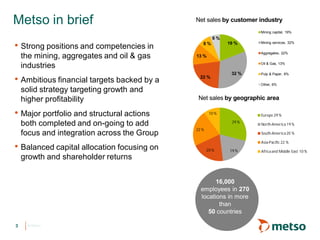

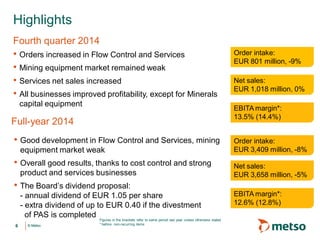

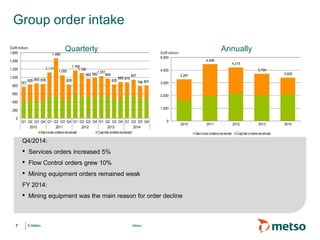

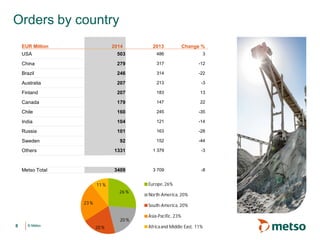

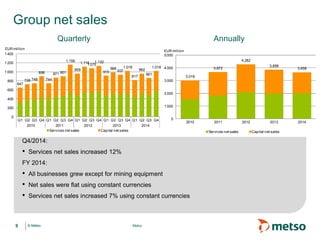

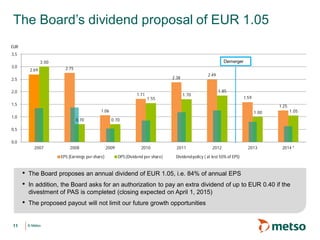

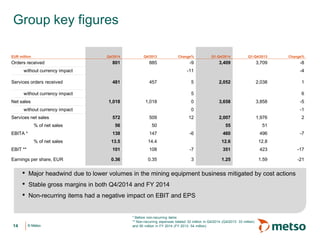

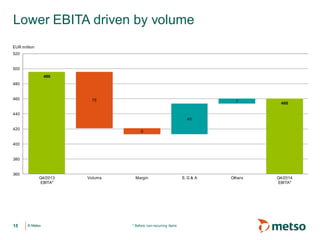

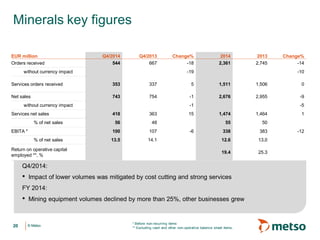

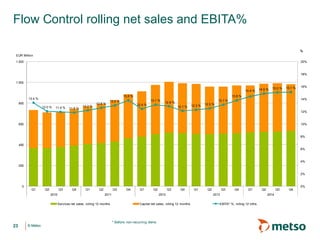

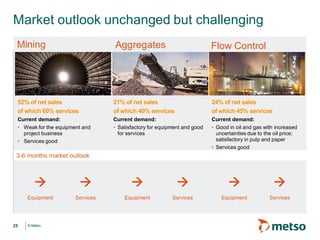

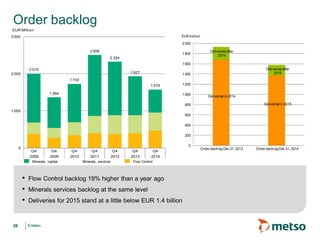

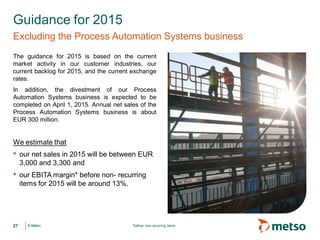

Metso's February 2015 report outlines the company's forward-looking statements concerning economic conditions, customer industry trends, and growth expectations, emphasizing risks that may affect actual performance. The company reported net sales of EUR 3,658 million in 2014, with growth in services and achieved a 12.6% EBITA margin despite challenges in the mining equipment market. Additionally, a dividend proposal of EUR 1.05 per share and strategic divestments are planned to enhance profitability and shareholder returns.