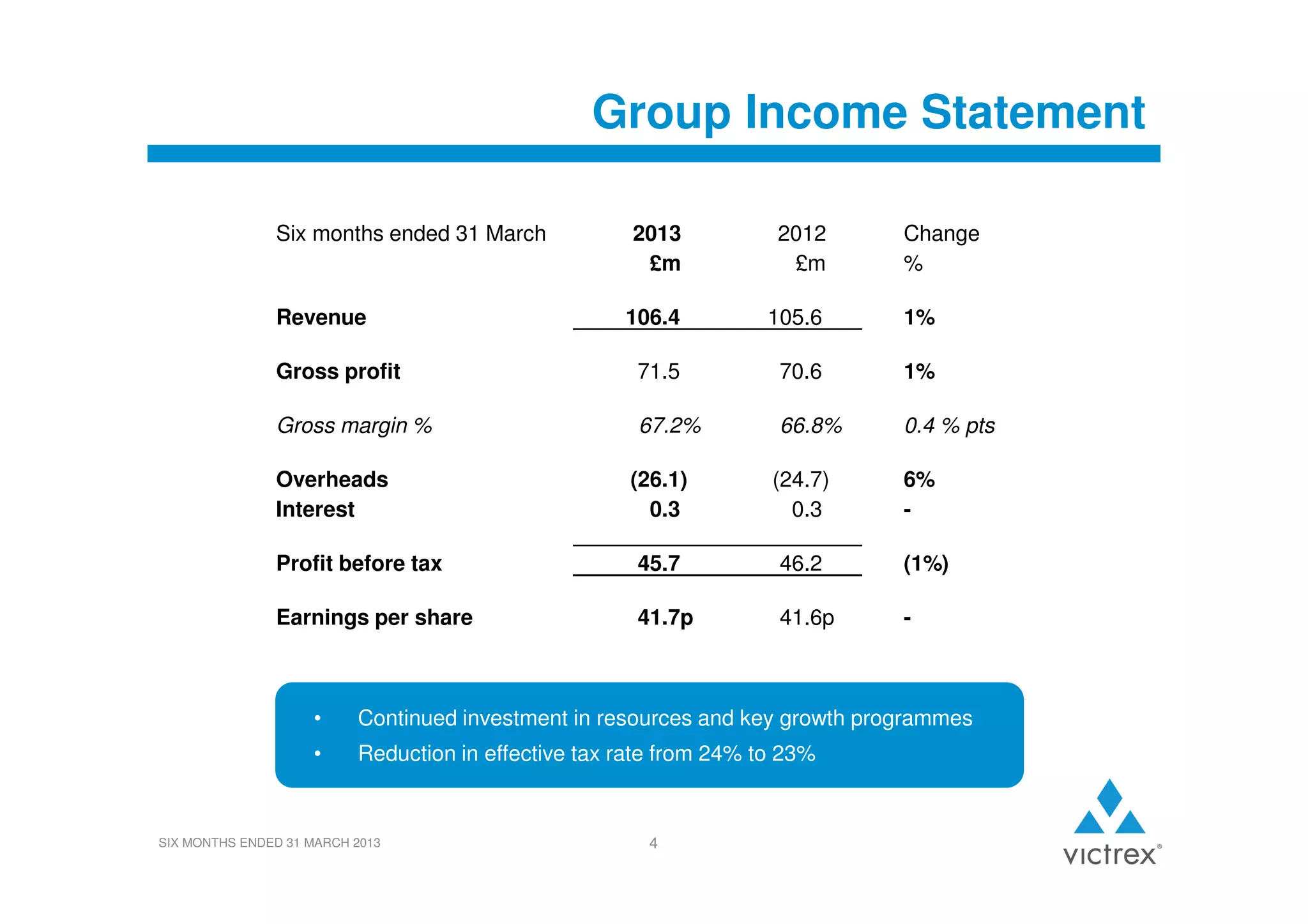

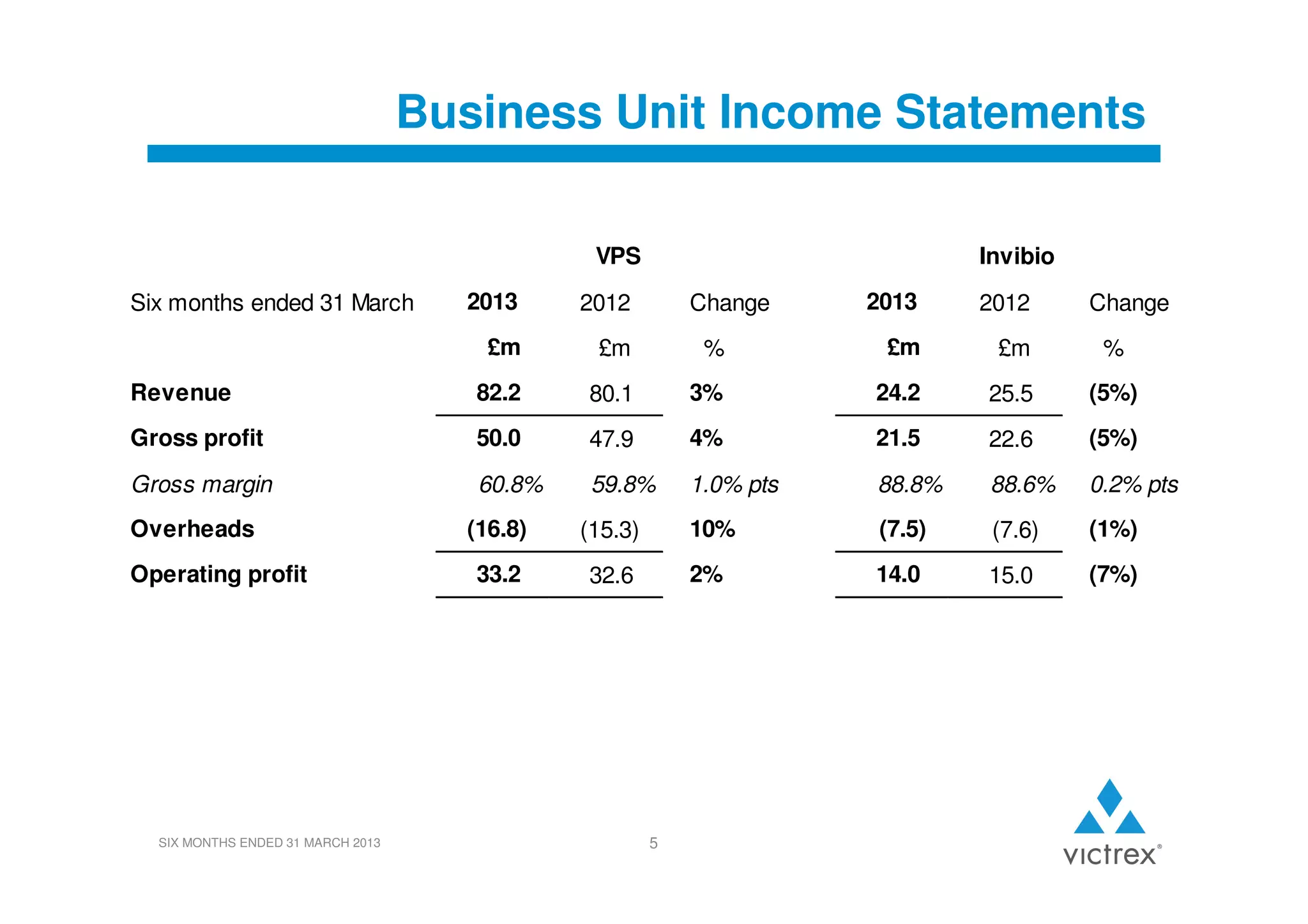

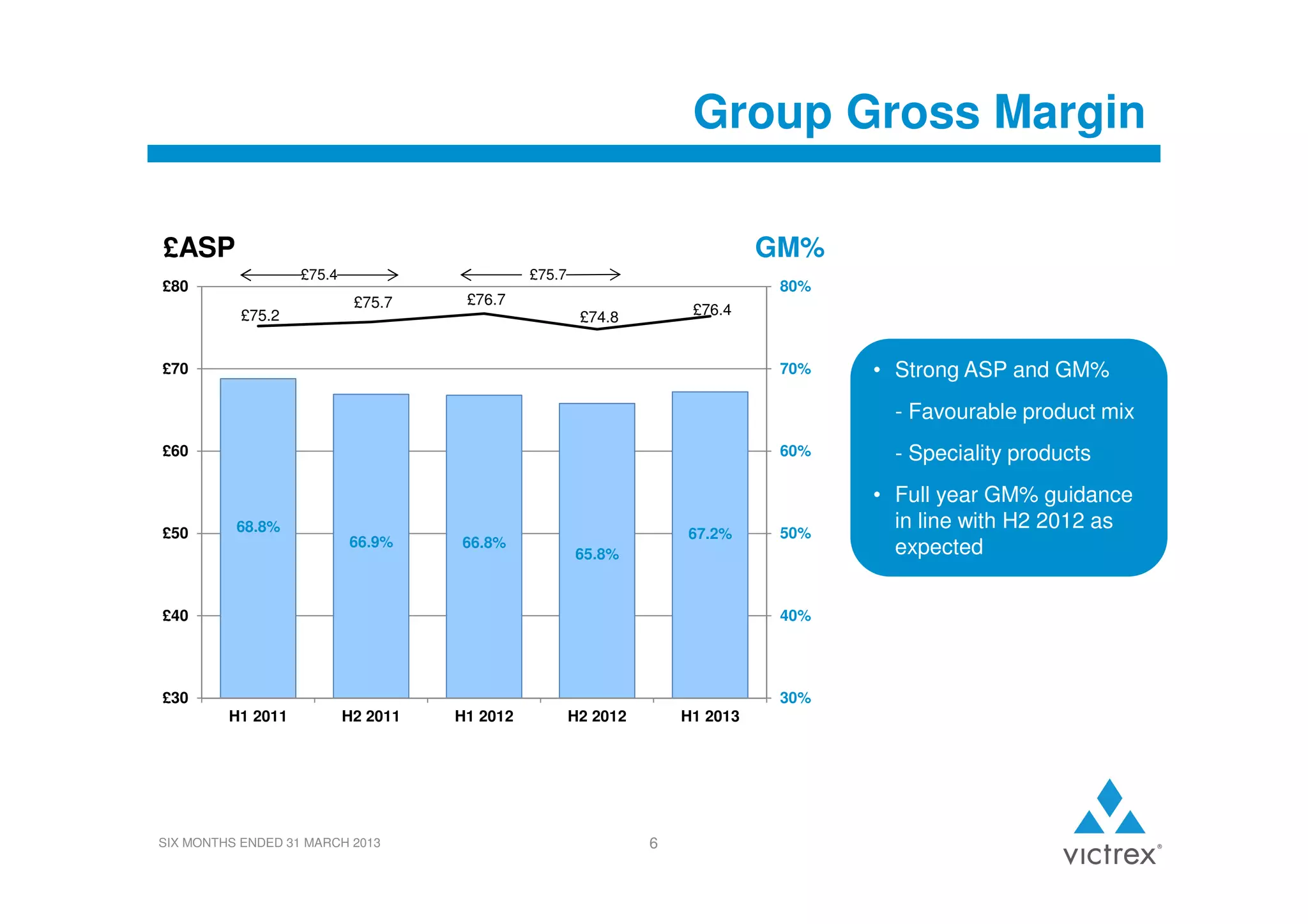

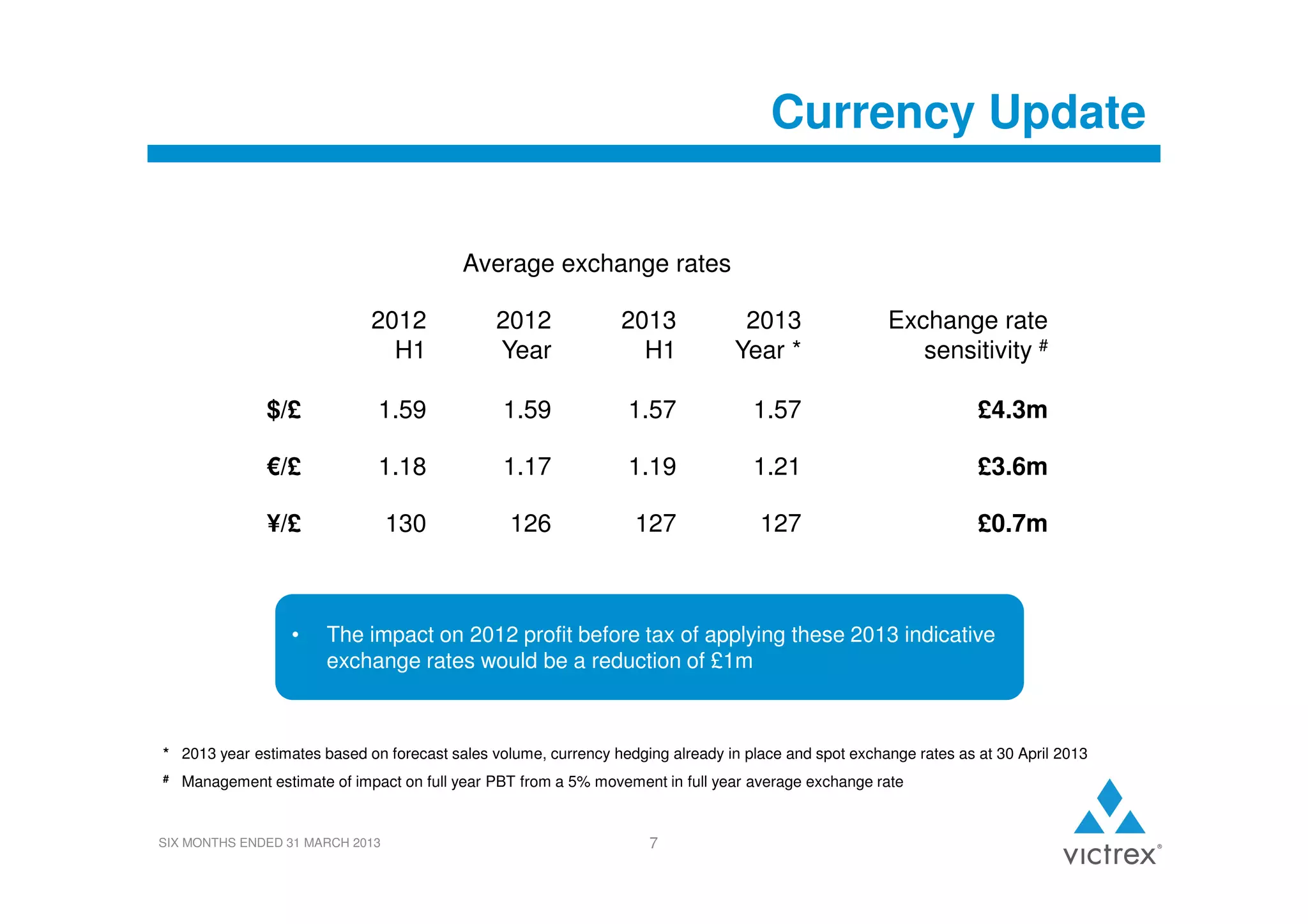

