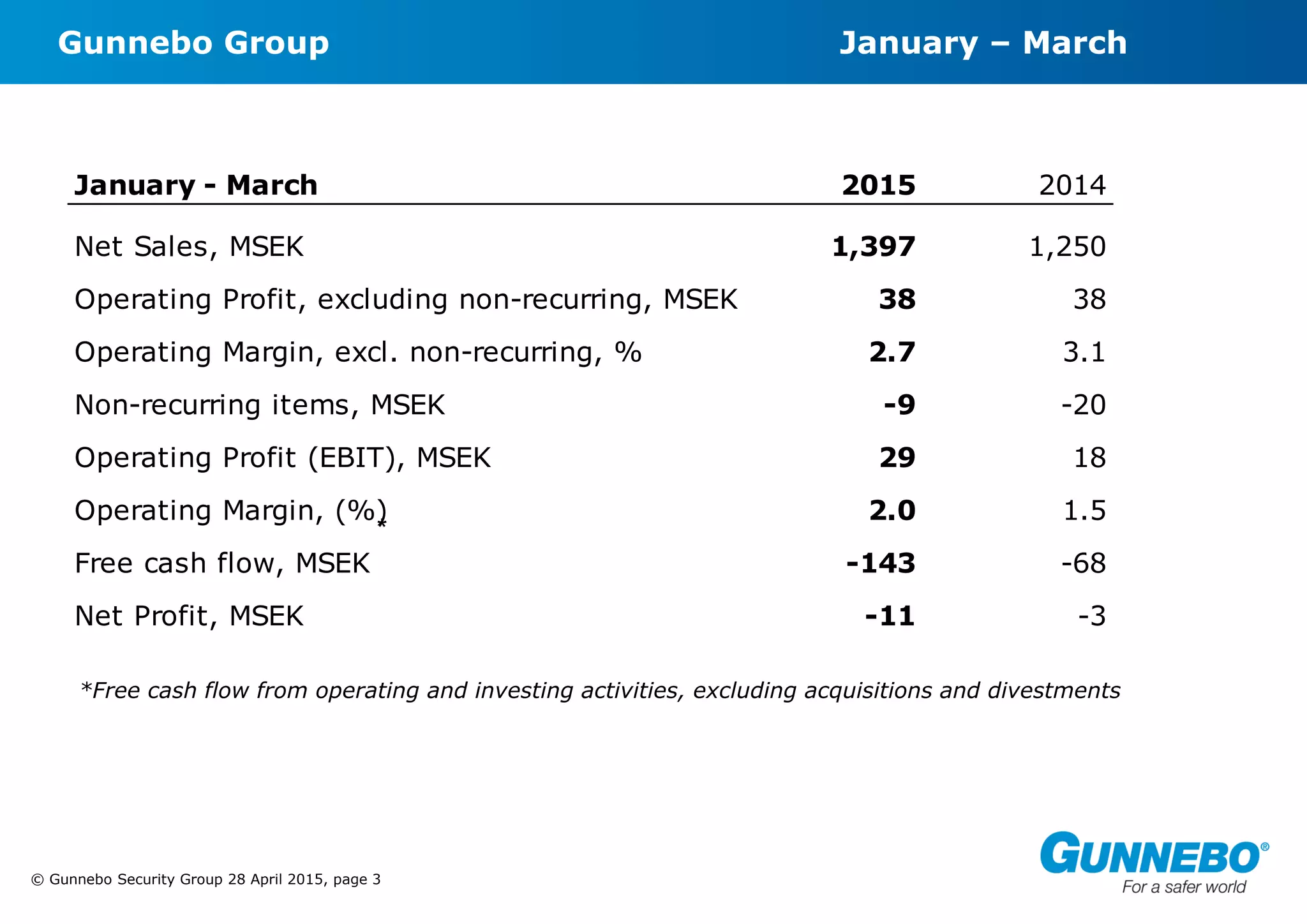

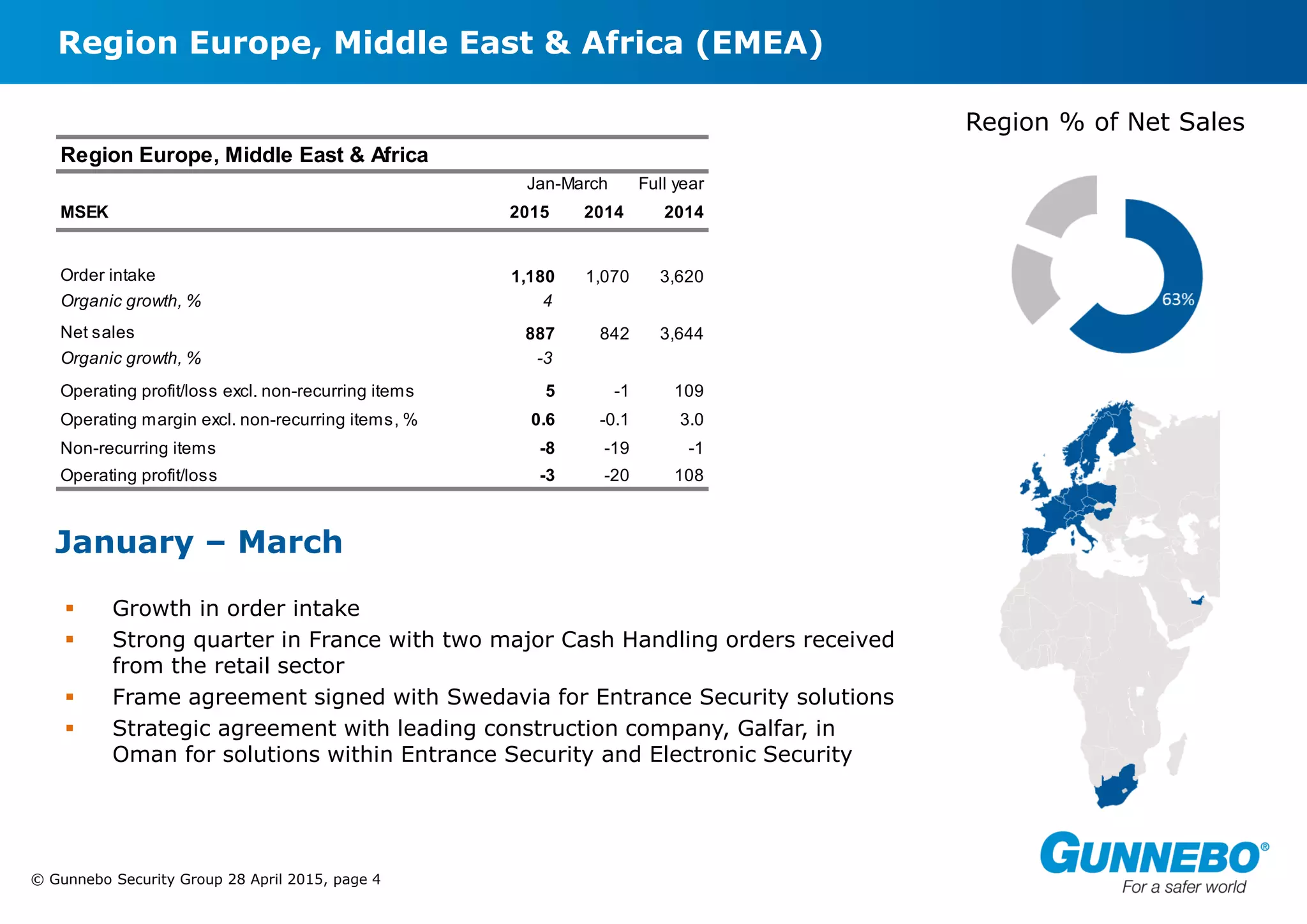

