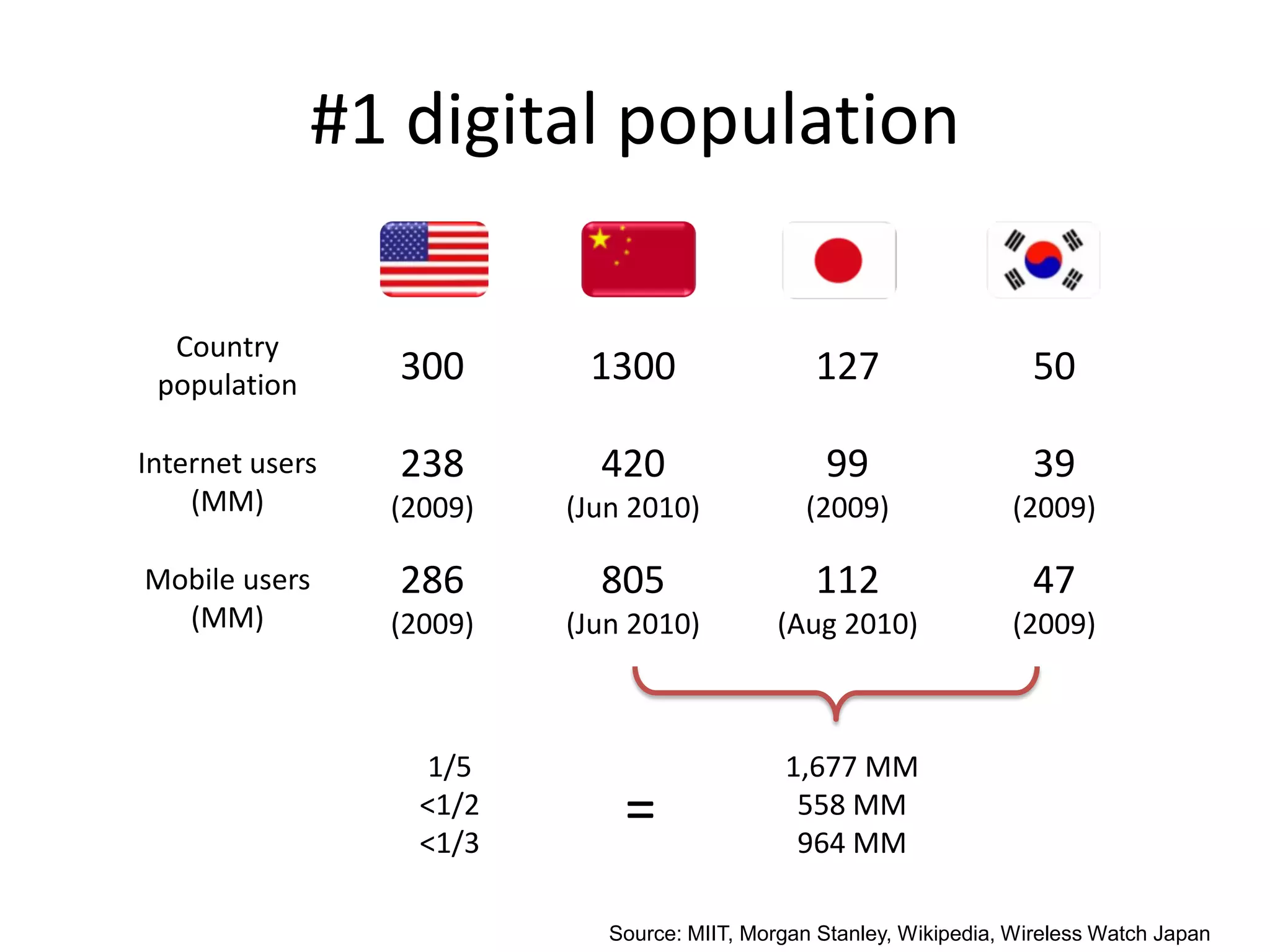

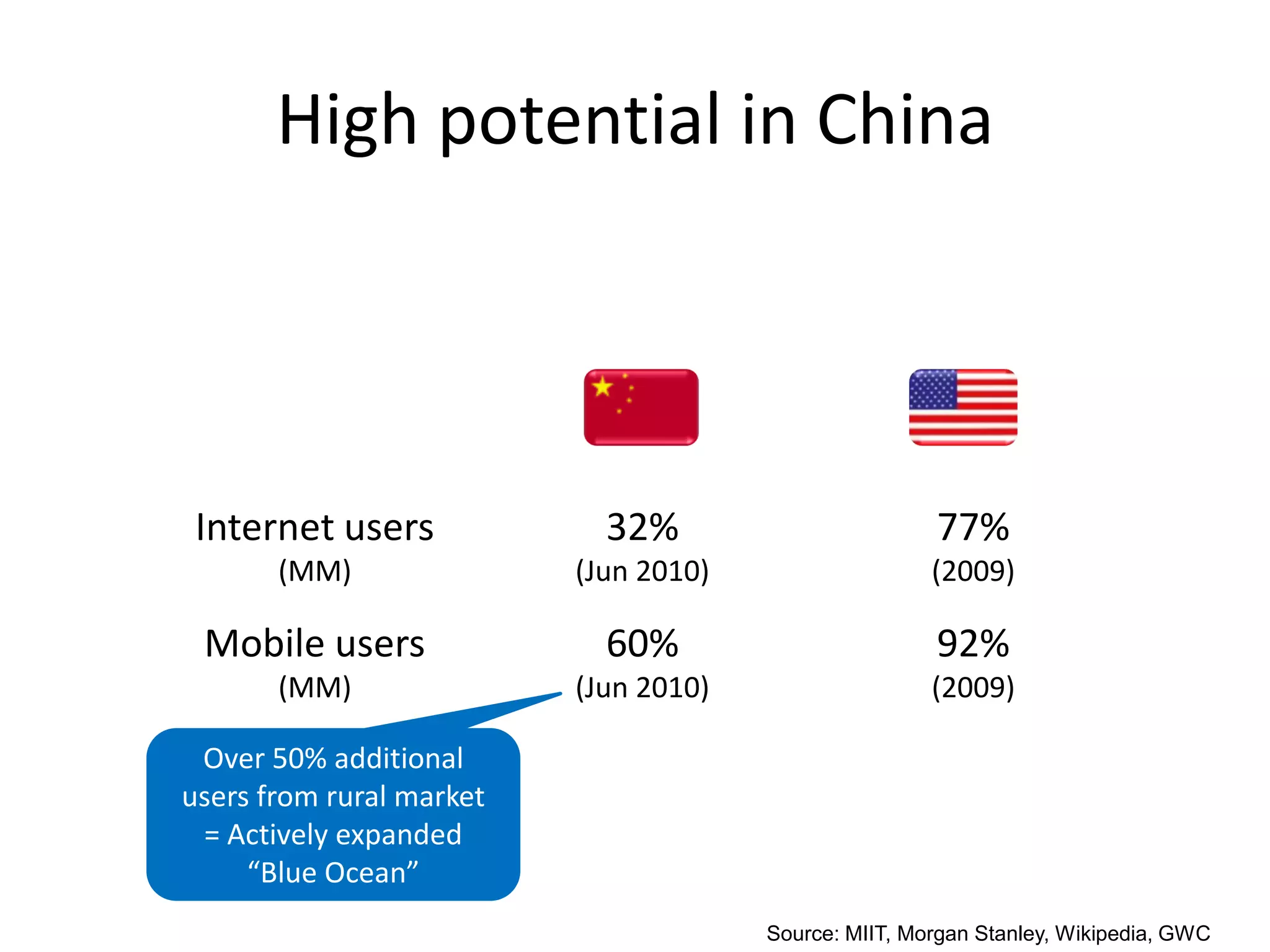

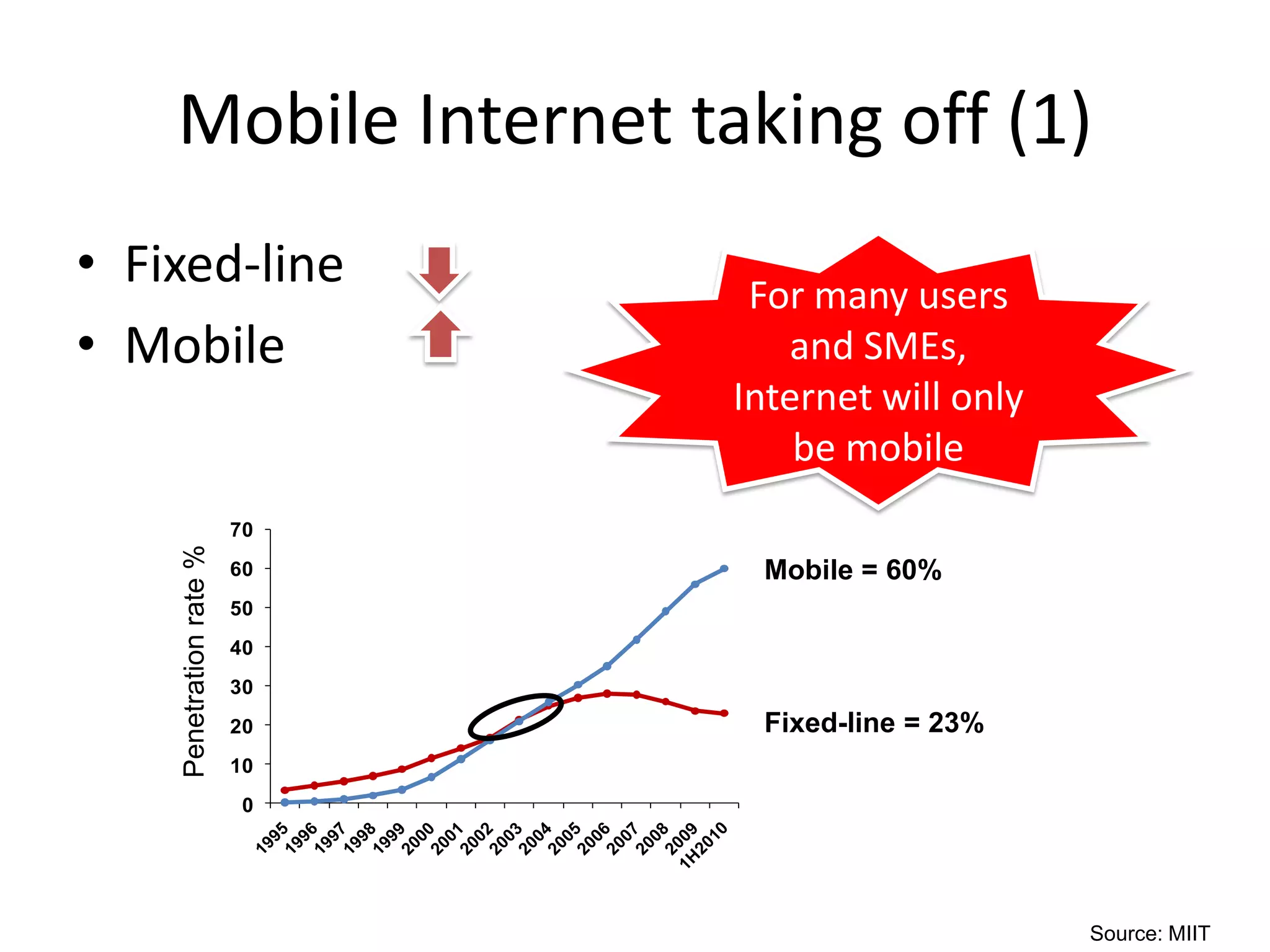