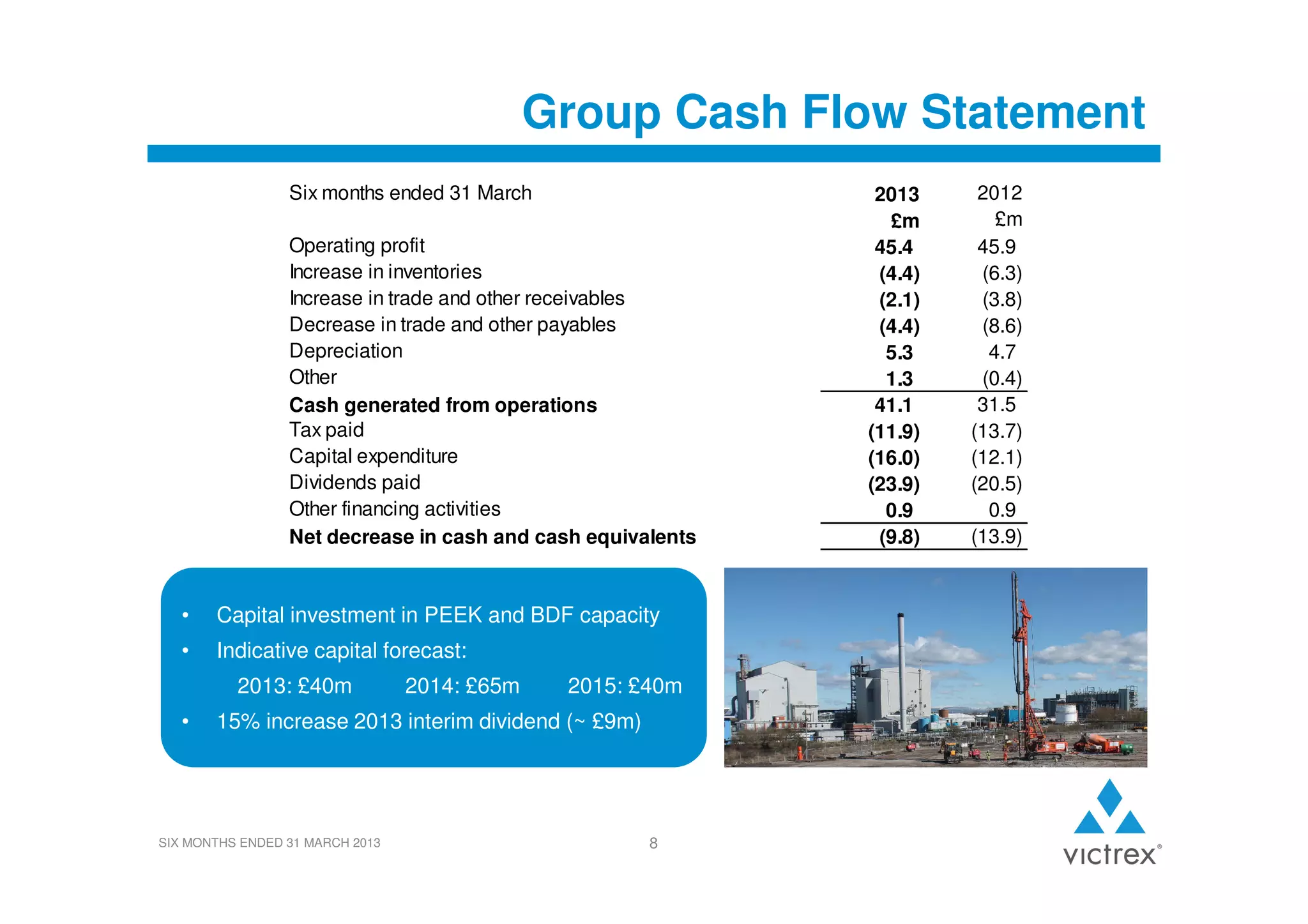

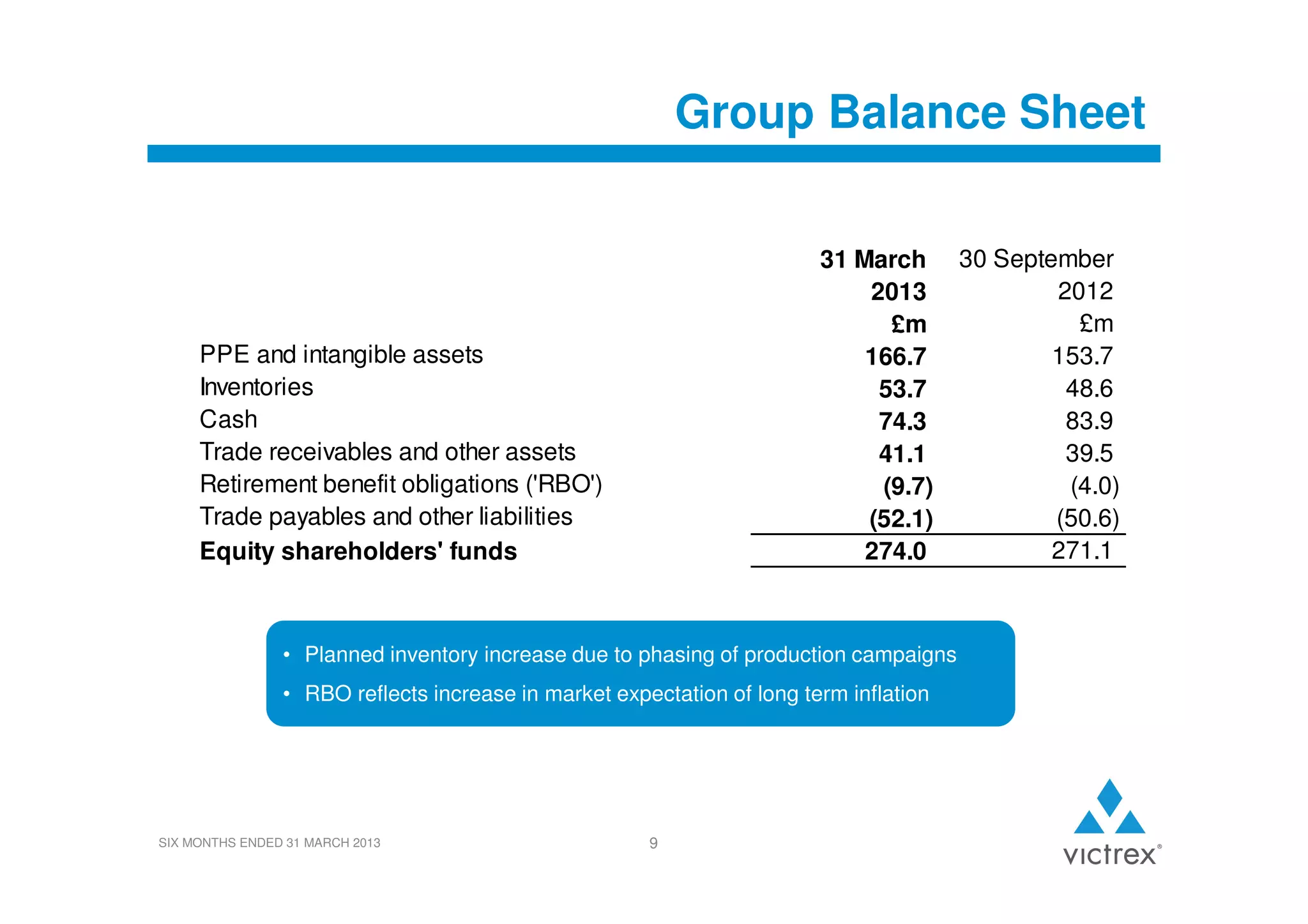

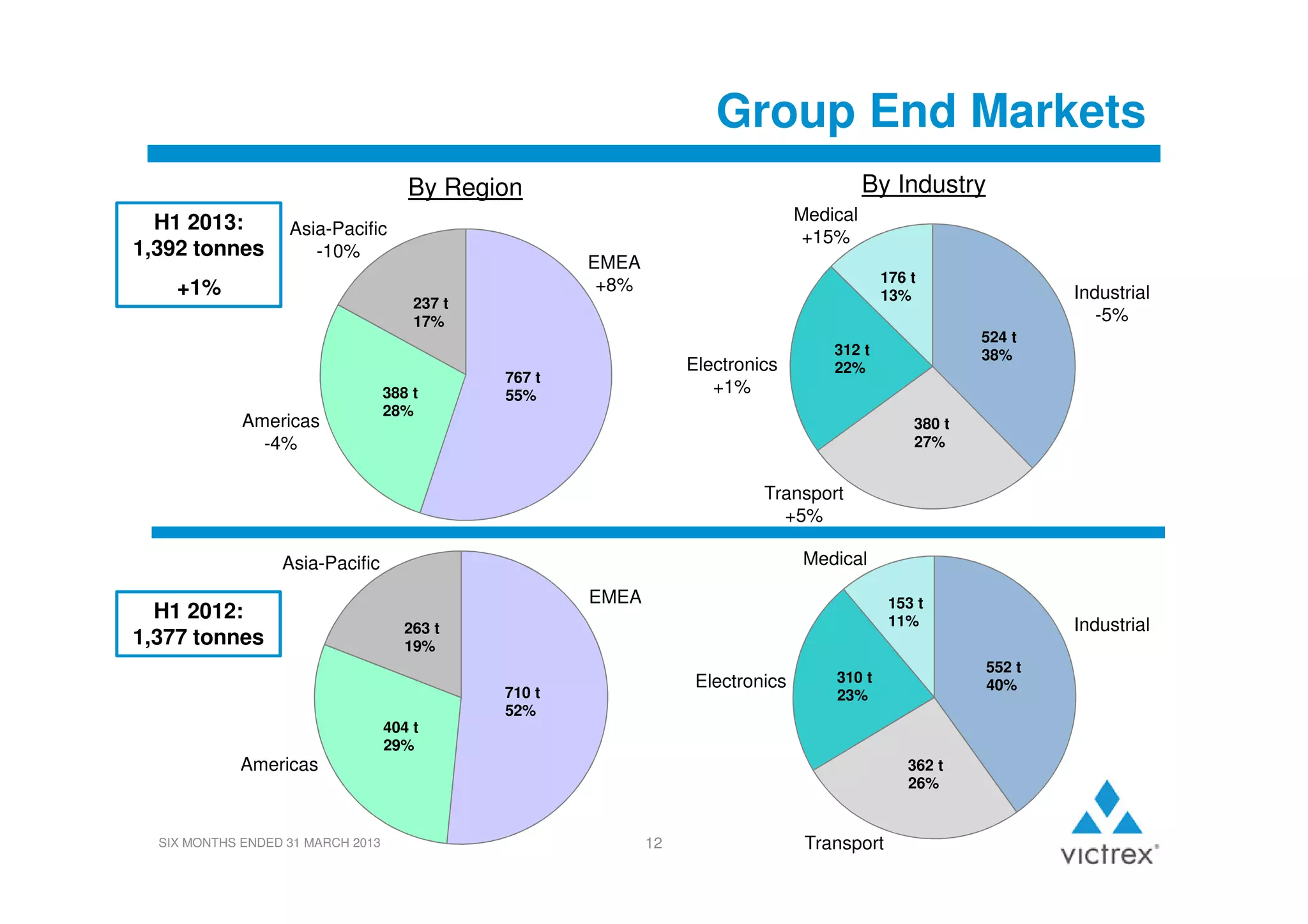

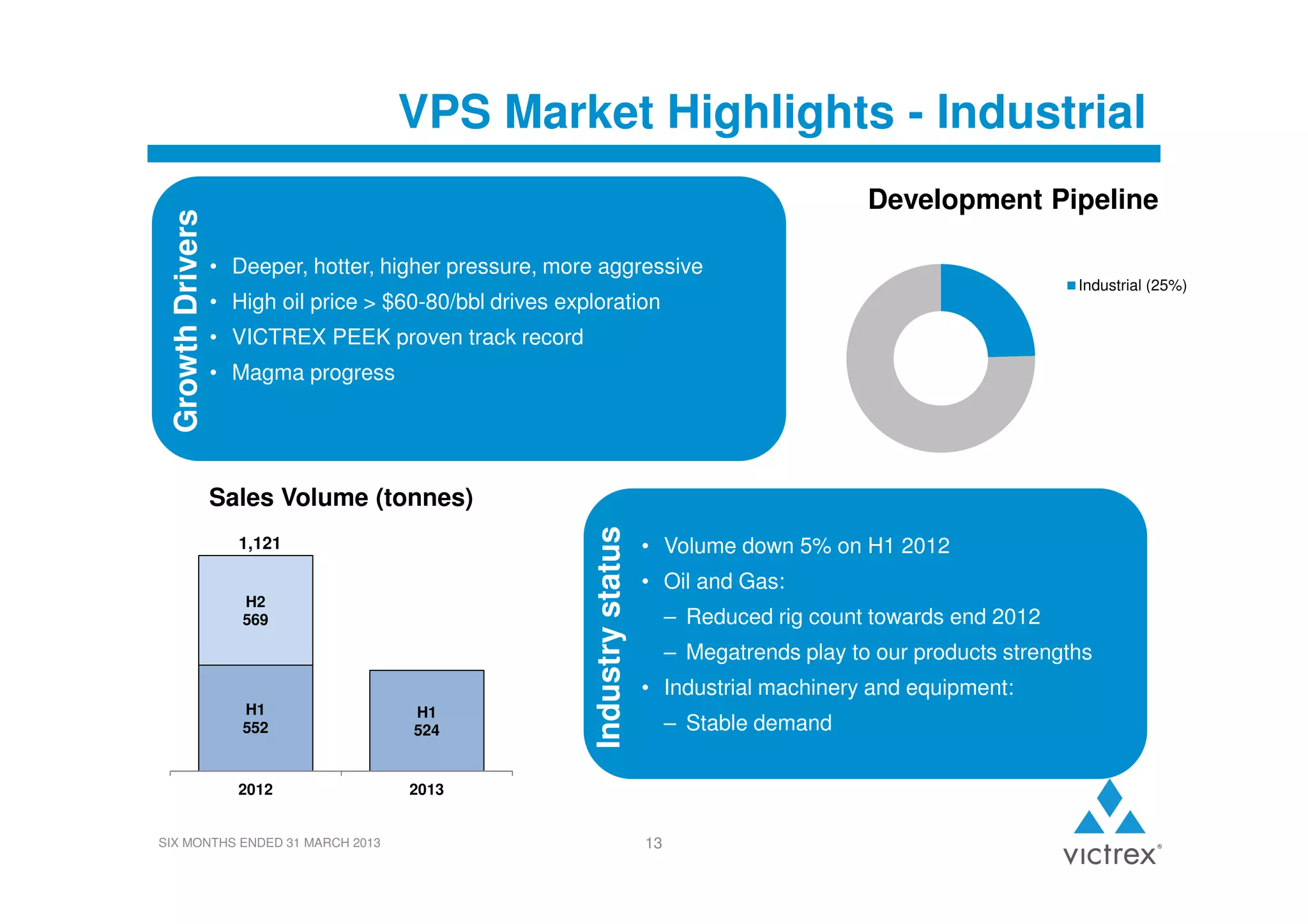