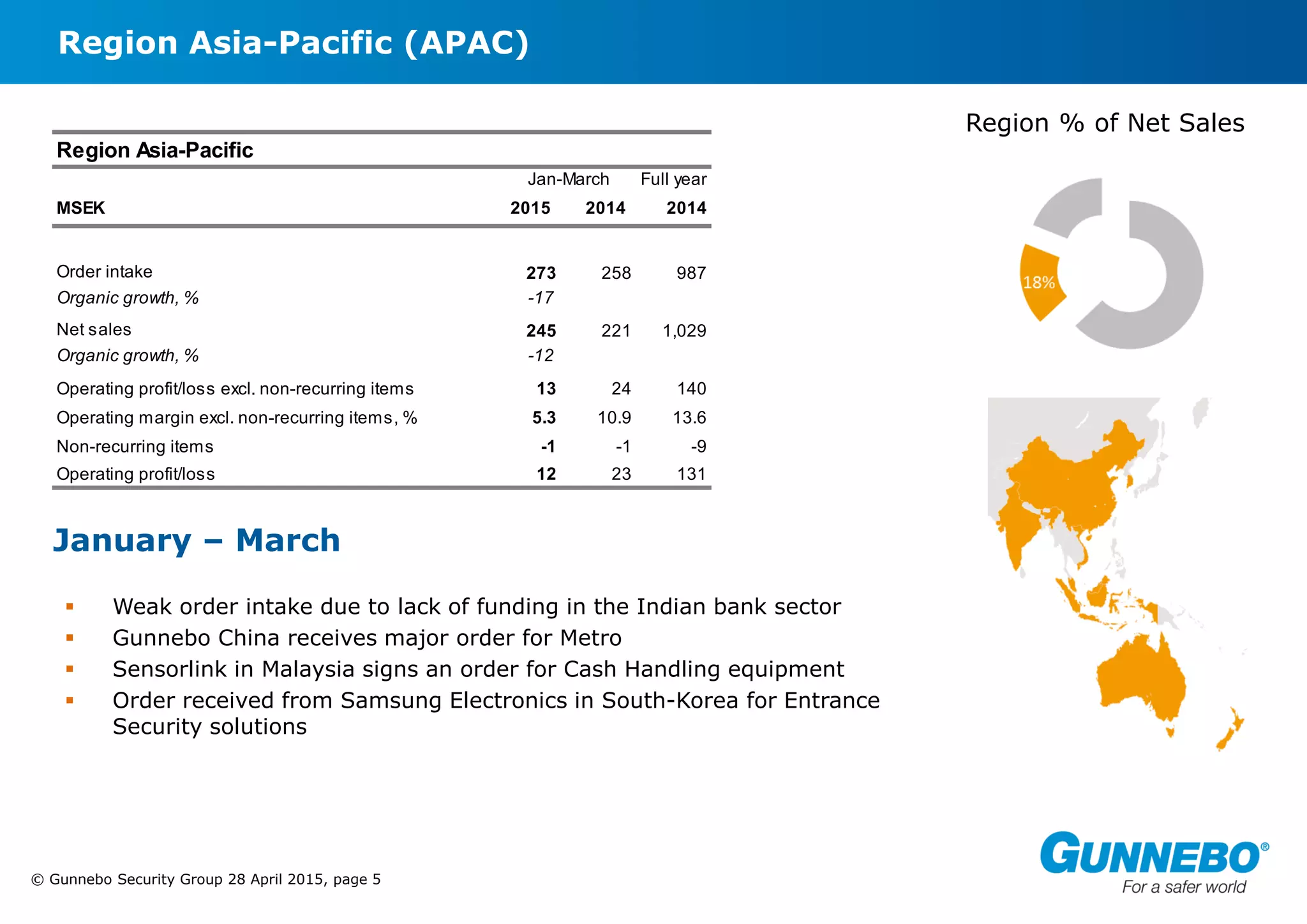

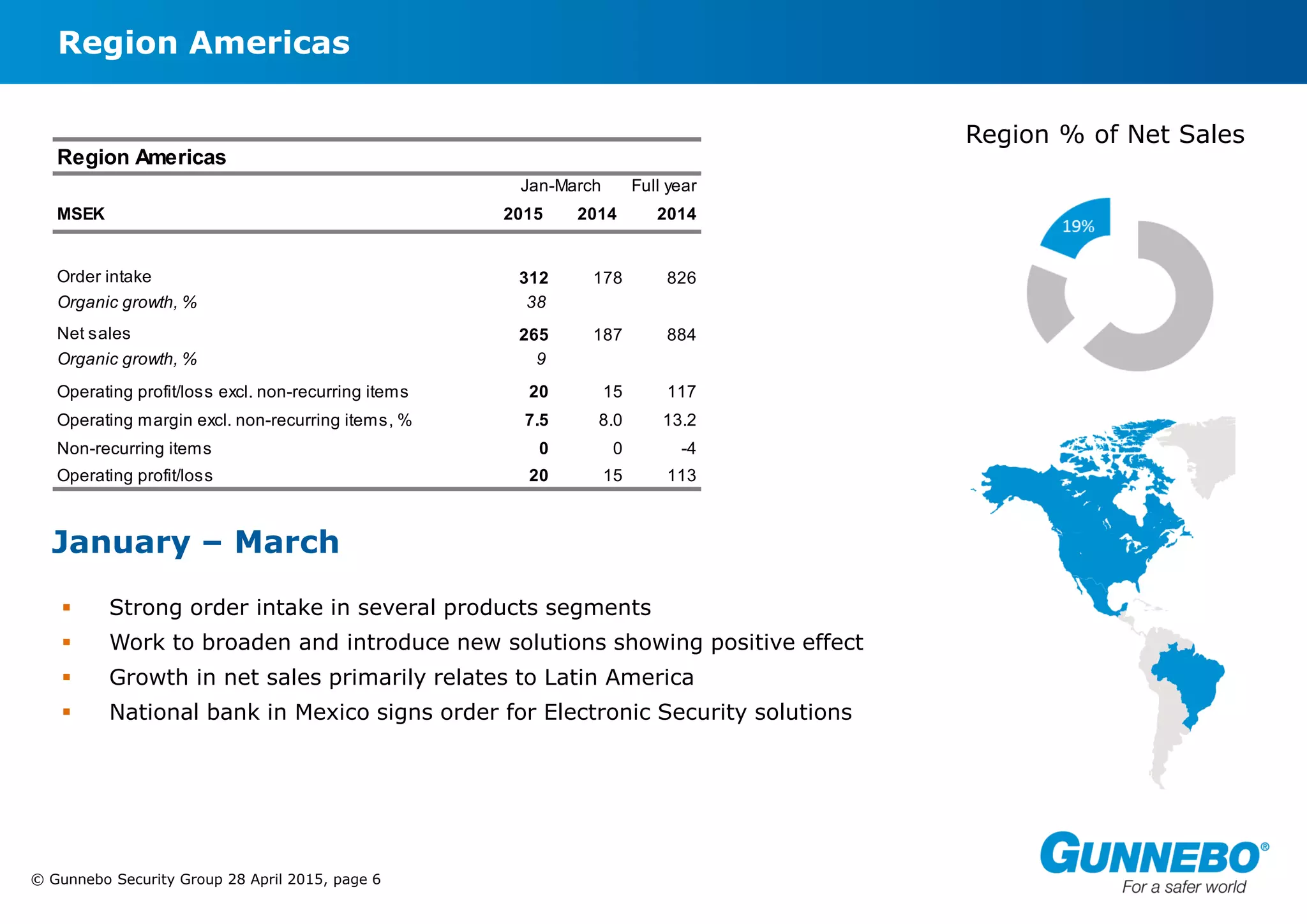

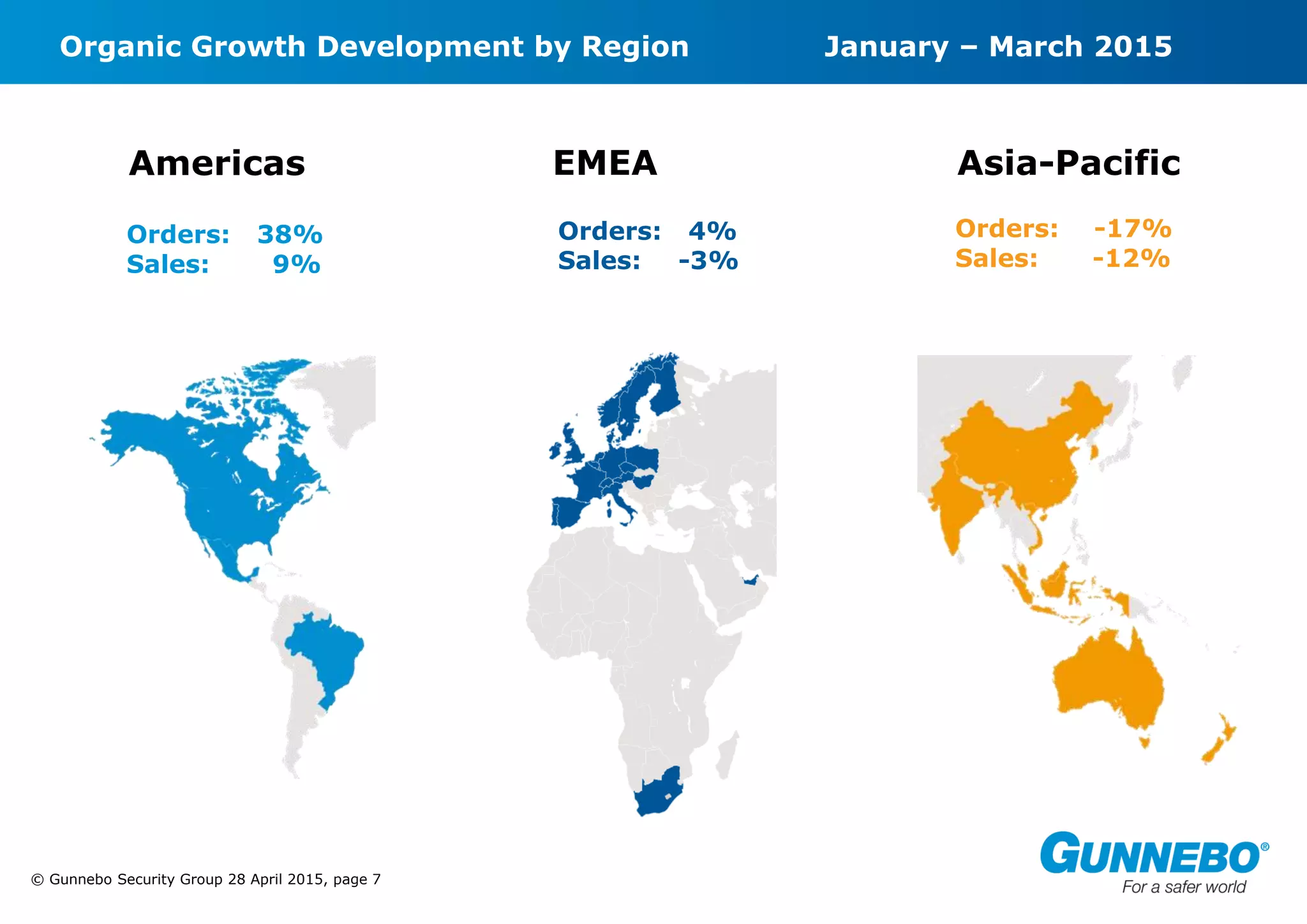

