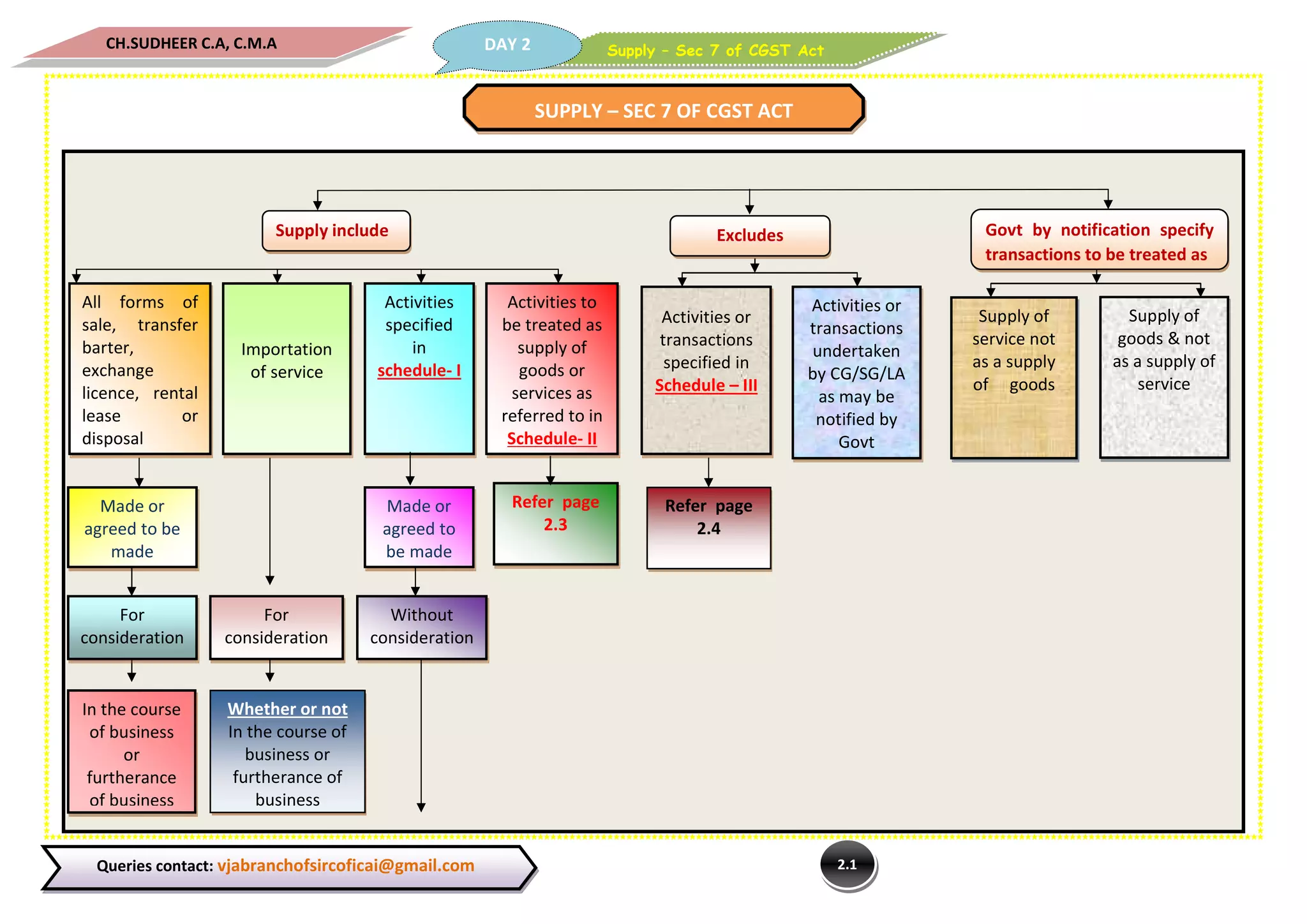

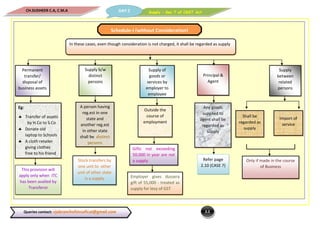

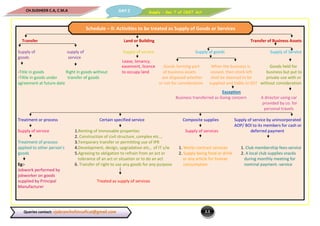

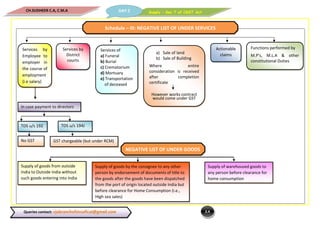

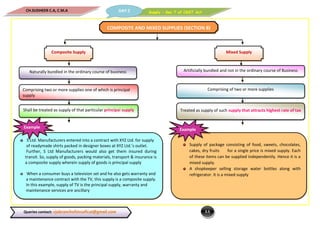

The document discusses the definition of supply under Section 7 of the CGST Act. It provides details on the various types of transactions that are considered a supply, including all forms of sale, transfer, barter, license, rental, lease or disposal of goods and services. It also summarizes the activities listed in Schedules I, II and III of the Act that are treated as supply, with or without consideration. The document further explains concepts of composite supply and mixed supply, and provides examples to distinguish between the two. It clarifies issues related to free samples, buy-one-get-one offers, and principal-agent relationships in the context of what constitutes a supply.