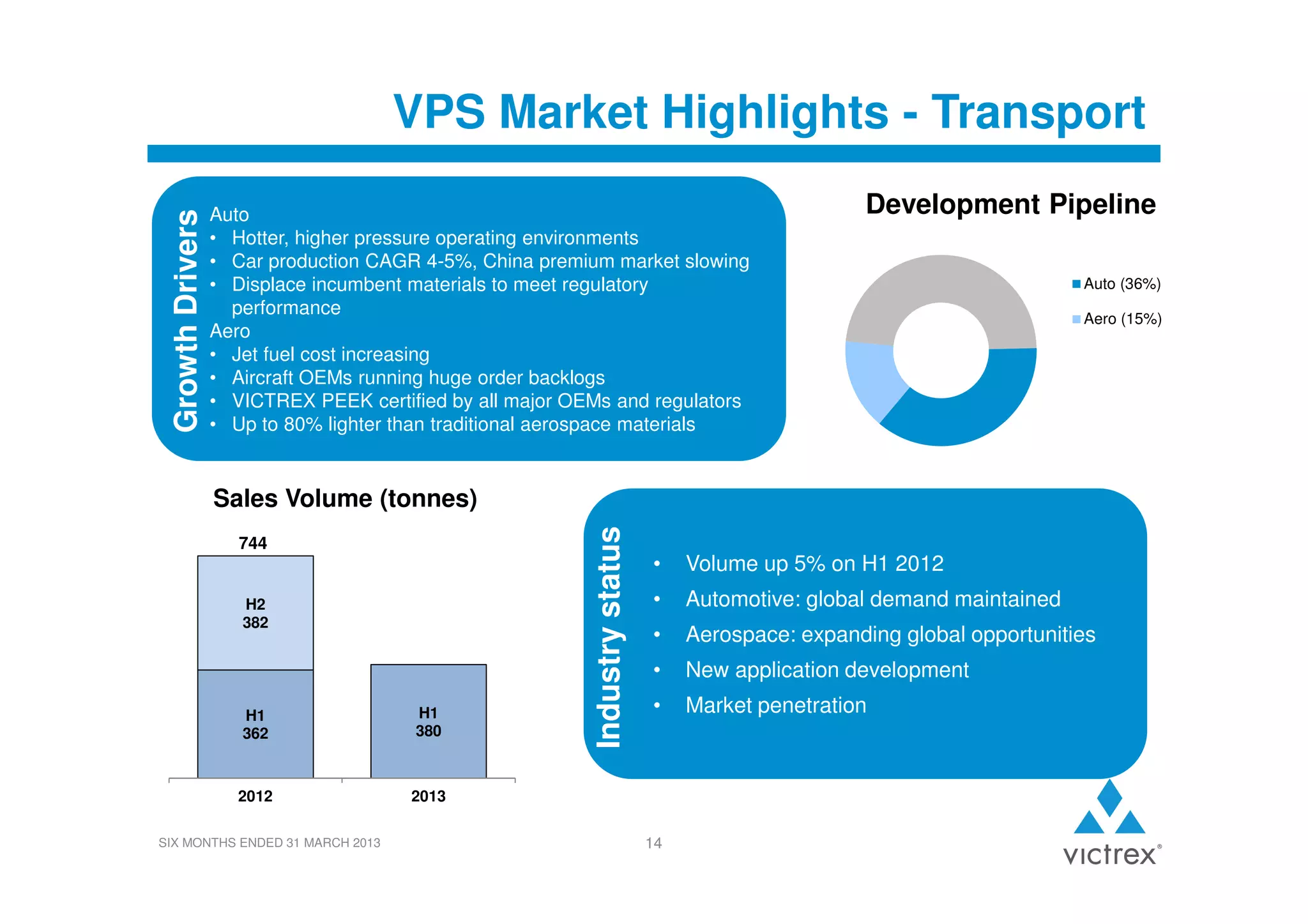

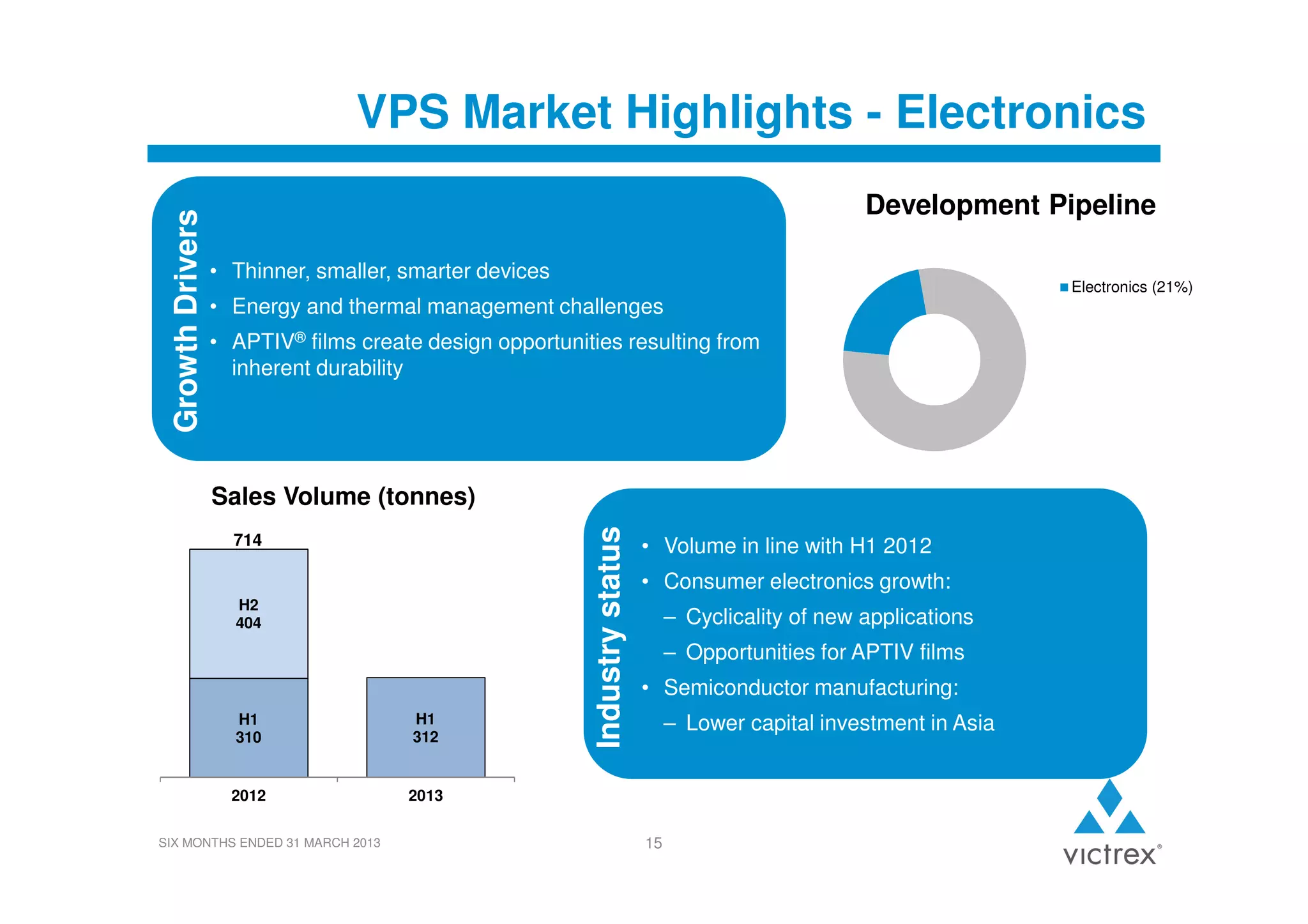

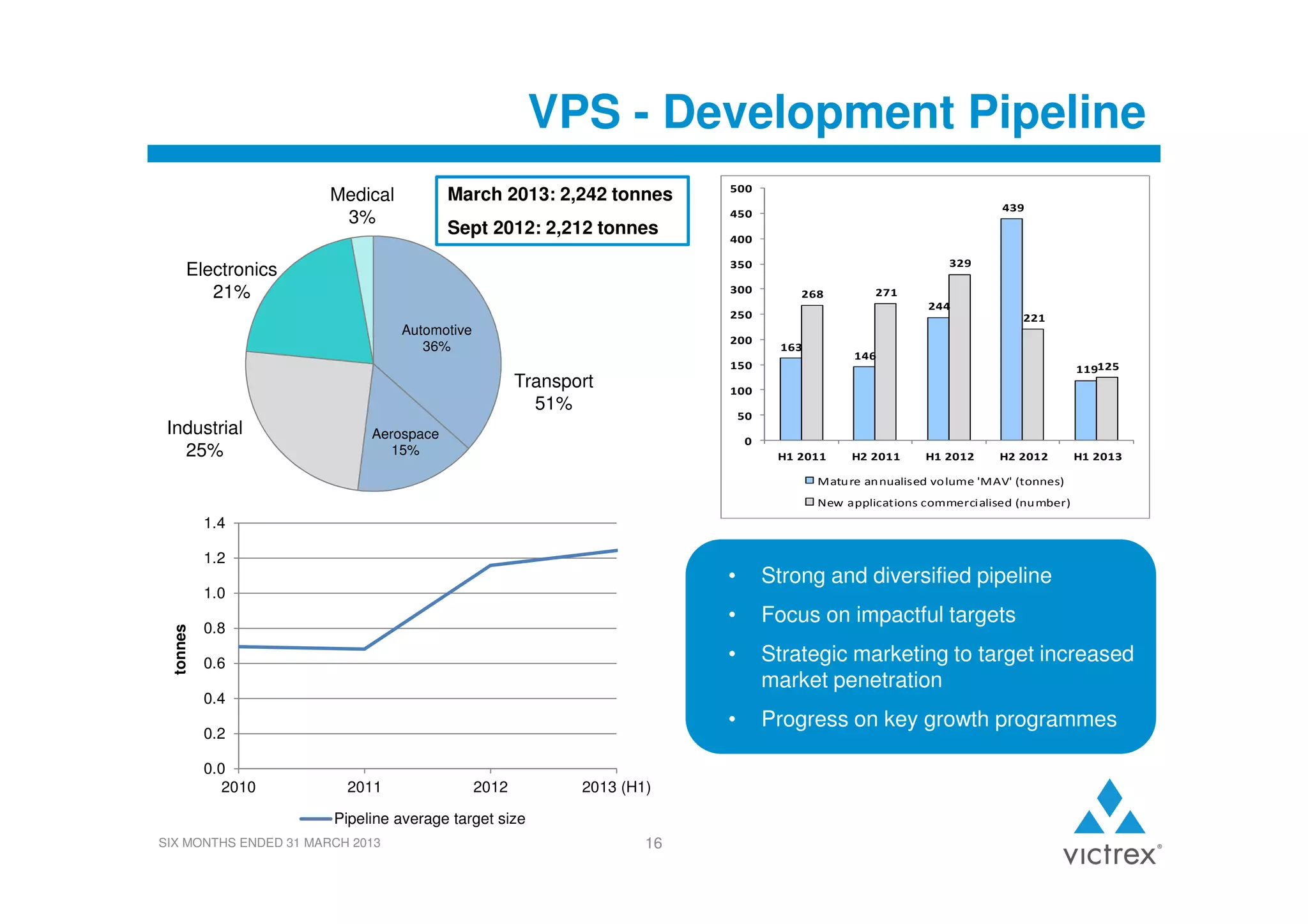

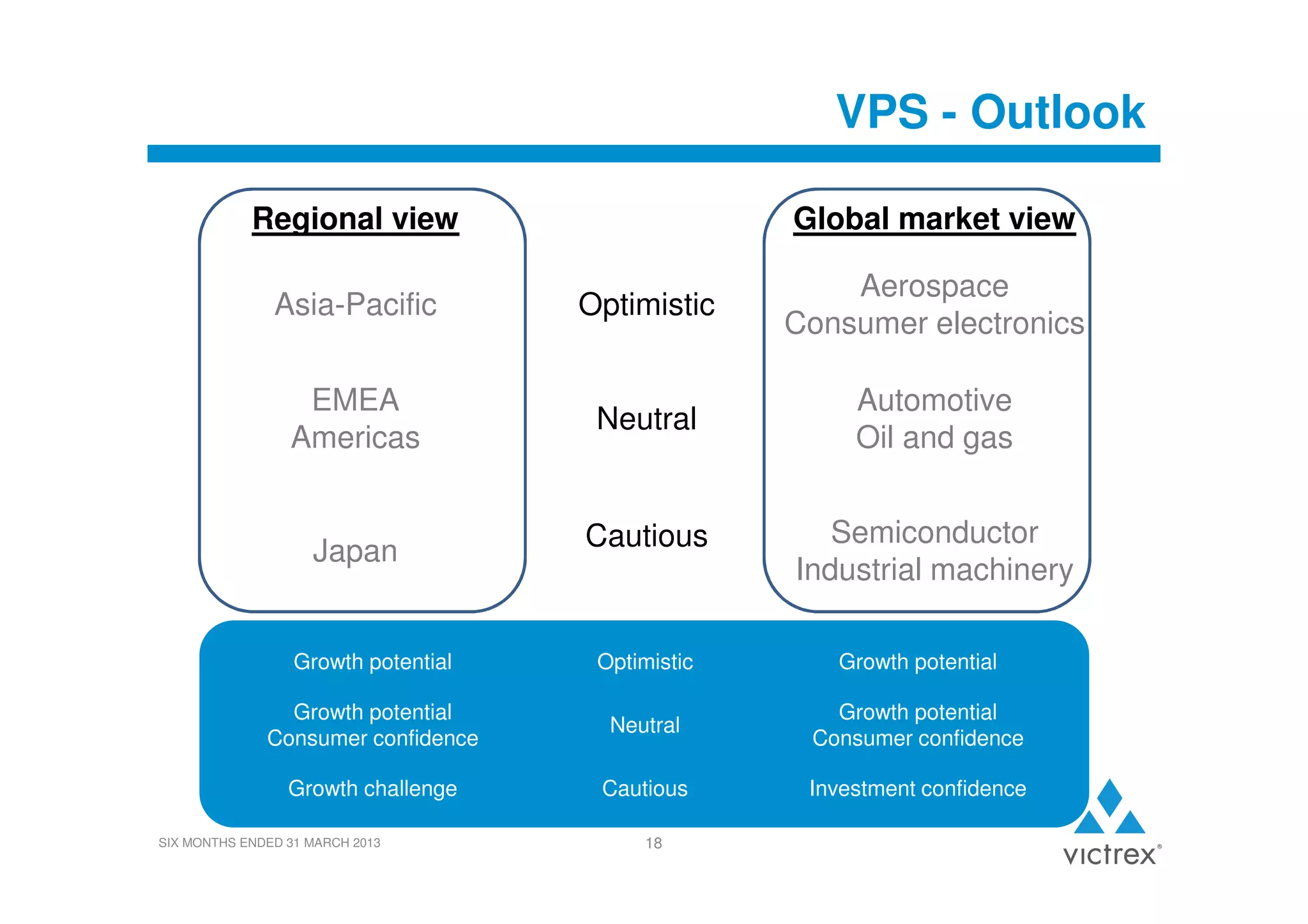

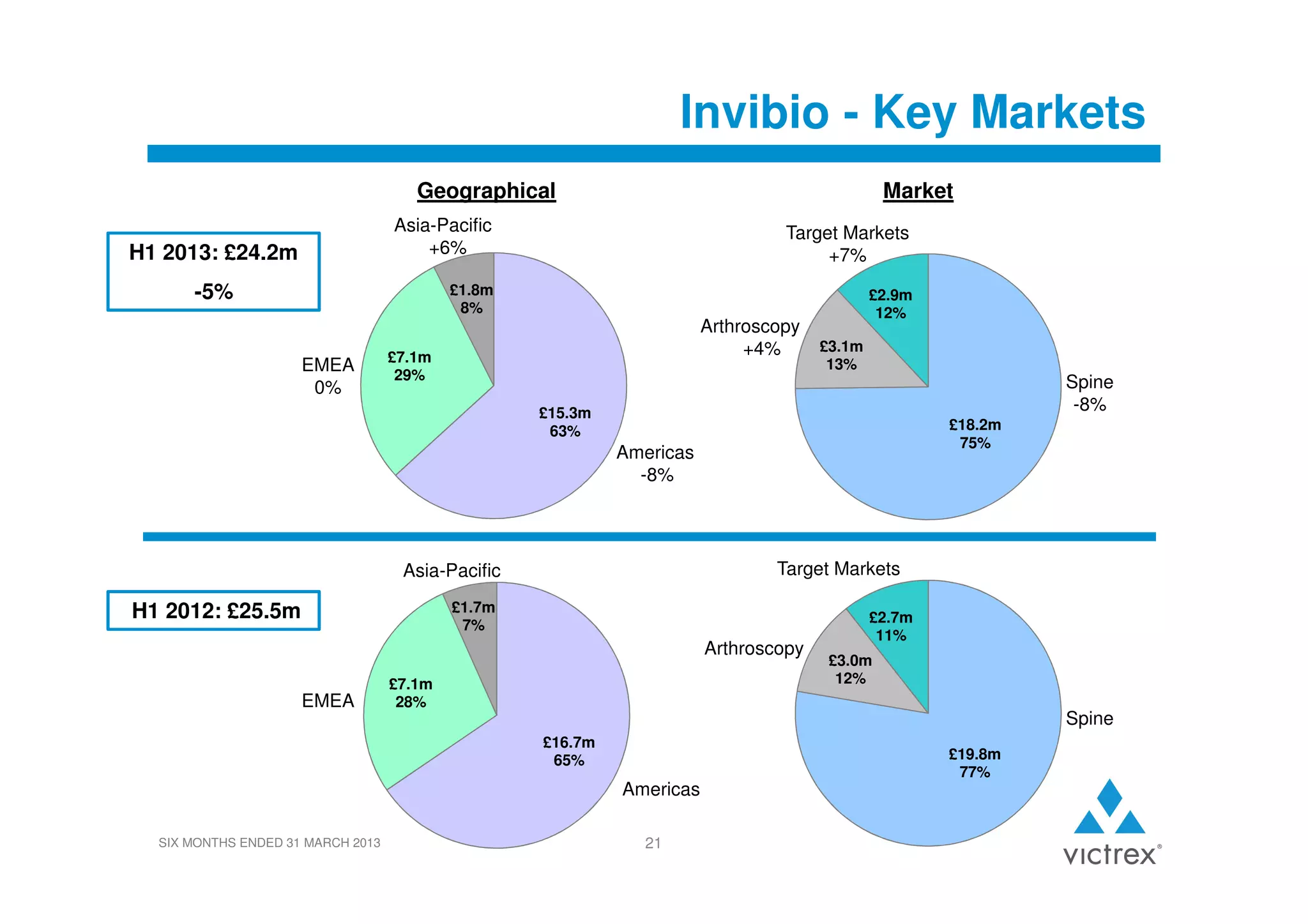