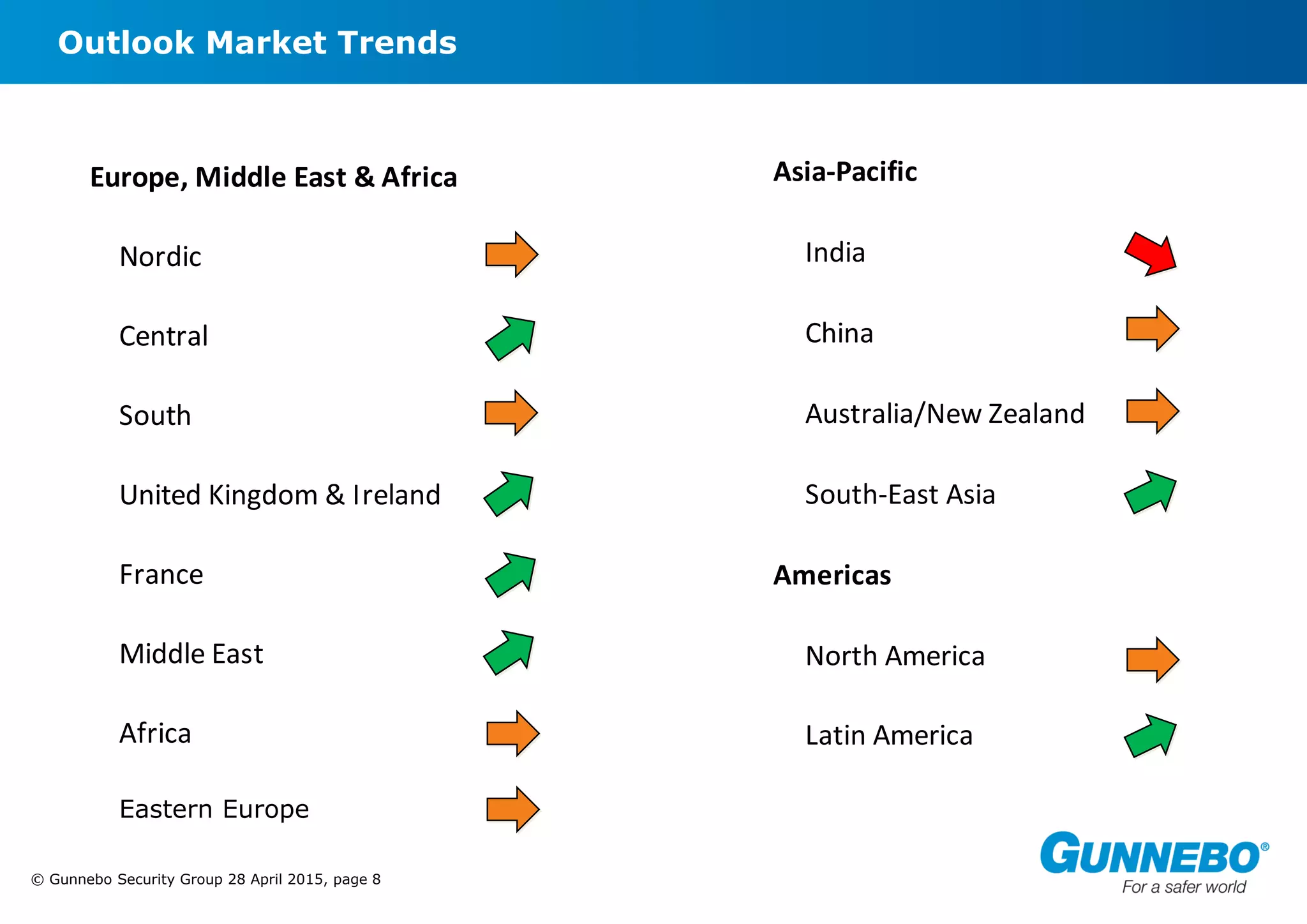

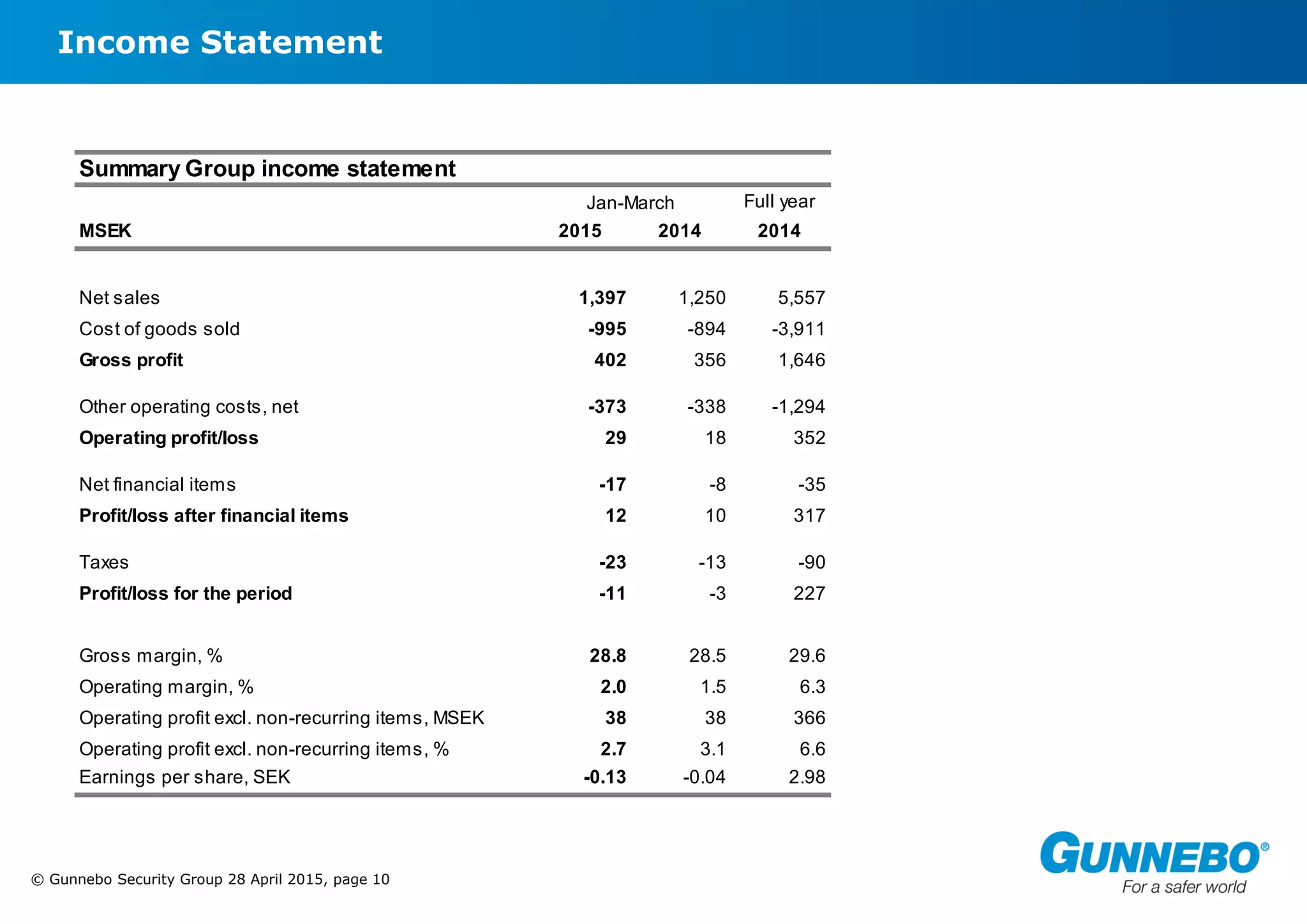