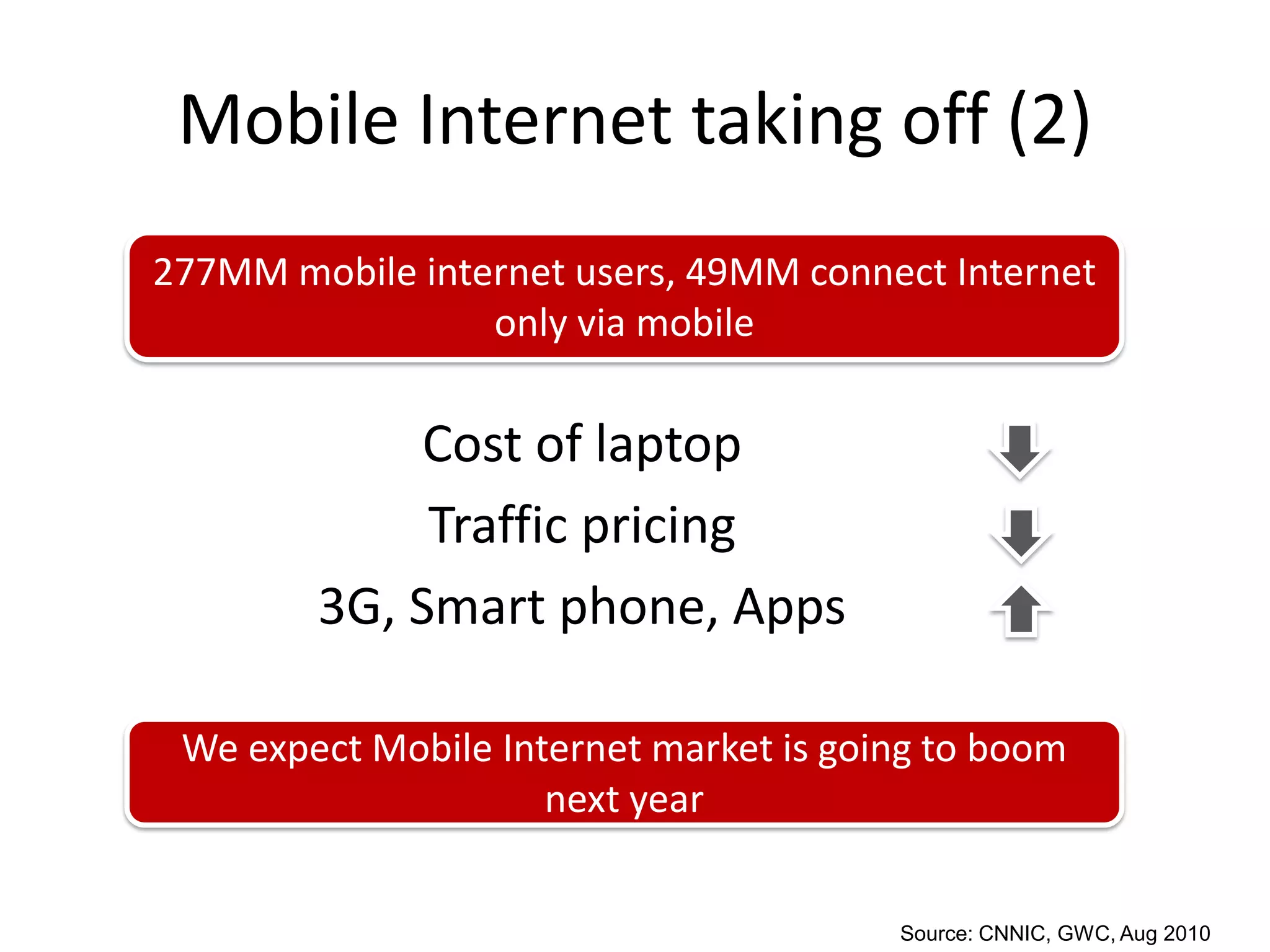

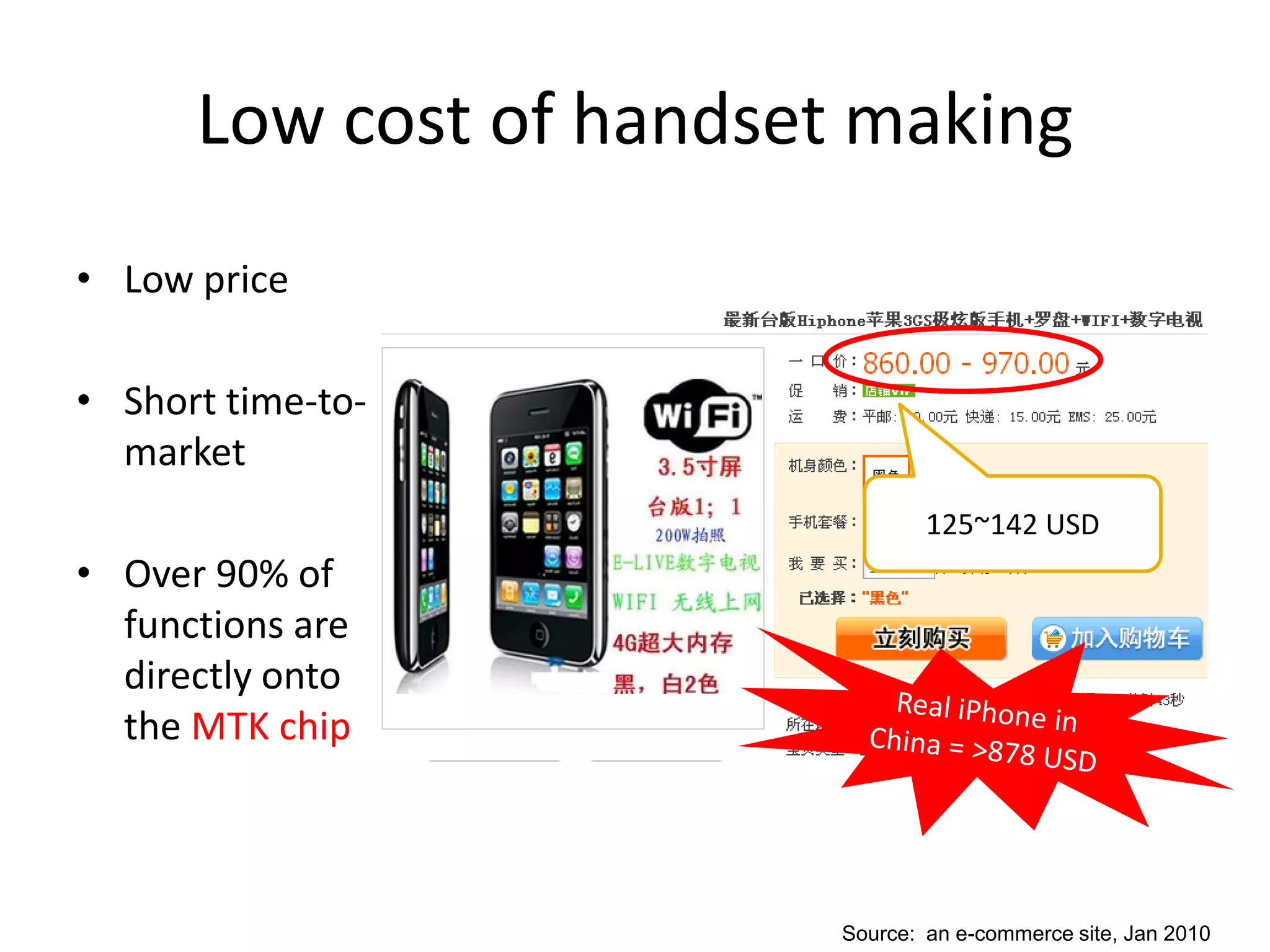

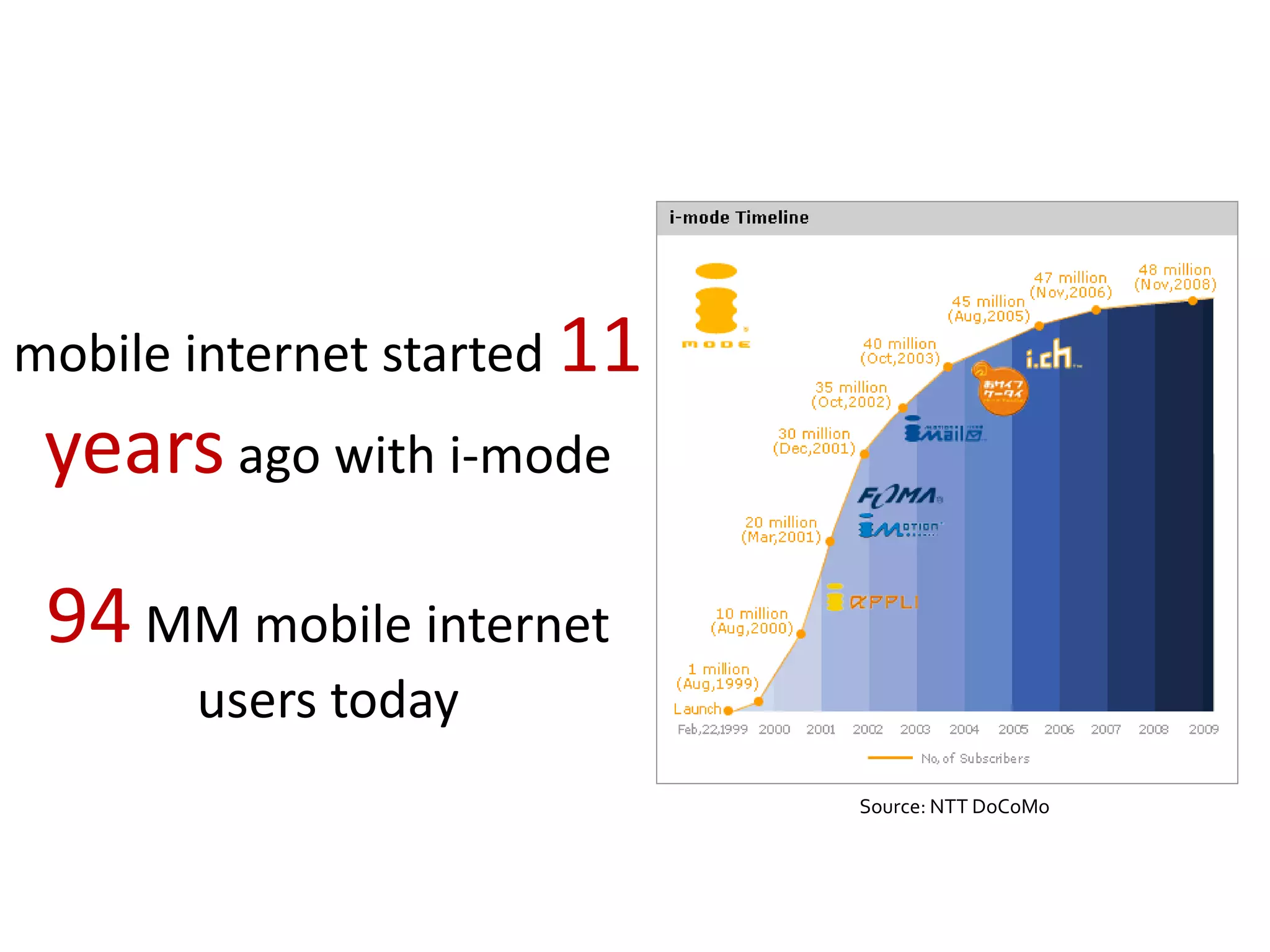

