The document summarizes several economic theories of consumption:

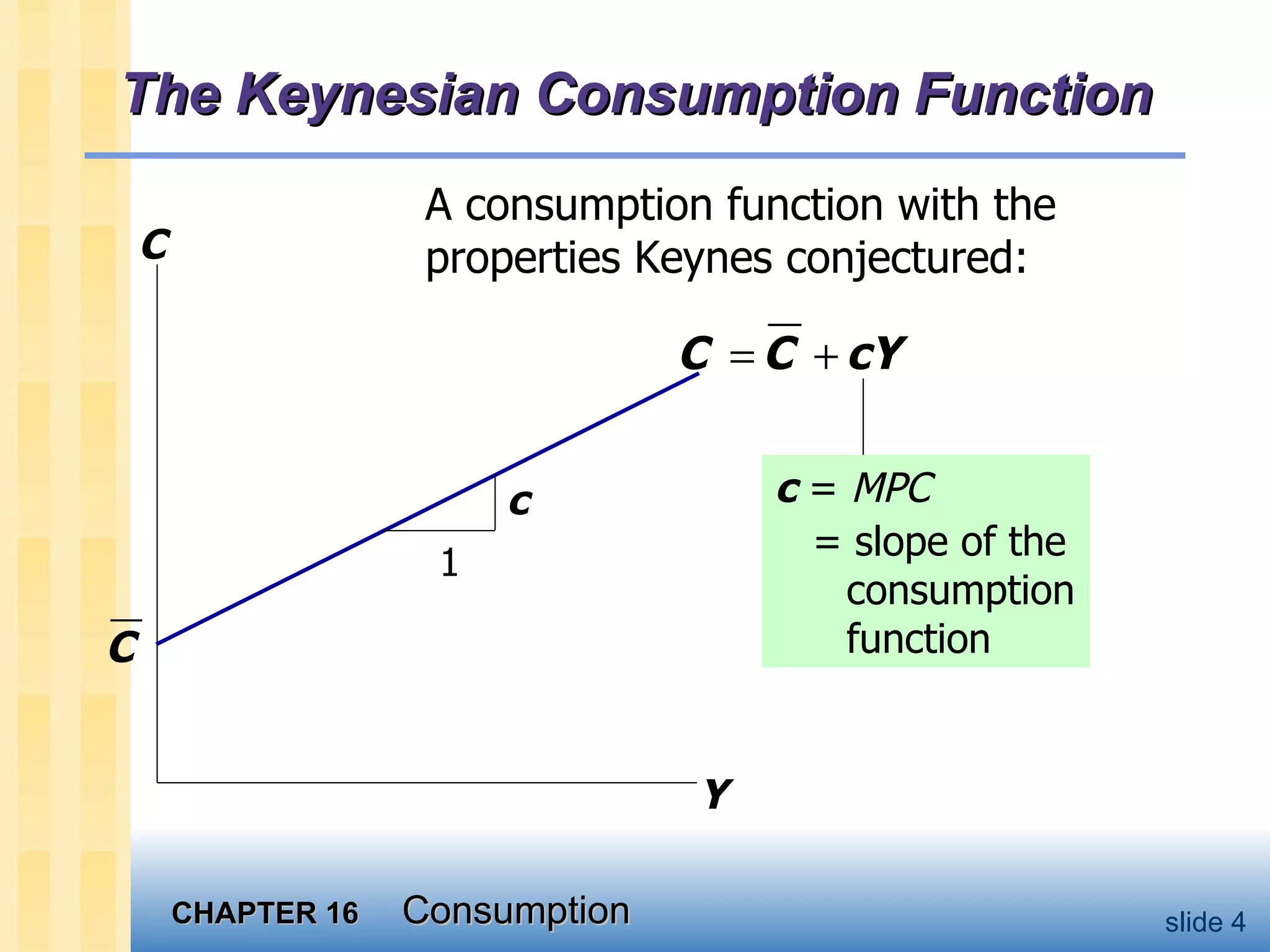

1) John Maynard Keynes theorized that consumption depends on current income, while later models incorporated expected future income and wealth.