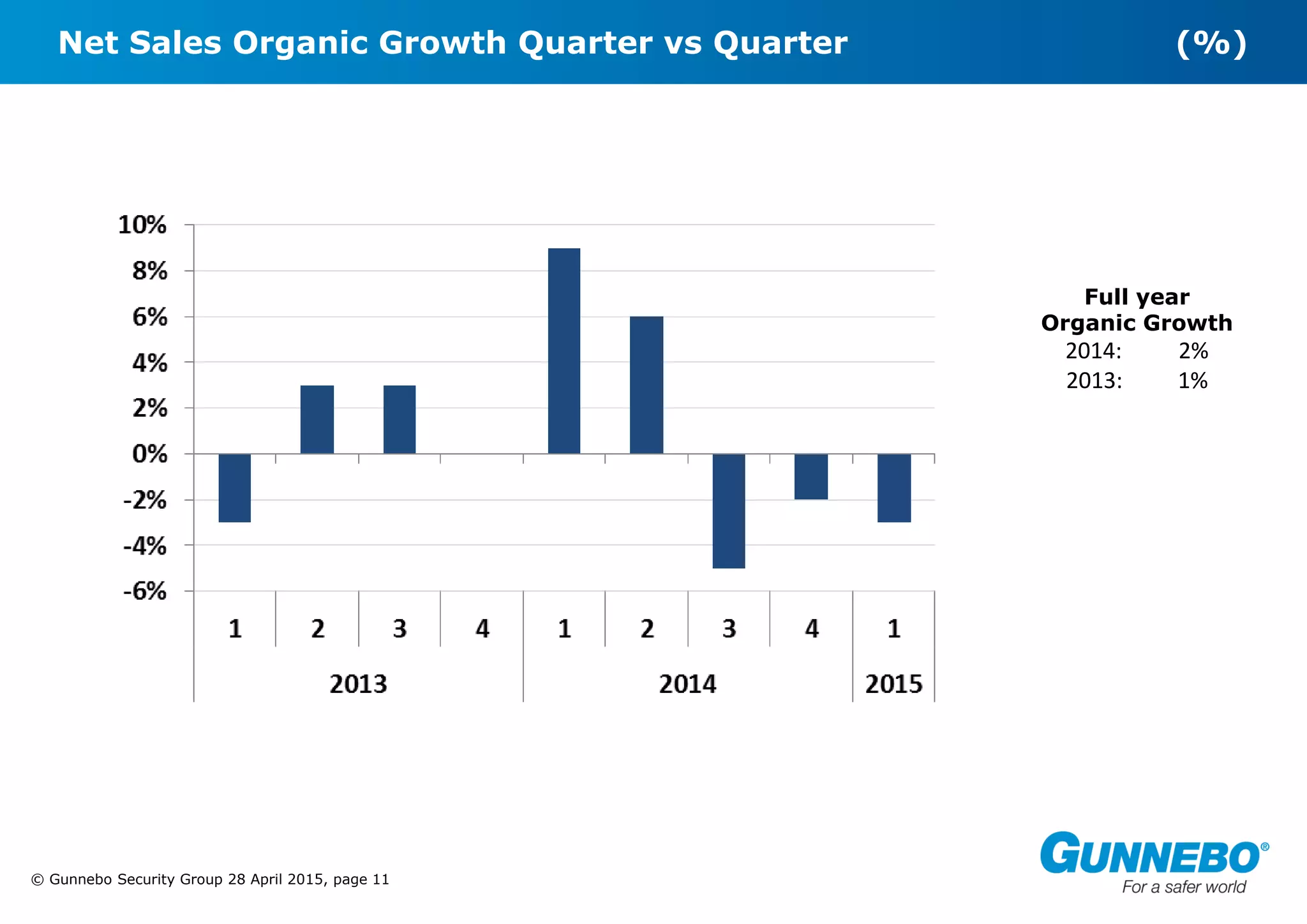

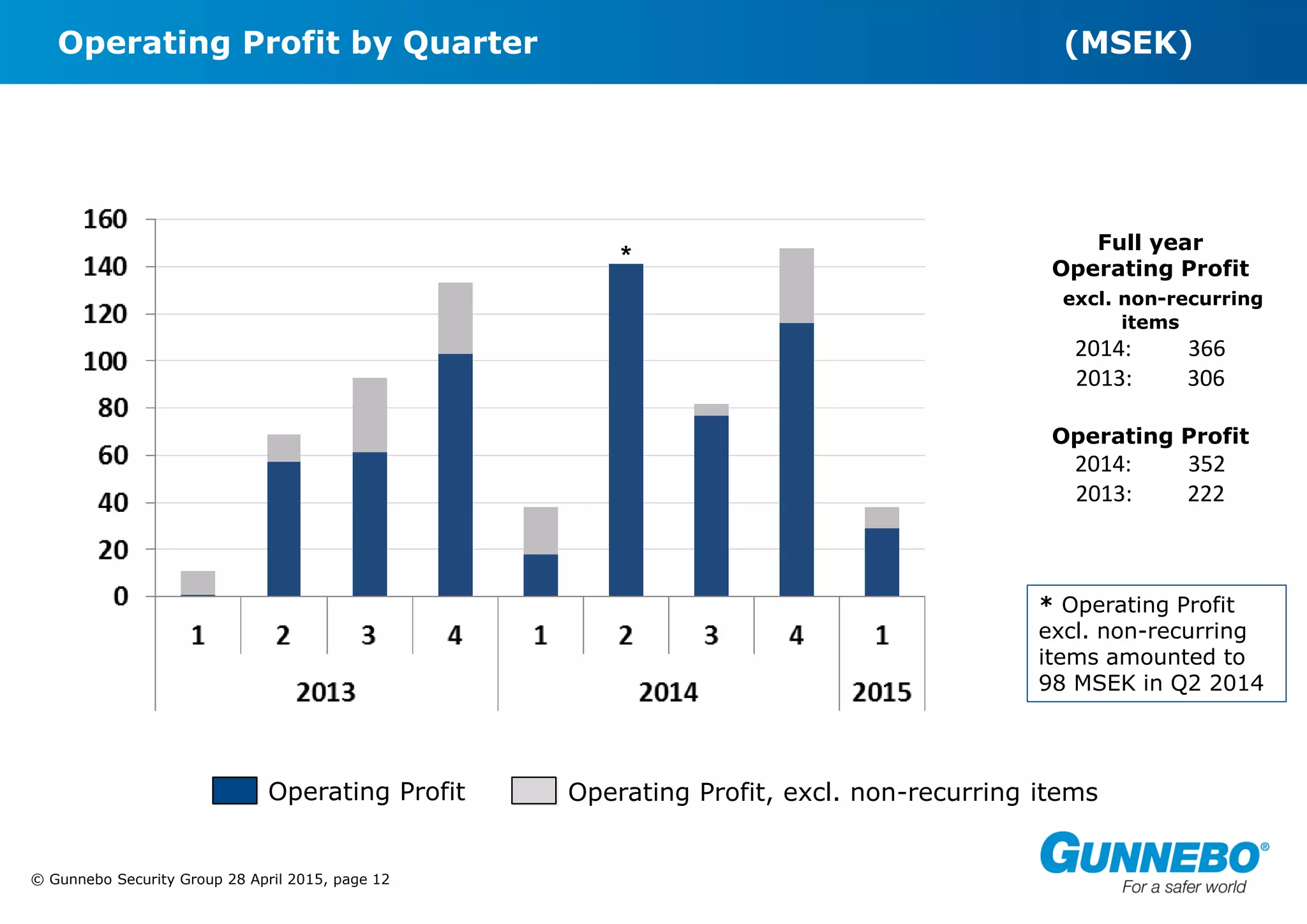

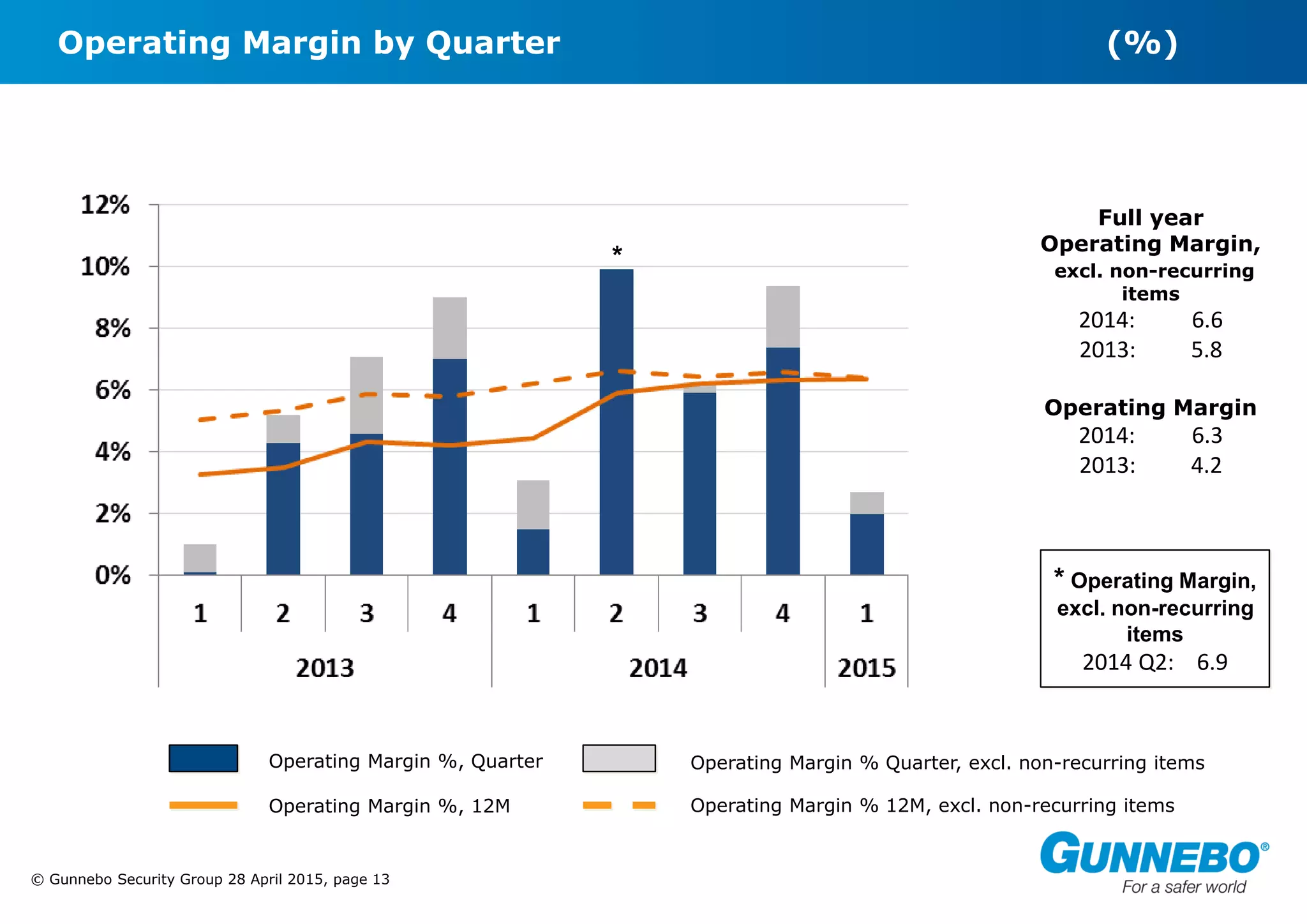

Gunnebo's first quarter report for 2015 showed a 5% increase in order intake but a 3% decrease in net sales organically. The operating profit was impacted by weak performance in India. EMEA saw 4% organic growth in order intake while the Americas saw 38% growth. Gunnebo will continue adjusting costs in Europe and priorities include broadening solutions and strengthening positions in emerging markets.