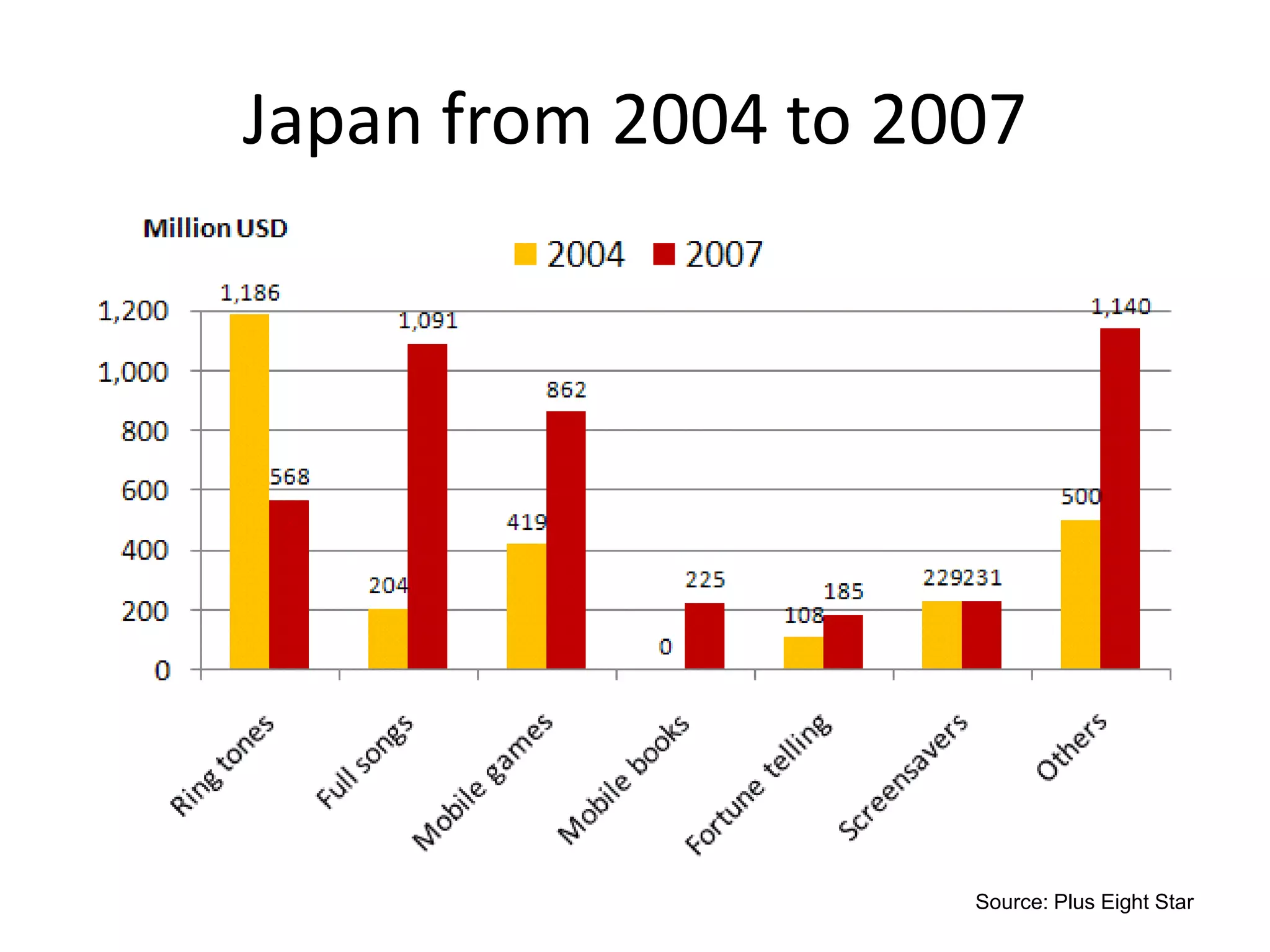

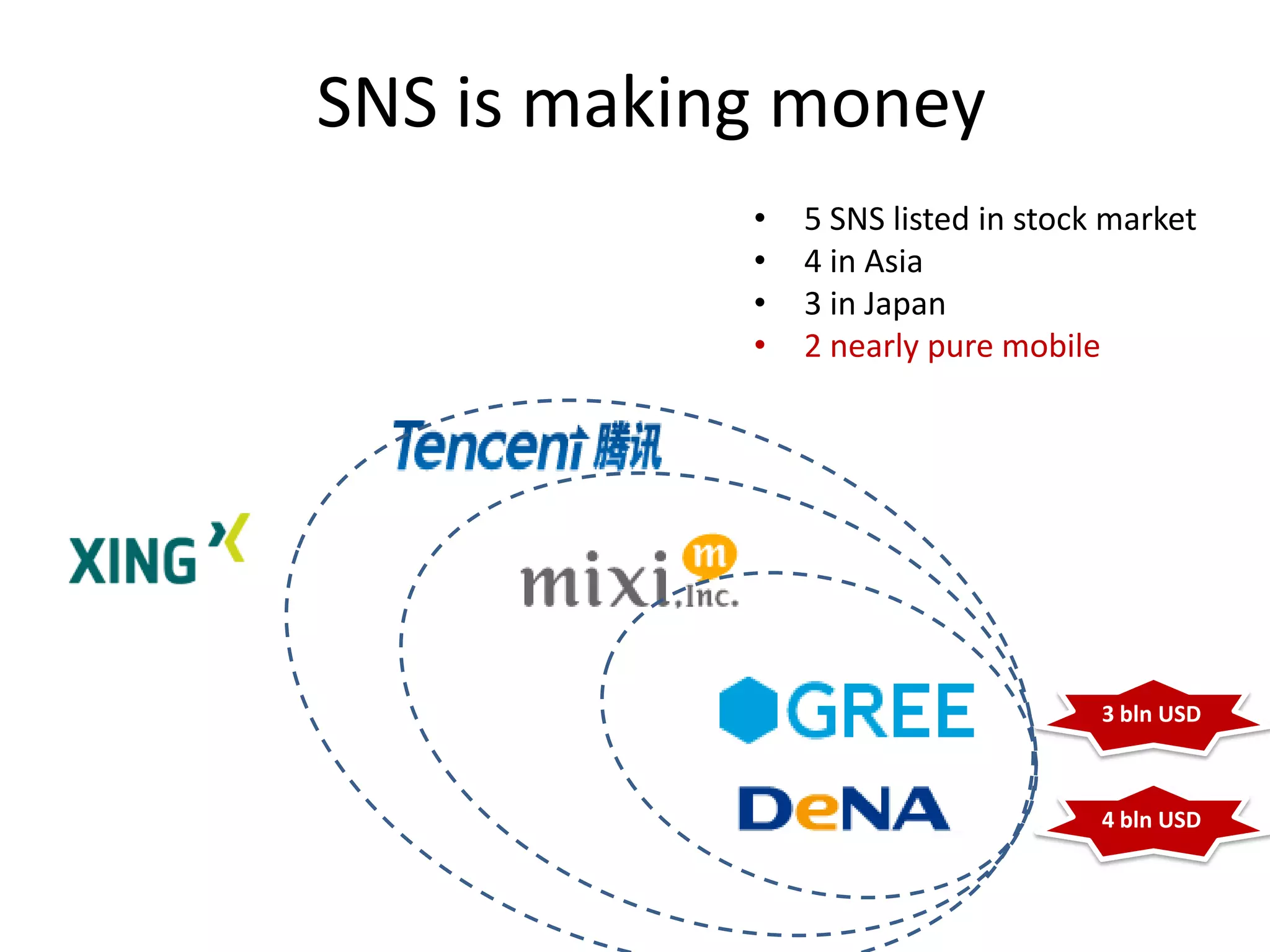

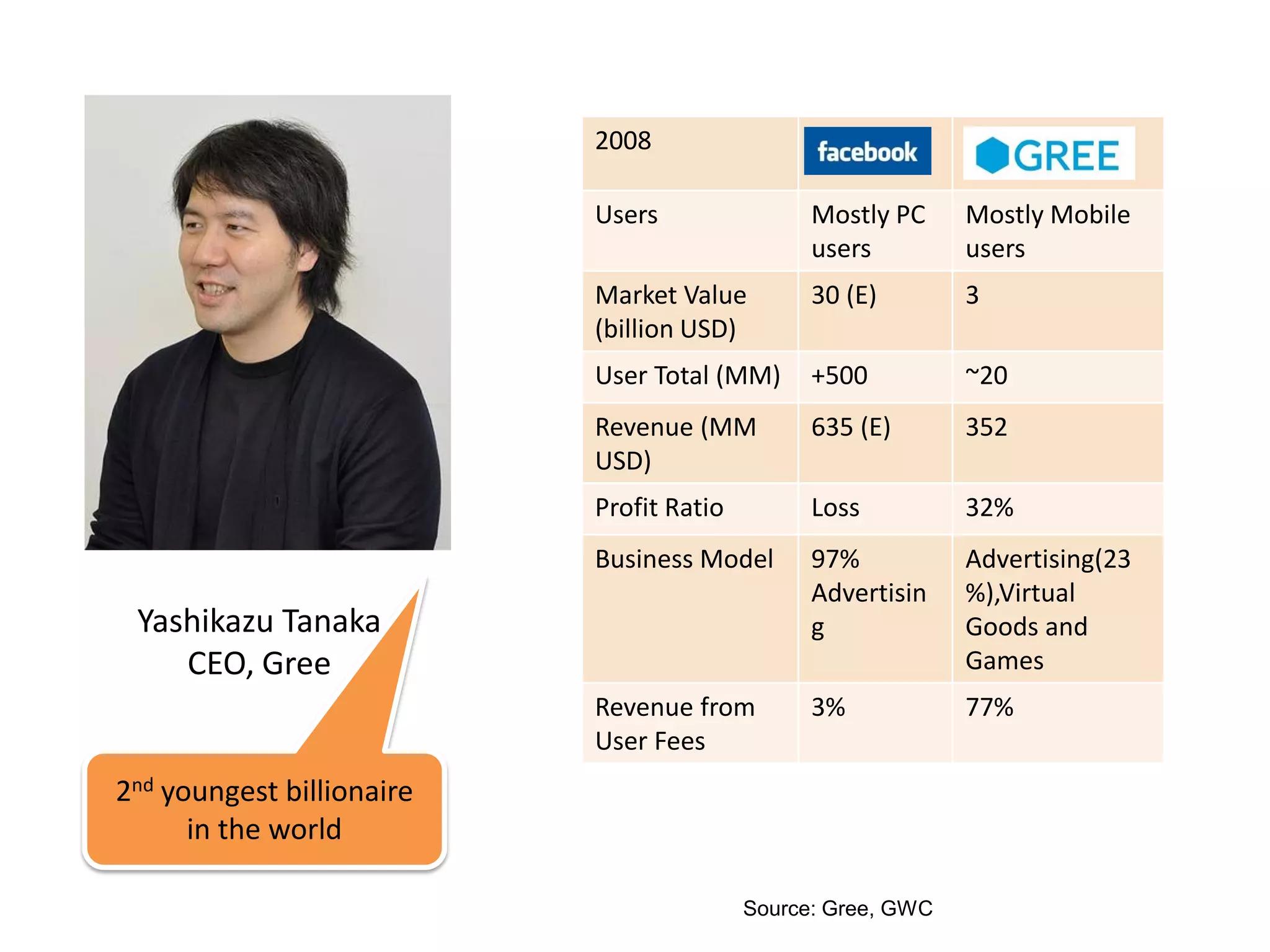

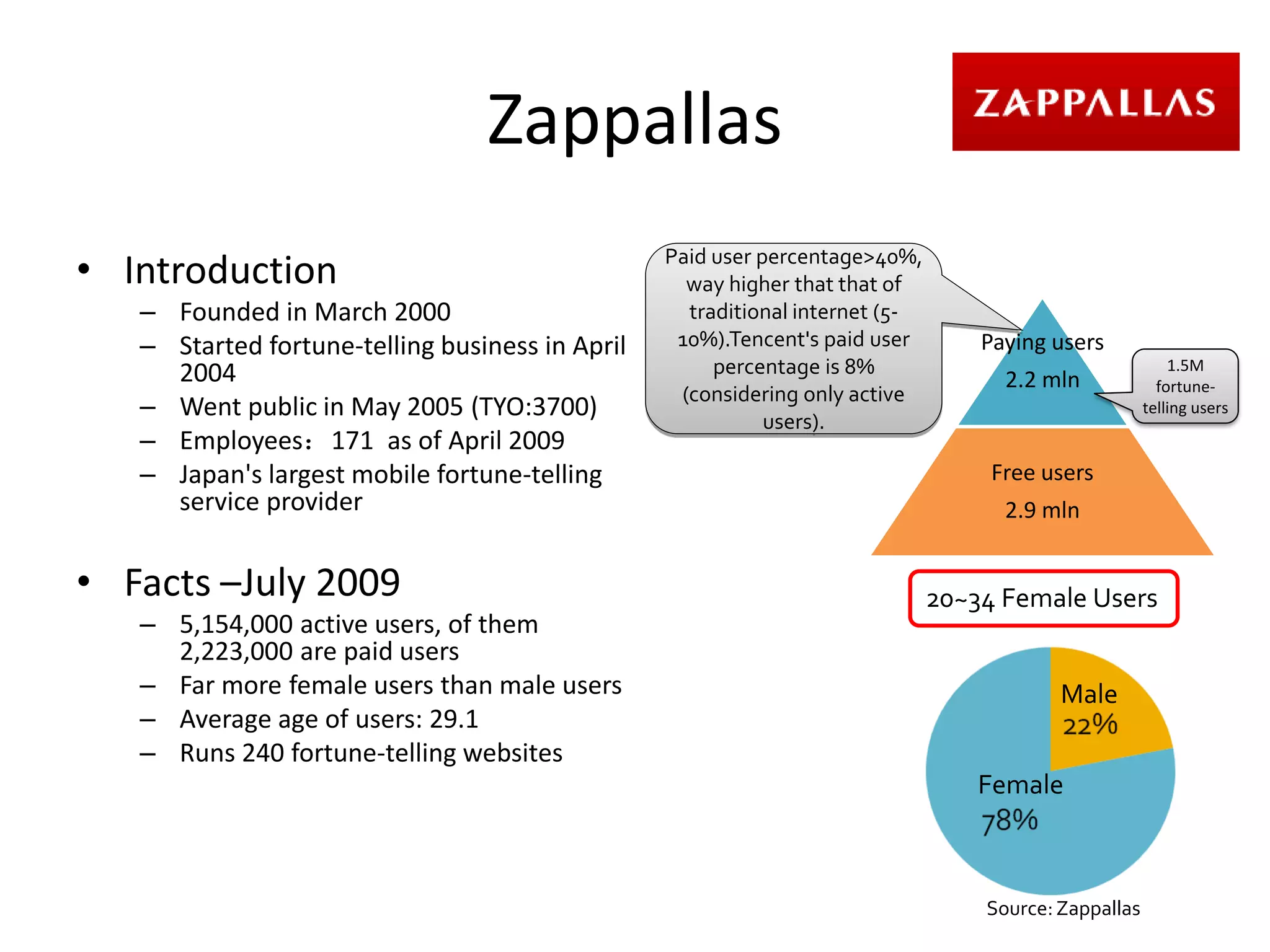

