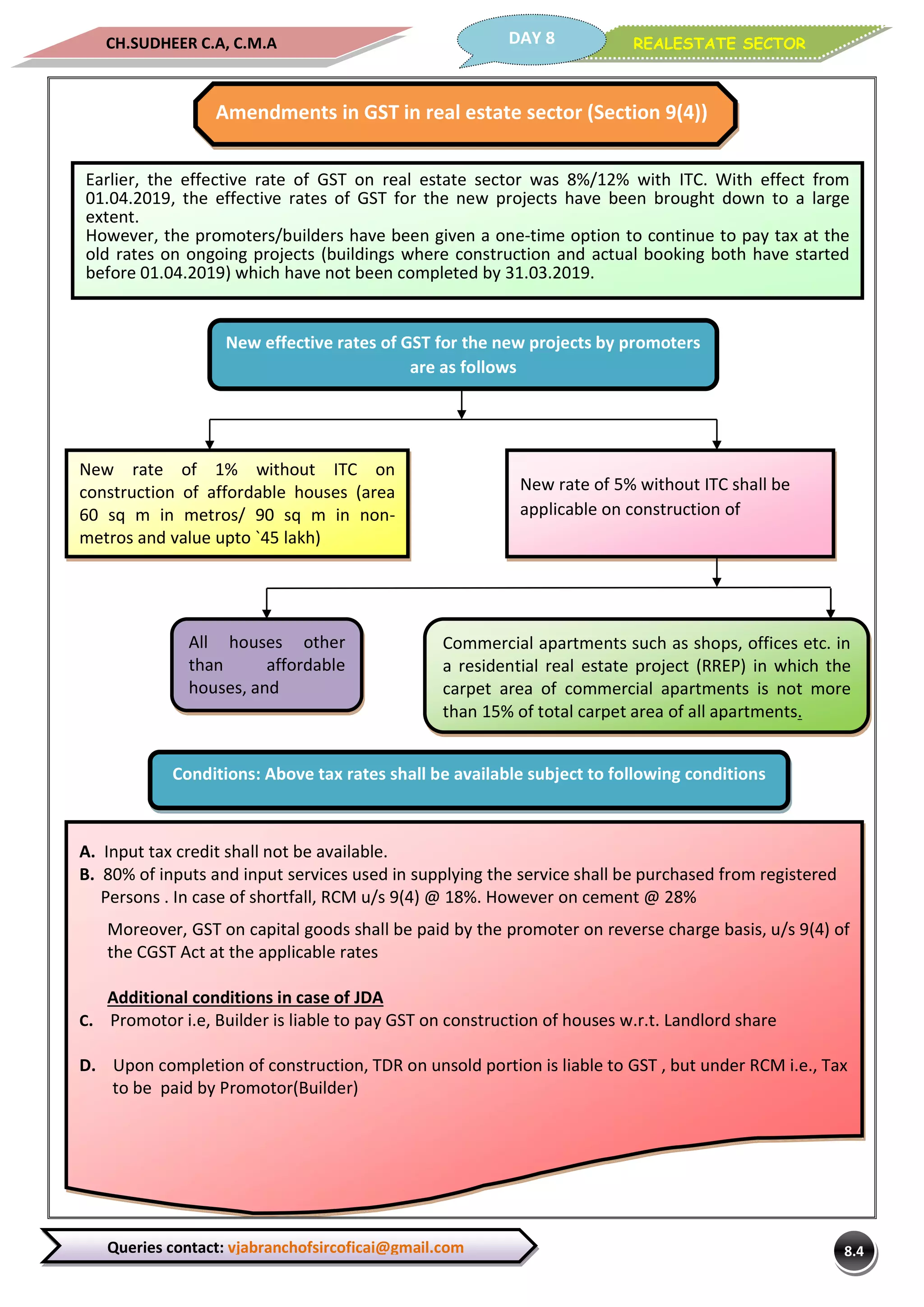

- The document discusses tax rates and rules in the real estate sector under GST in India.

- For new construction projects starting on or after April 1, 2019, the applicable GST rates are 1% without ITC for affordable housing and 5% without ITC for other residential projects and commercial spaces in residential townships.

- The builder/promoter is liable to pay GST under reverse charge mechanism on transfer of development rights or long term lease of land for unsold flats/inventory as on the date of project completion.