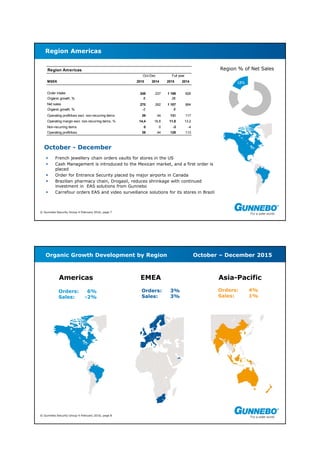

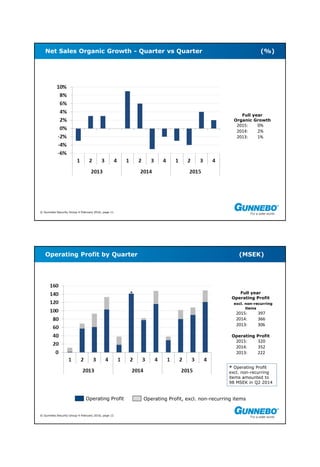

In the fourth quarter of 2015, Gunnebo Security Group saw increased organic order intake of 3% and sales growth of 2%. Key highlights included orders from airports in Germany and Canada, metro lines in China, and the launch of cash management solutions in Mexico. The operating margin was 8.9% excluding non-recurring items. For the full year, organic sales growth was flat while operating profit excluding non-recurring items was 397 MSEK and the operating margin was 6.6%.