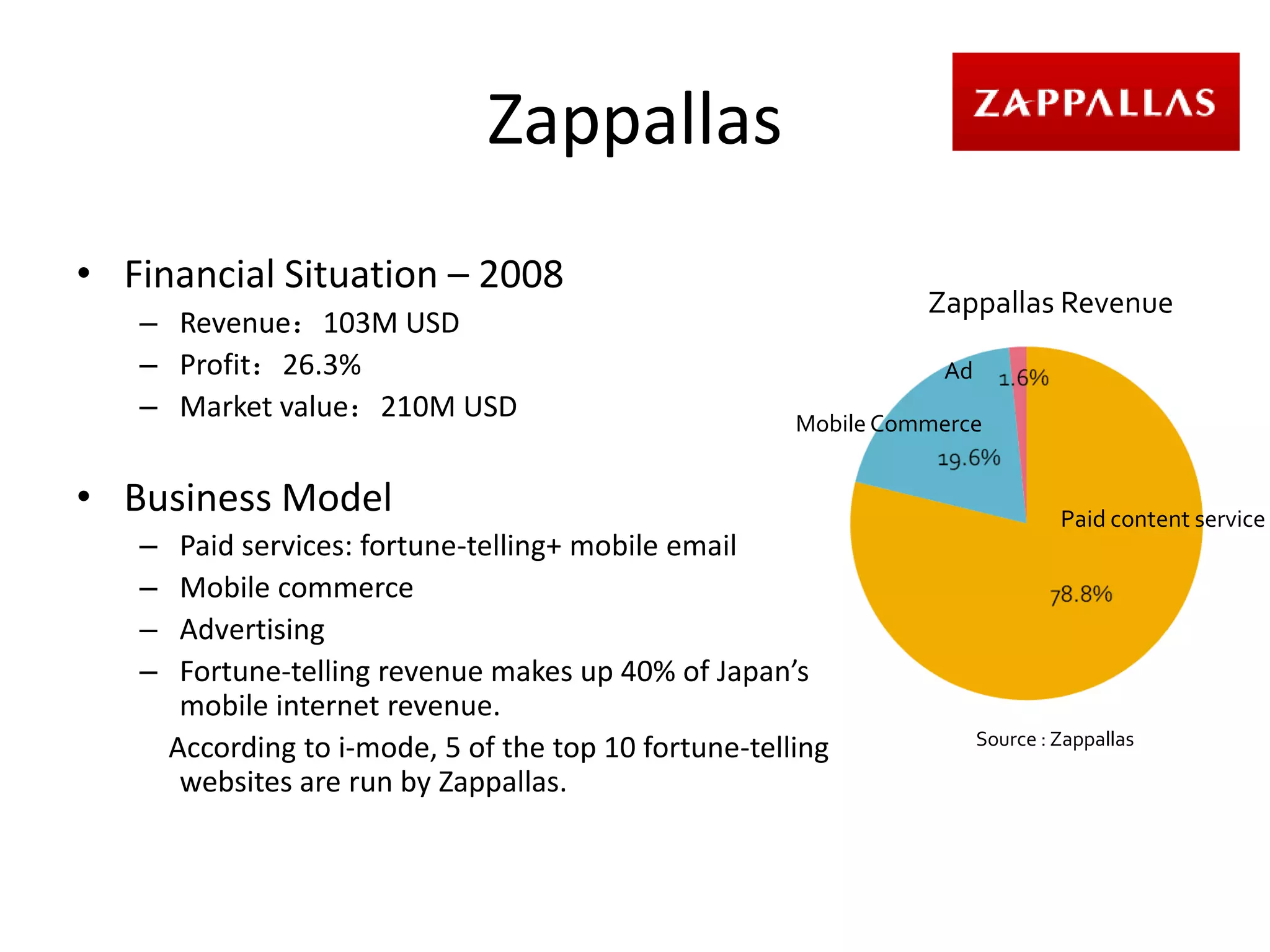

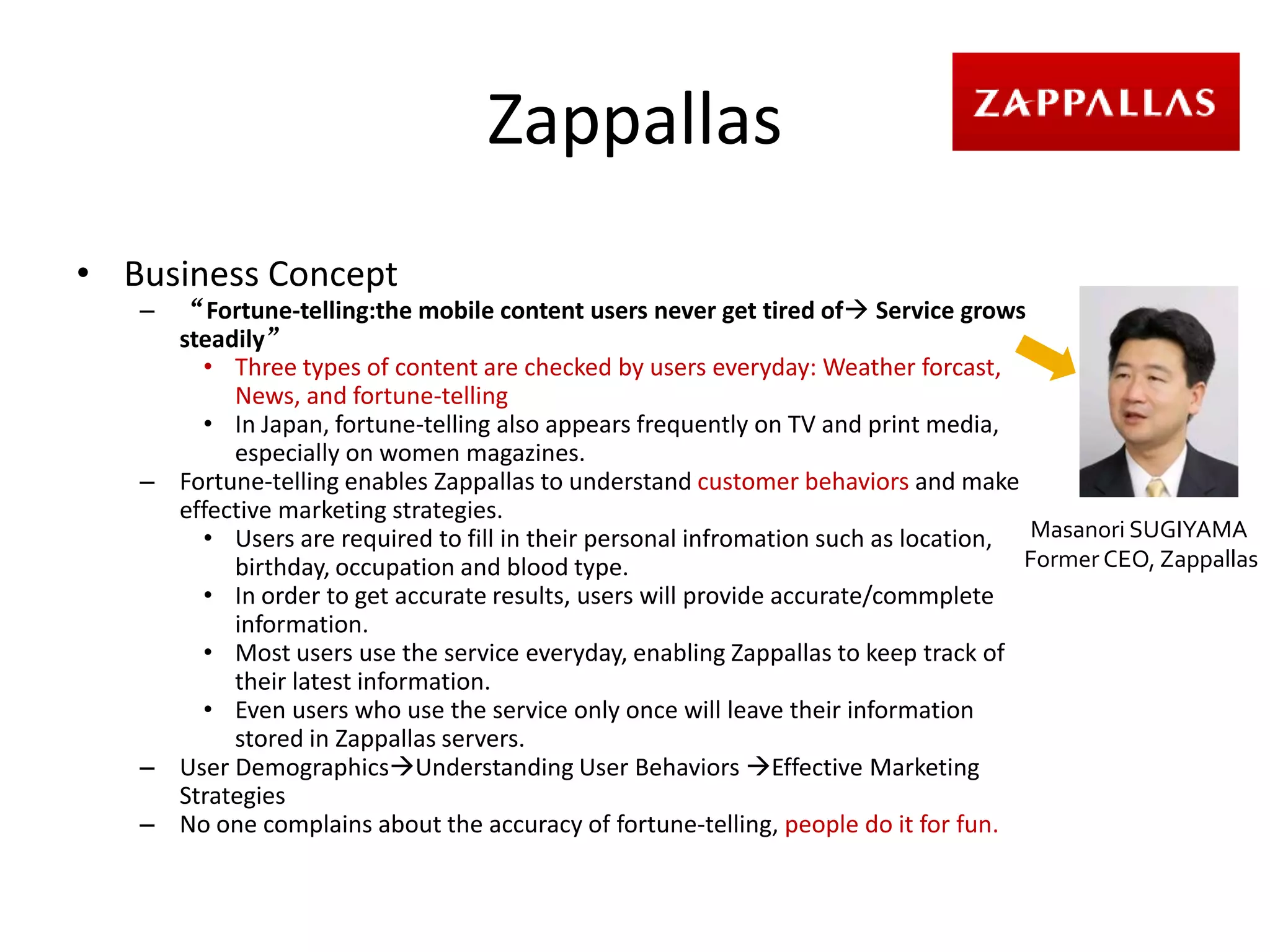

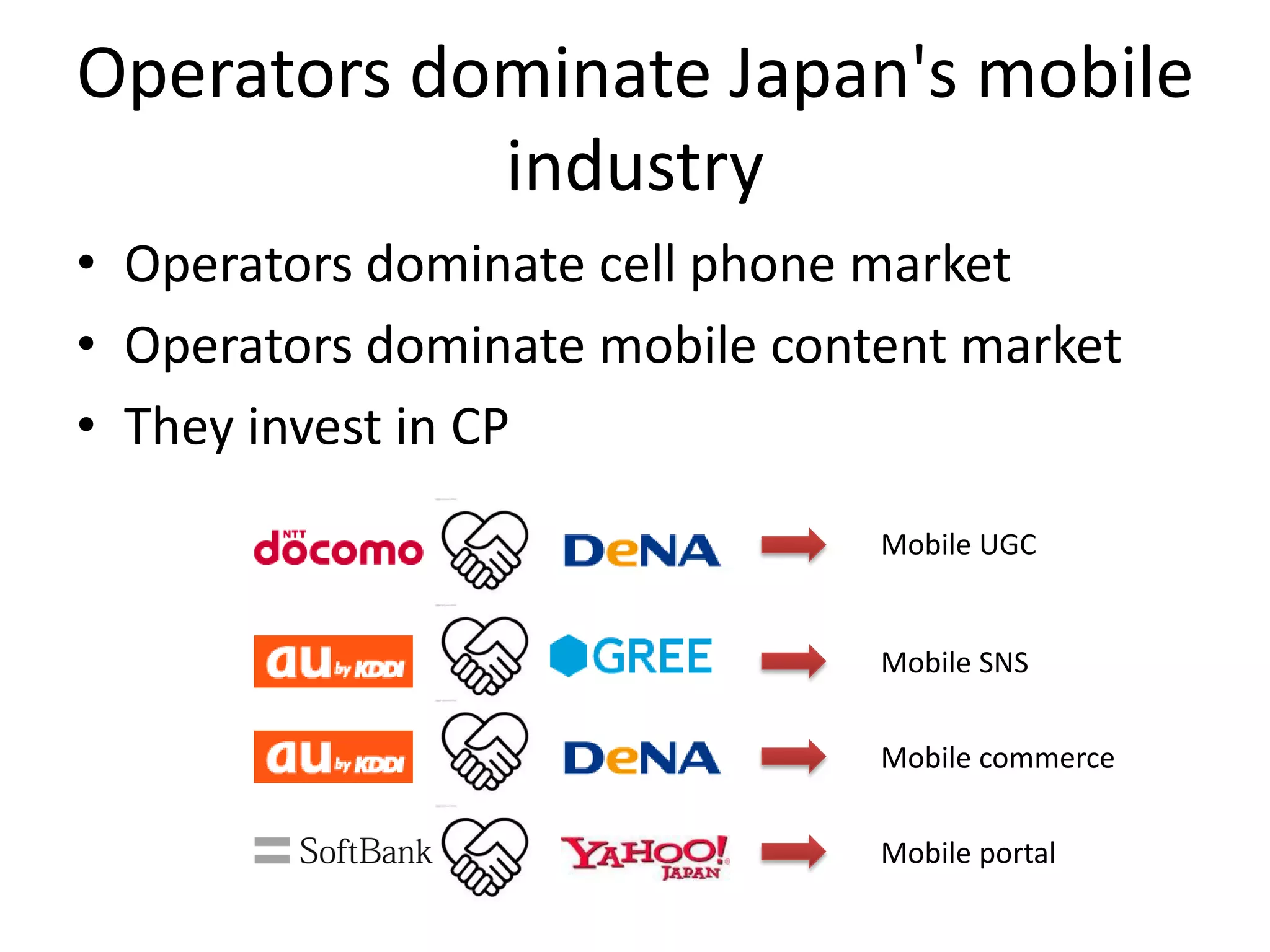