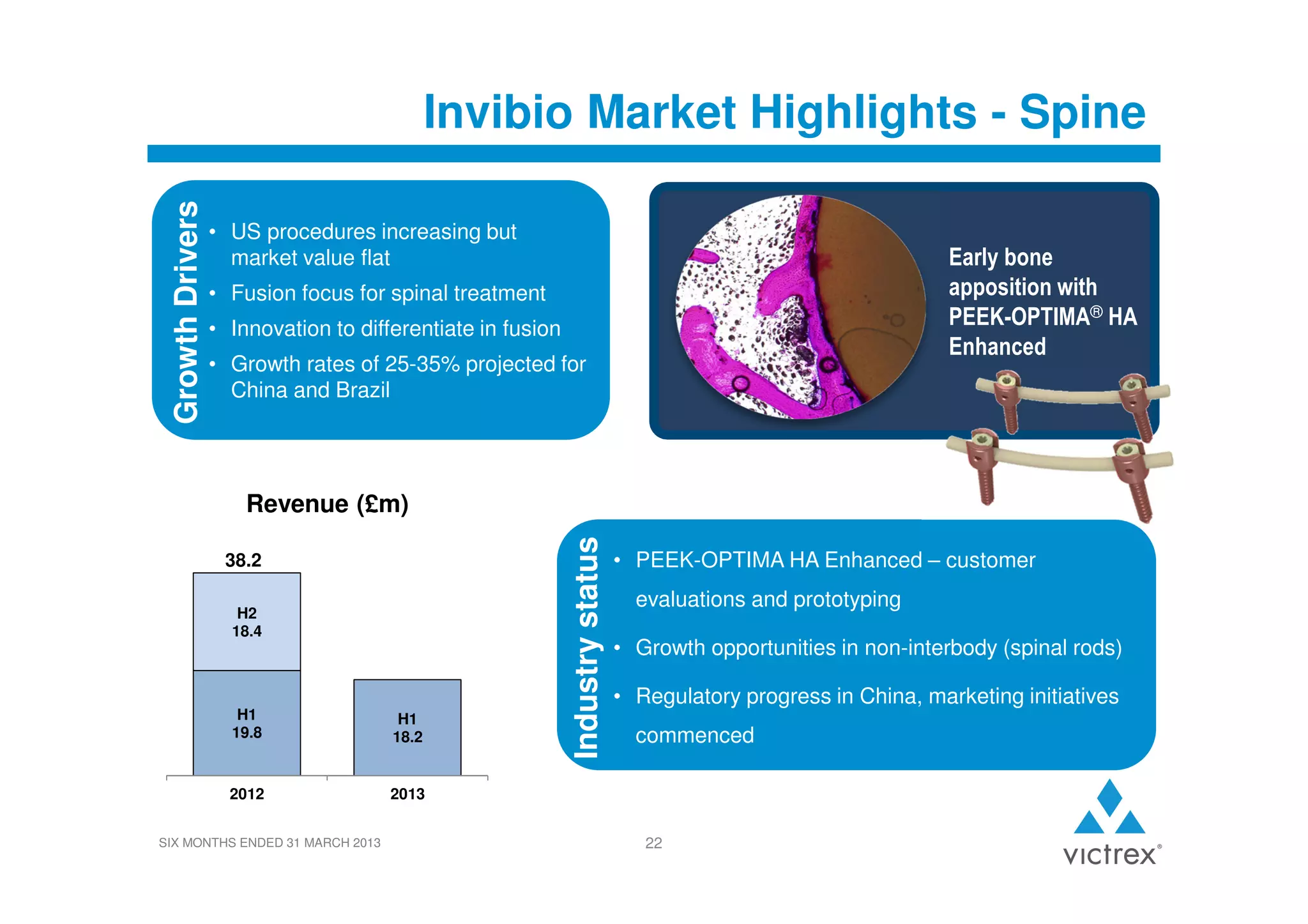

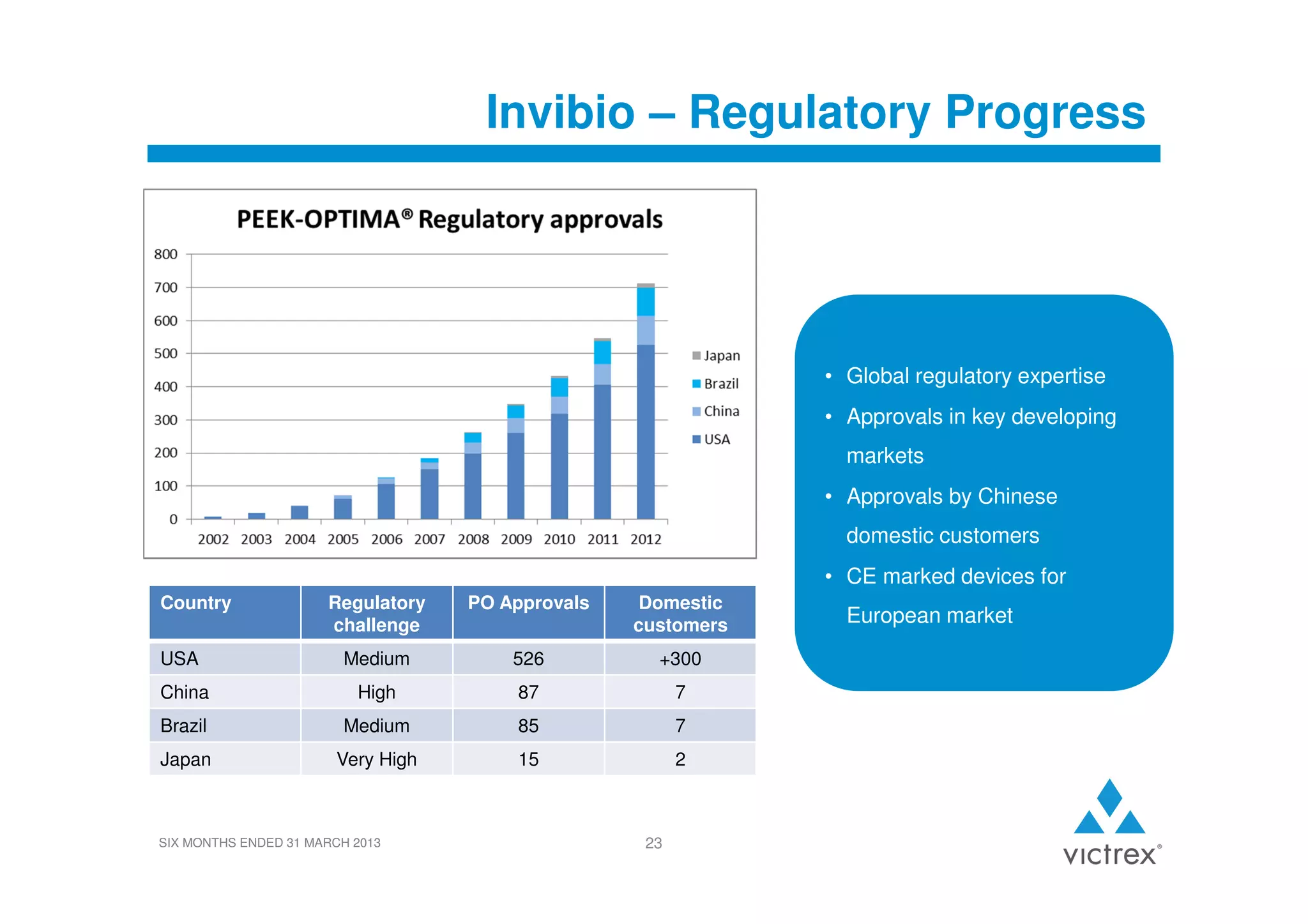

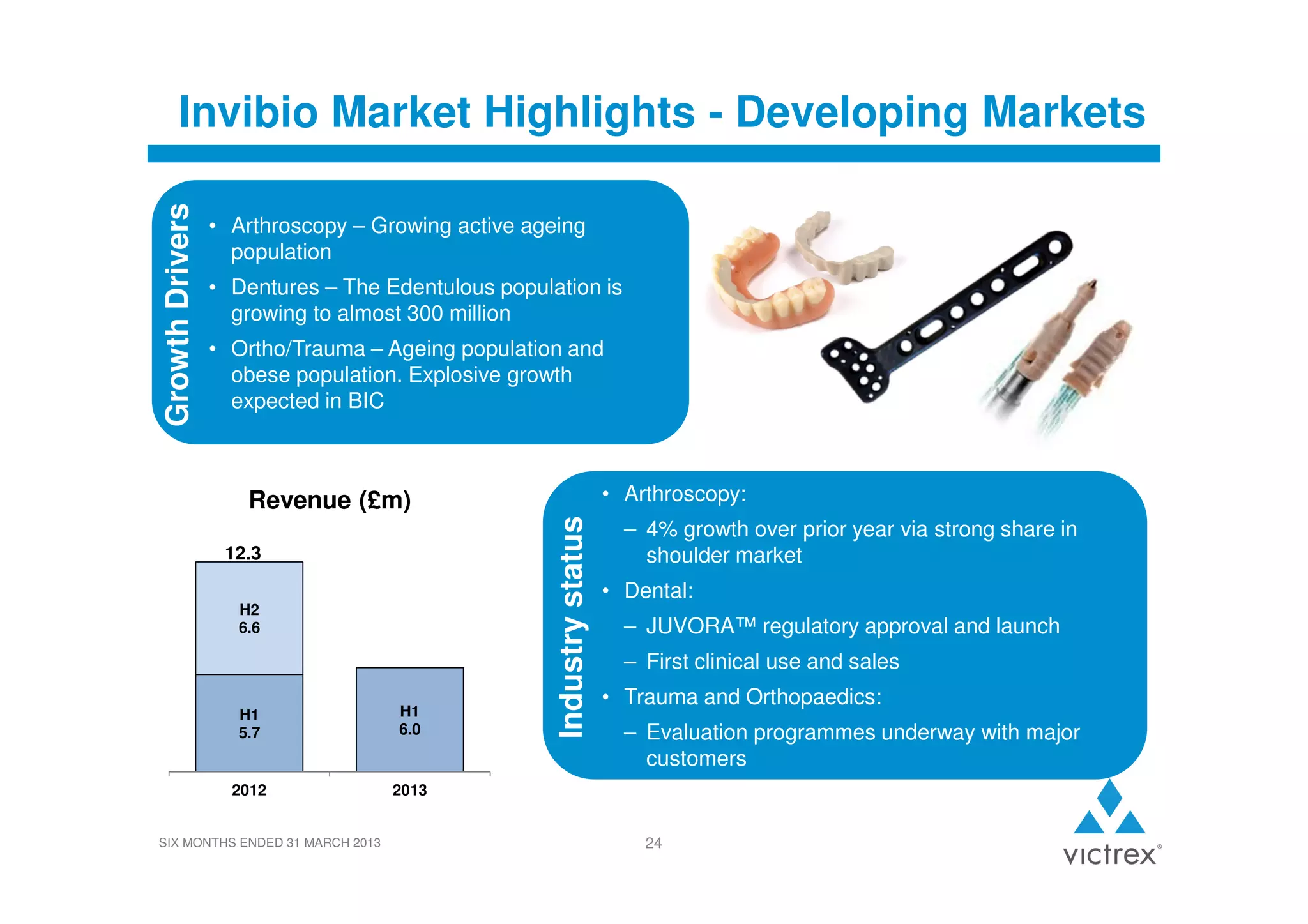

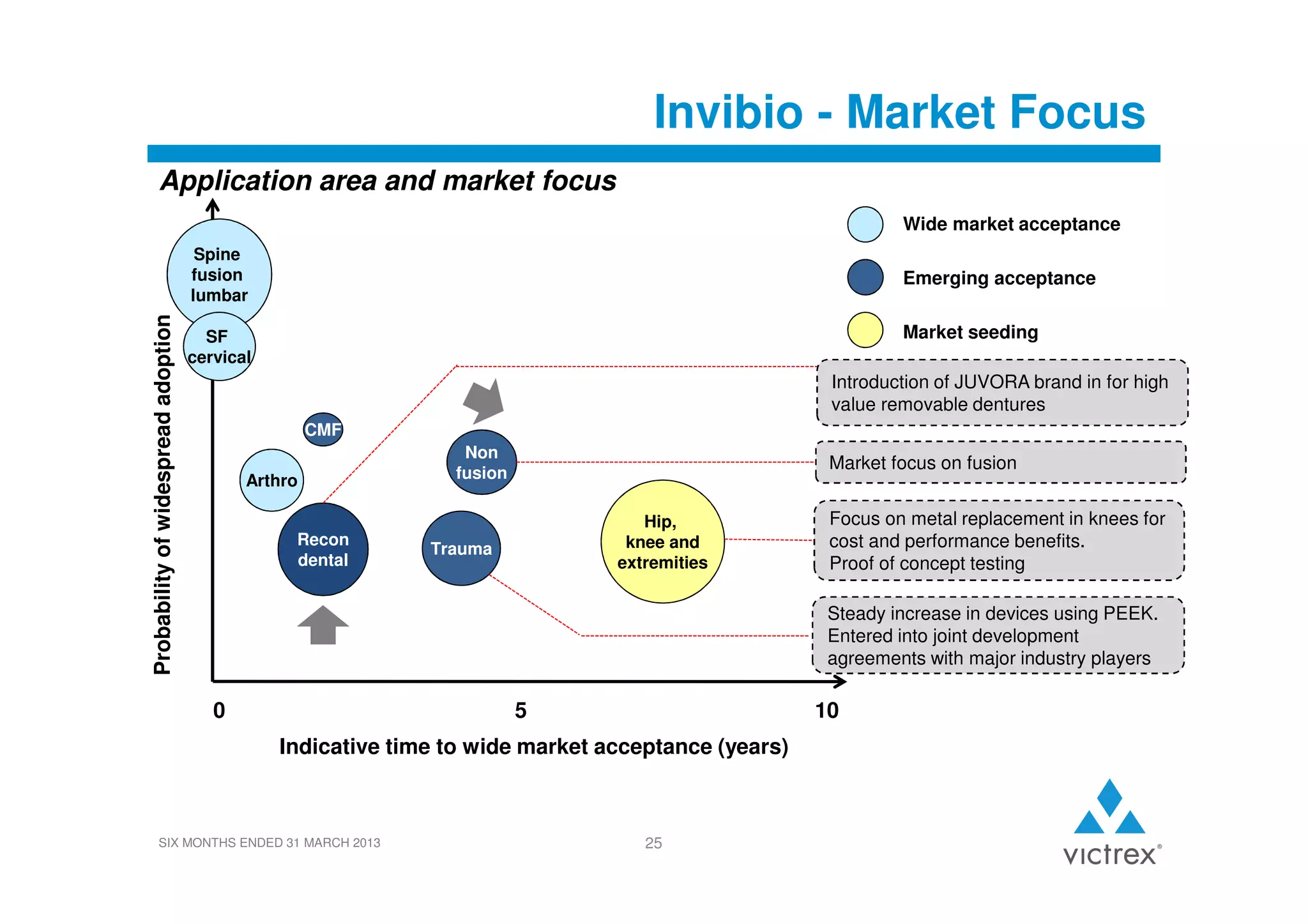

