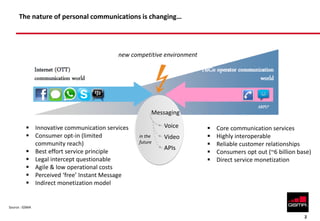

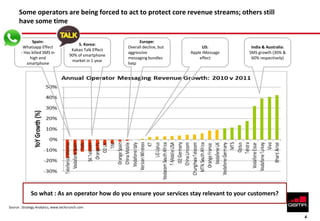

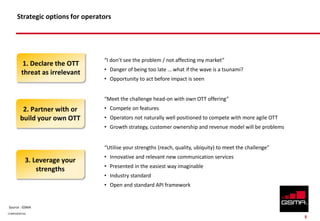

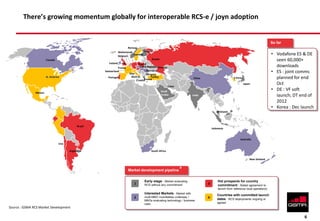

This document discusses the rise of over-the-top (OTT) messaging services and their impact on traditional mobile operators. It notes that OTT services like WhatsApp, KakaoTalk, and iMessage have seen explosive growth in users and messaging volumes. This threatens operators' core SMS revenue streams. The document outlines three strategic options for operators: ignoring the threat, developing their own OTT service, or leveraging their strengths through an open messaging standard like RCS. It shows momentum is growing for interoperable RCS adoption globally as a way for operators to ensure their services remain relevant to customers.