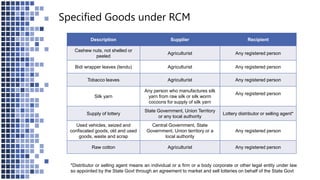

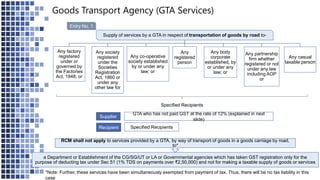

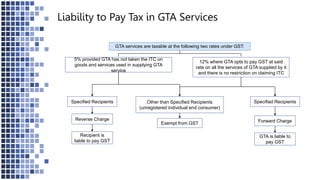

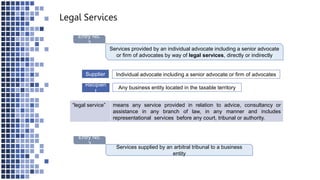

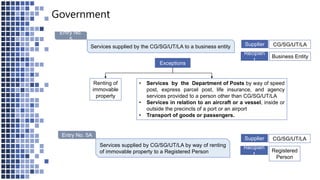

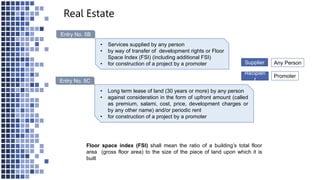

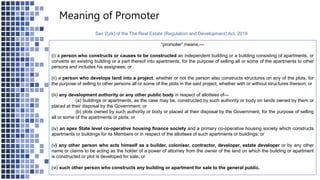

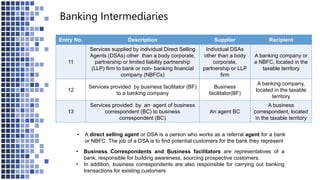

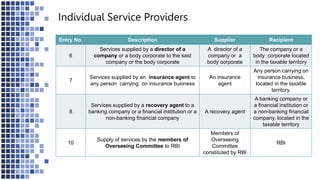

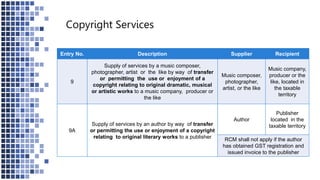

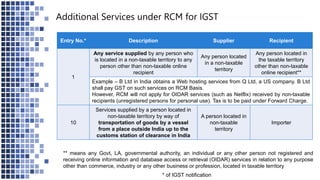

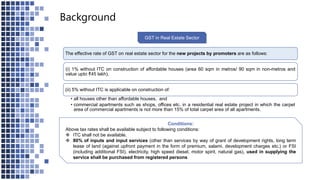

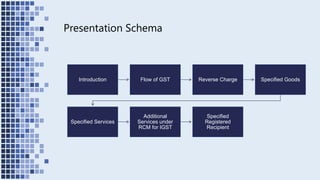

The document outlines the Reverse Charge Mechanism (RCM) under GST, where the liability to pay GST shifts from the supplier to the recipient for specified goods and services. It details the types of supplies affected by RCM, including certain categories of agricultural products, transport services, legal services, and real estate transactions, along with their applicable GST rates. The document also specifies conditions under which the RCM applies and exemptions based on the nature of the recipient or the service provided.

![Introduction

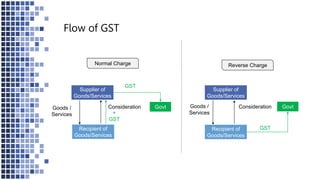

Under GST, the supplier of goods or services is liable to pay the tax to the Government.

However, under the reverse charge mechanism (RCM), the liability to pay GST is cast on

the recipient of the goods or services.

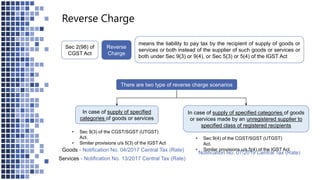

Reverse charge means the liability to pay tax is on the recipient of supply of goods or

services instead of the supplier of such goods or services, in respect of notified categories of

supply.

The burden to pay GST ultimately lies on the recipient only

Therefore, under RCM, only the compliance requirements, [i.e. to obtain registration under GST,

deposit the tax with the Government, filing returns, etc.] have been shifted from supplier to recipient.

However, the underlying principle of indirect tax is that tax burden has to be ultimately borne by the recipient.](https://image.slidesharecdn.com/reversechargeundergst-200213042737-240421104633-3ecd5023/85/reversechargeundergstfinal-200213042737-pptx-4-320.jpg)