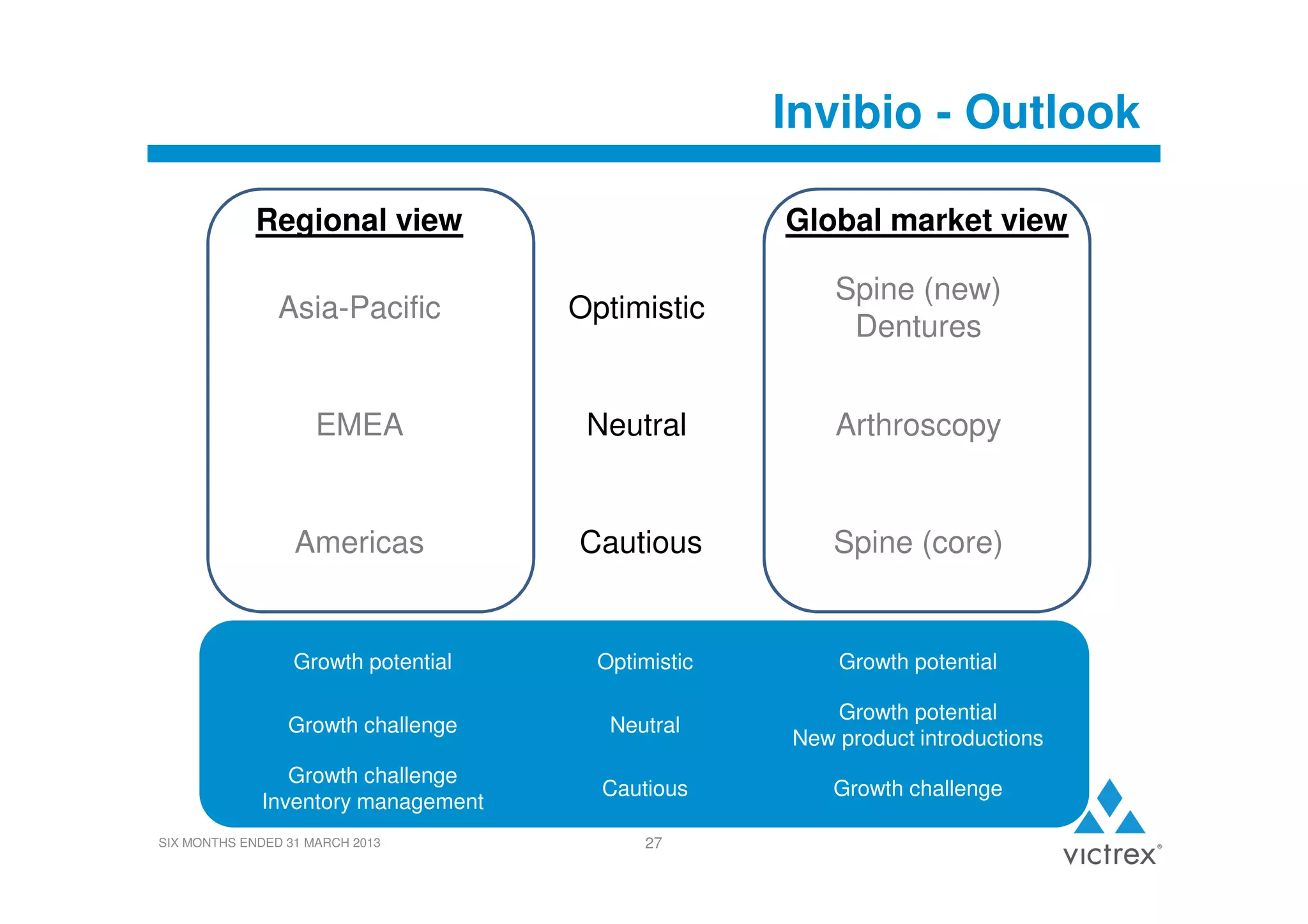

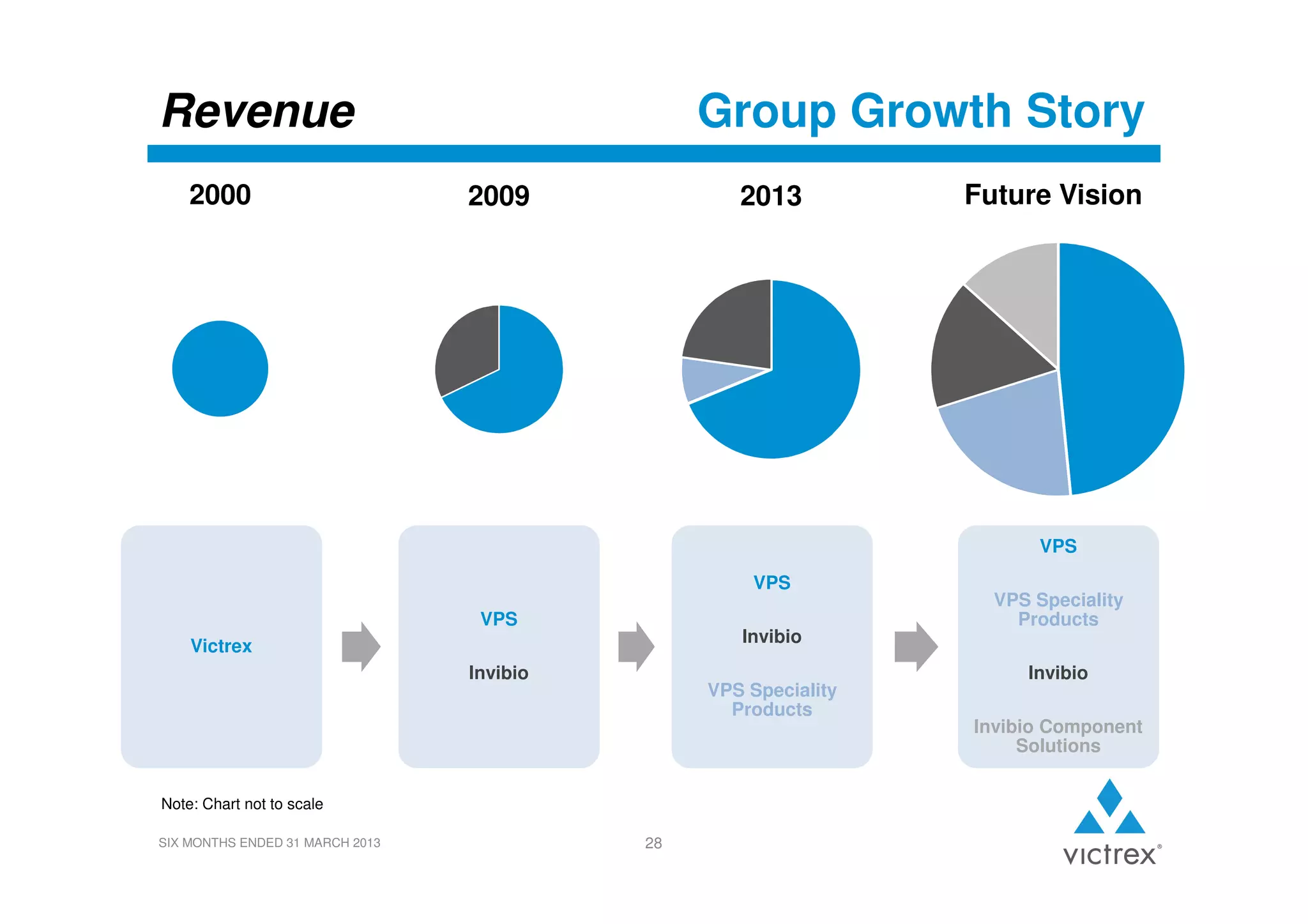

Victrex reported its half-yearly results for the period ending March 31, 2013. Revenue and earnings per share were slightly ahead of the previous year. Gross margins were maintained despite challenging market conditions. The company continued investing in key growth programs and PEEK capacity expansion. The interim dividend was increased by 15%. Both VPS and Invibio saw resilience in difficult markets, with VPS revenue up 1% and Invibio revenue down 5% from the previous year. The outlook remains cautiously optimistic with a continued focus on driving volume growth and expanding product offerings.