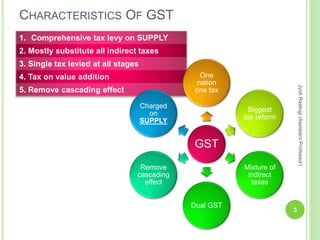

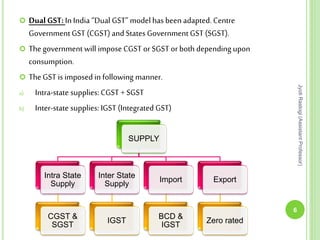

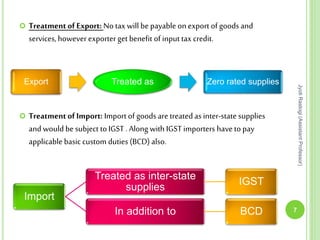

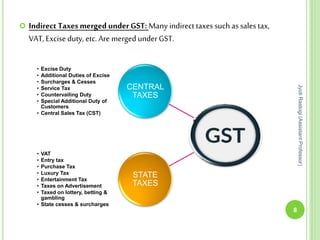

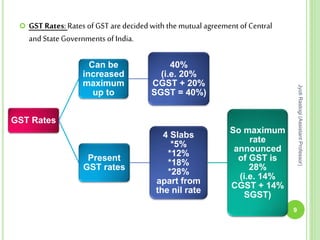

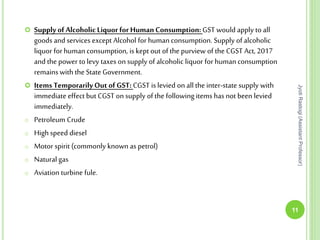

GST is a comprehensive indirect tax that will replace multiple taxes into a single tax applicable at all stages of supply of goods and services. It is based on the principle of destination and follows a dual GST model with CGST imposed by the central government and SGST by state governments. Exports are zero-rated while imports attract an IGST in addition to basic customs duty. GST will merge several indirect taxes and is divided into multiple tax slabs with the maximum rate being 28%. Certain items like alcohol and petroleum products are temporarily exempted from GST.