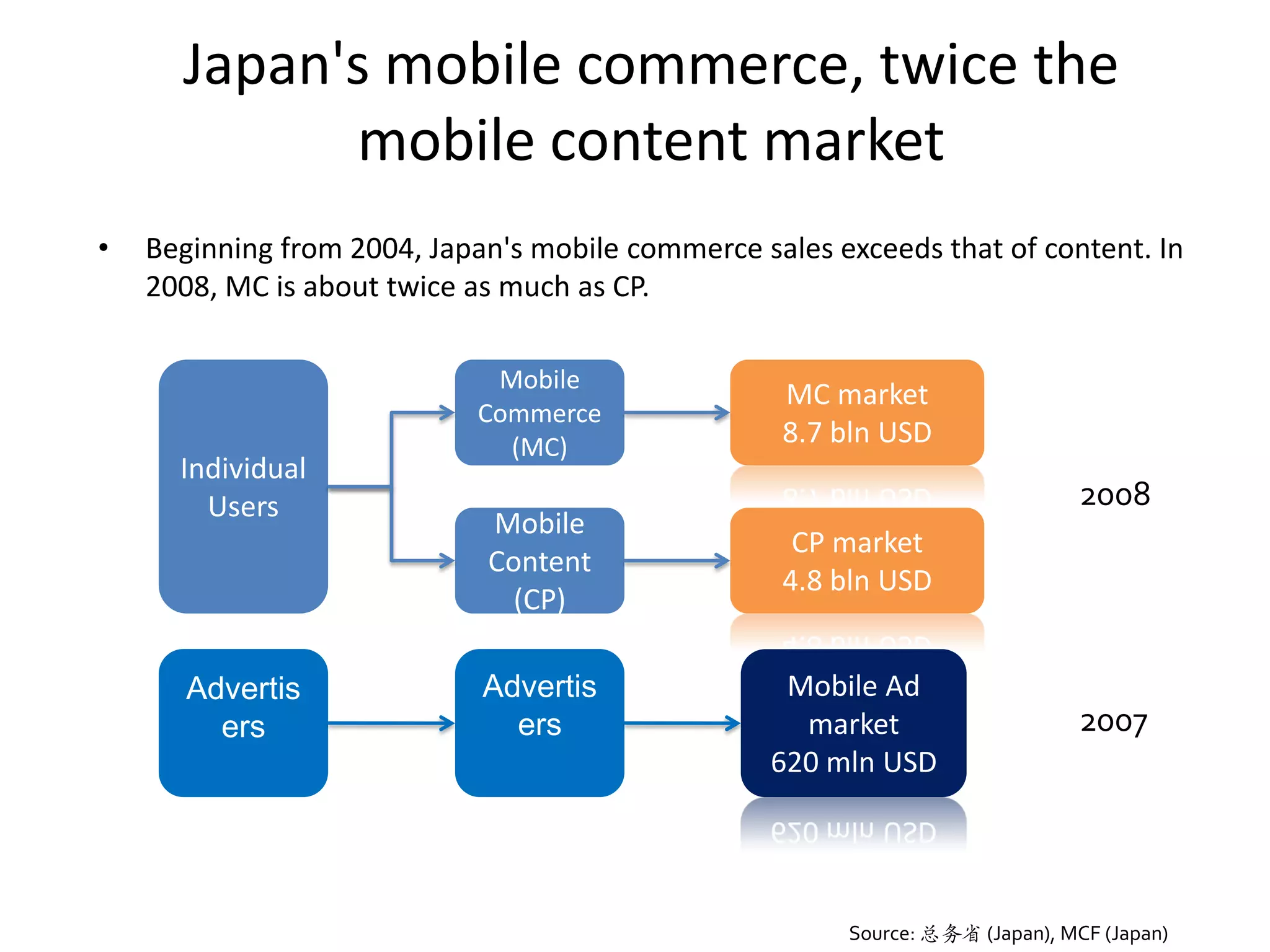

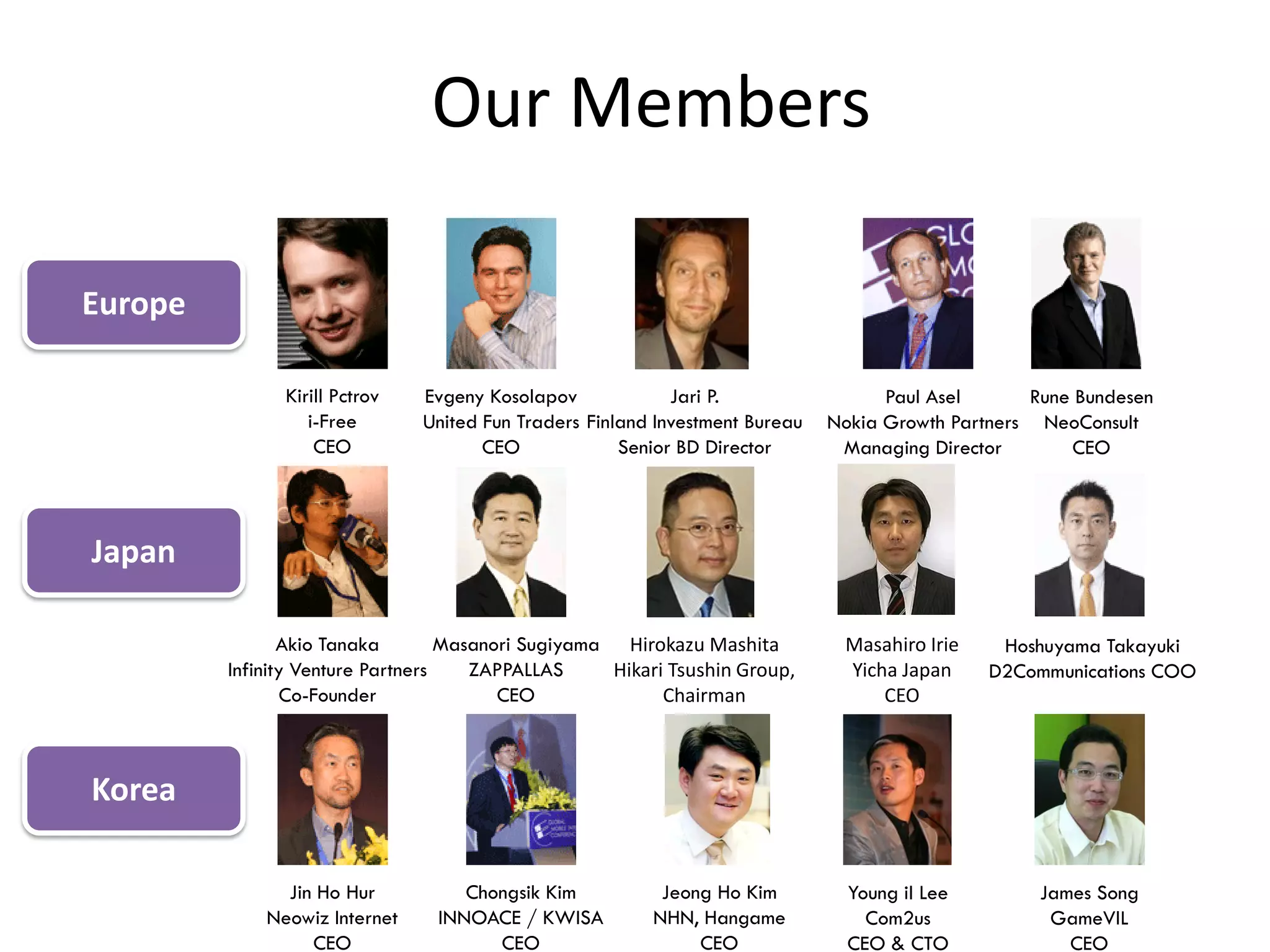

The document discusses the mobile internet markets in China and Japan, emphasizing the large user bases and the significant potential for growth in China. It compares key aspects such as user demographics, revenue generation, and innovation, highlighting the dominance of mobile operators in Japan's market. Additionally, it notes the role of the Great Wall Club in fostering a network among mobile internet executives across various countries.