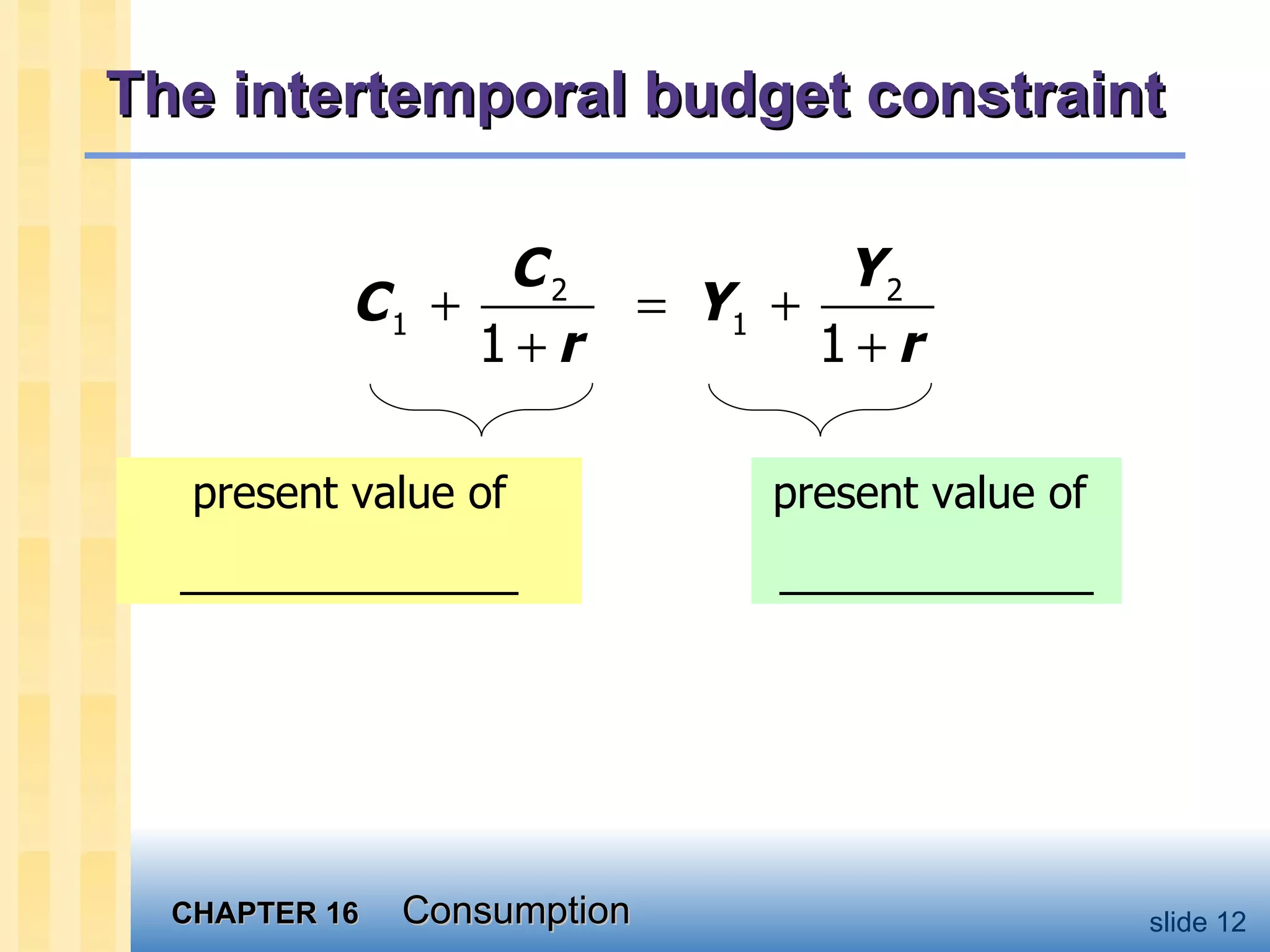

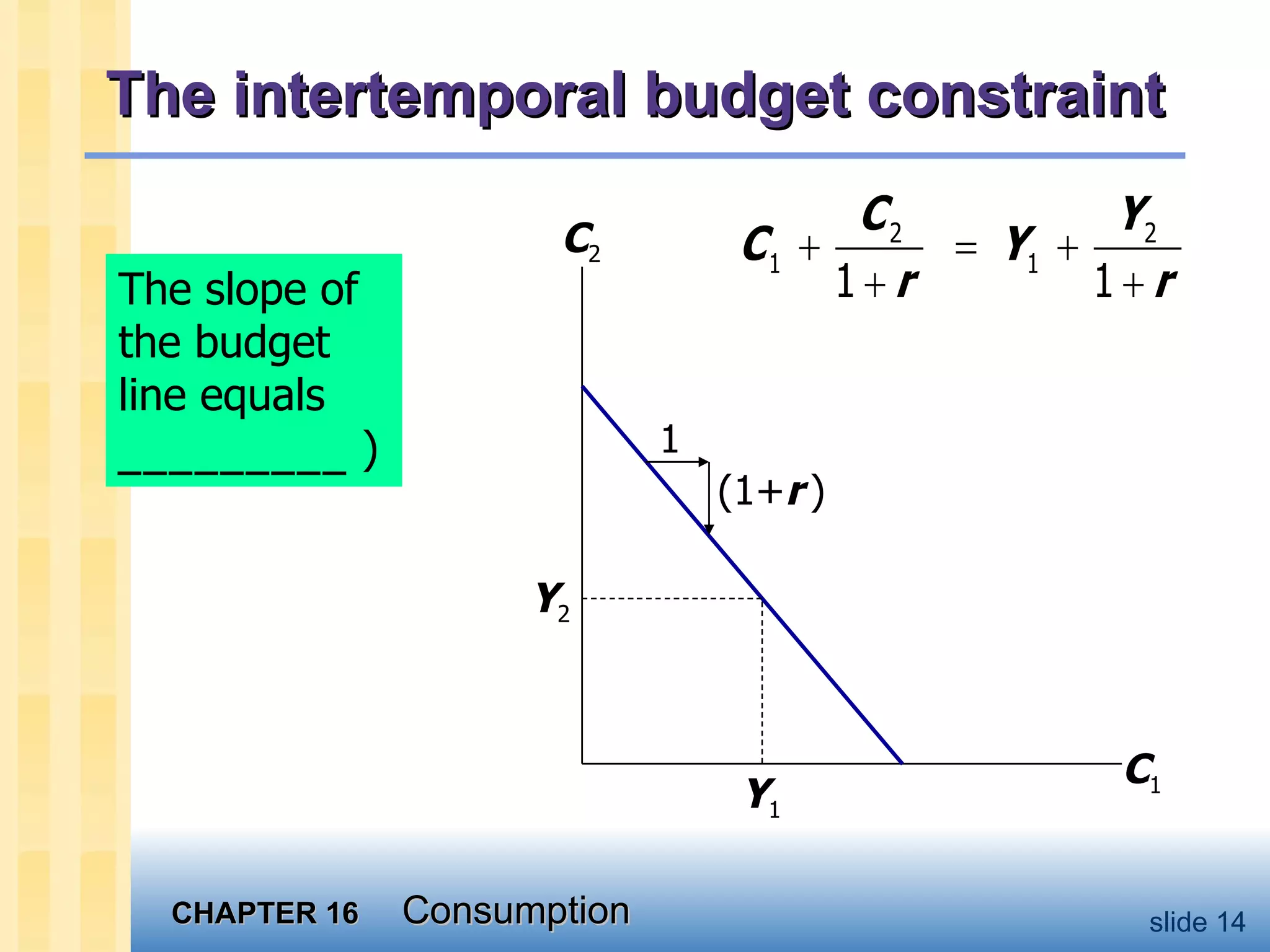

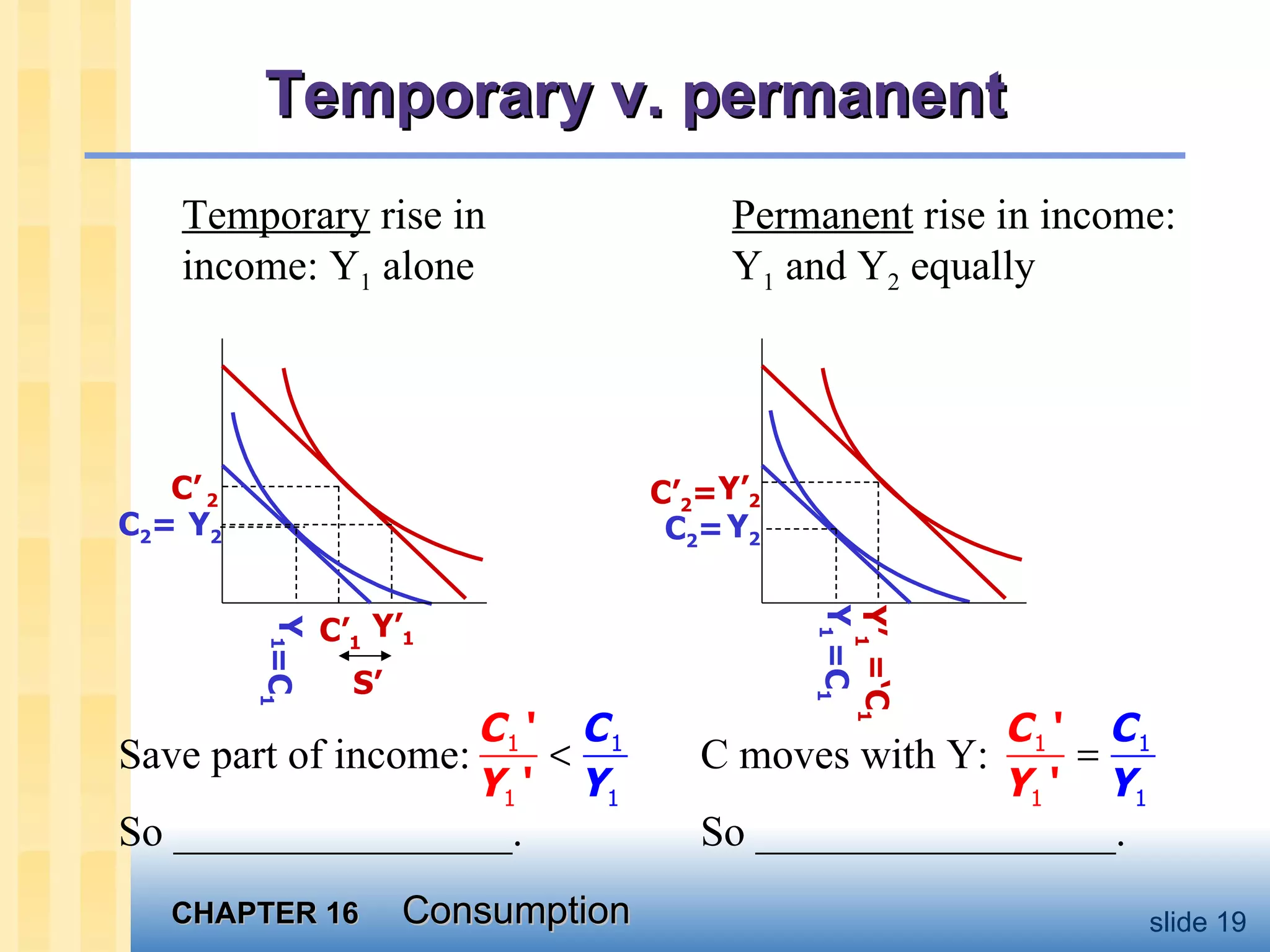

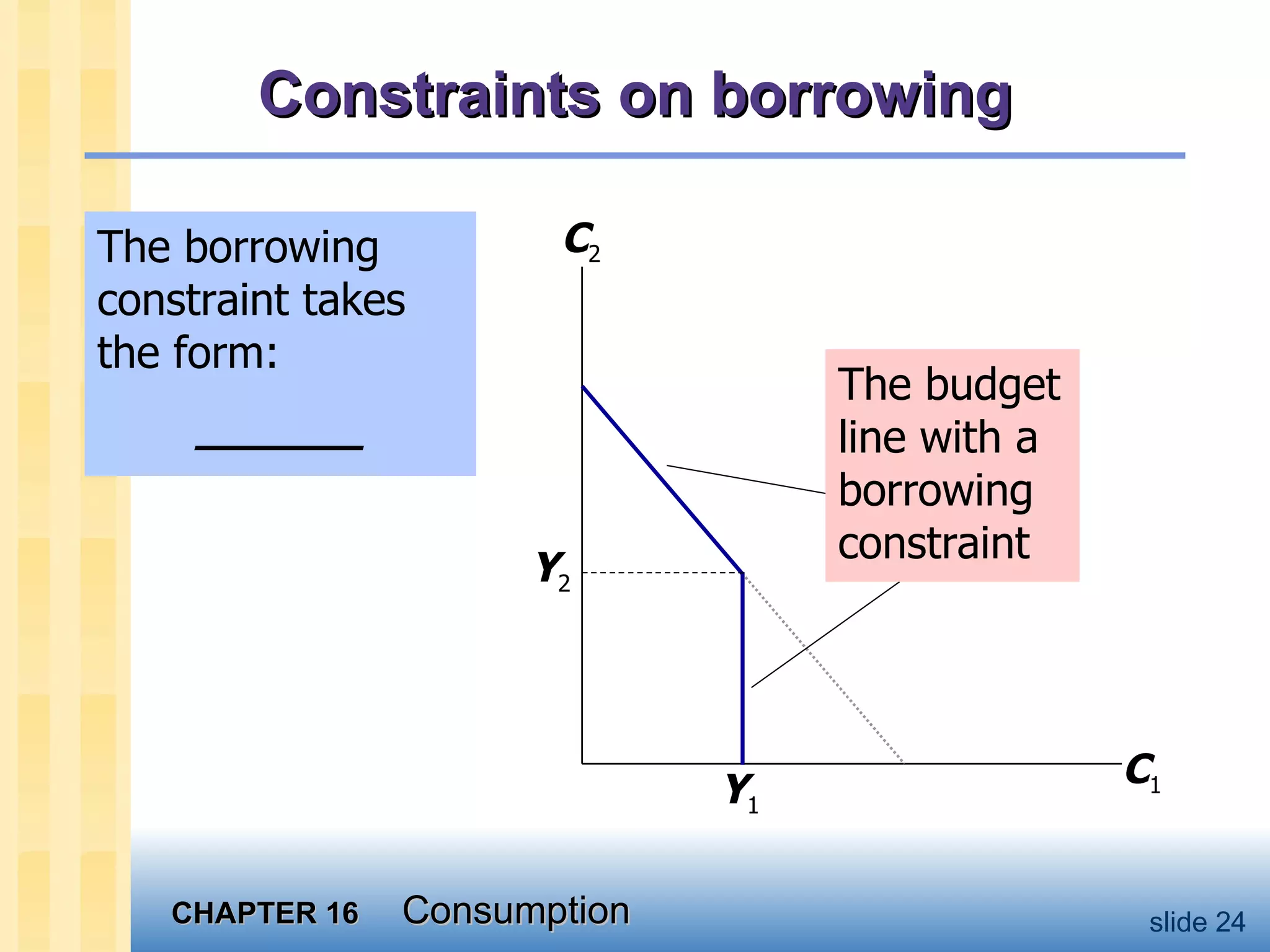

2) Irving Fisher introduced intertemporal choice theory, assuming consumers maximize lifetime utility subject to budget constraints.

3) Franco Modigliani's life-cycle hypothesis proposes consumption varies over a person's life cycle as they save during working years and dissave in retirement.

4) Milton Friedman's permanent income hypothesis views current income as having permanent and transitory components, with consumption based on permanent income.