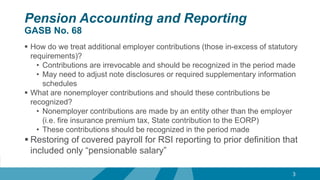

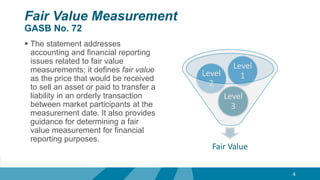

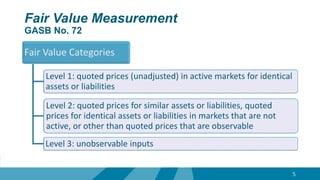

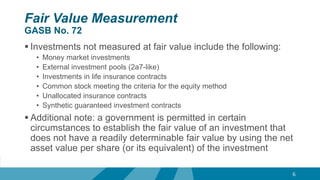

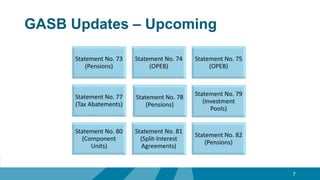

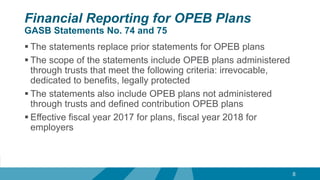

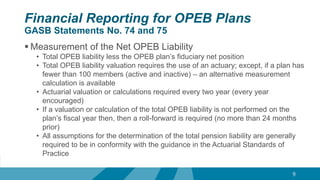

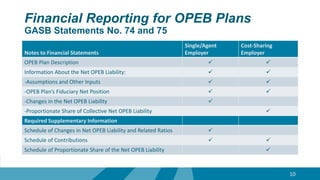

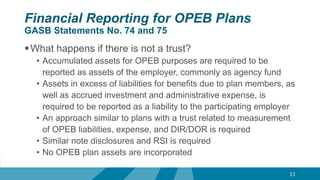

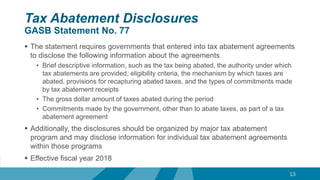

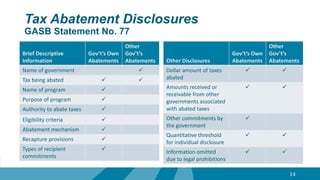

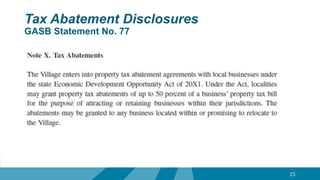

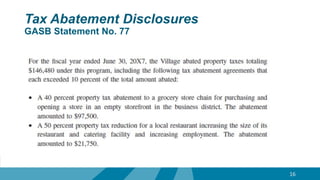

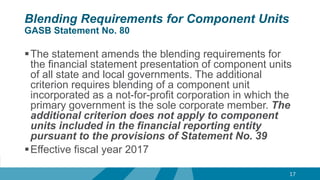

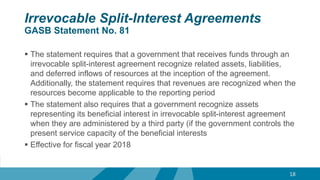

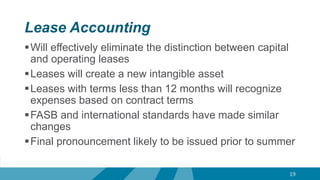

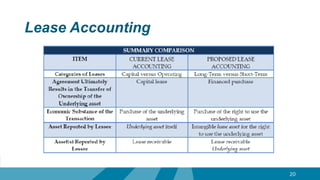

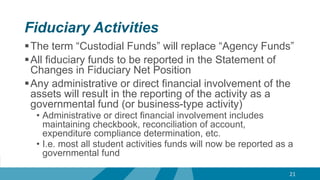

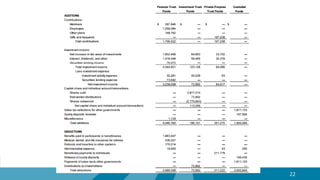

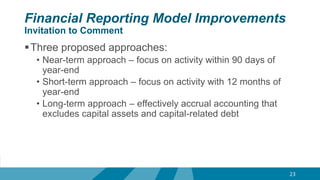

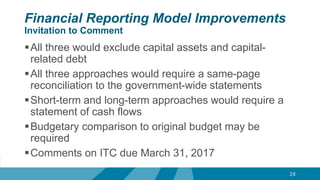

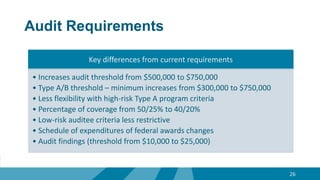

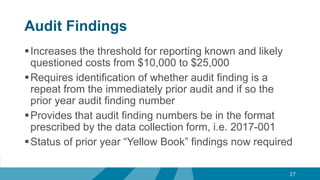

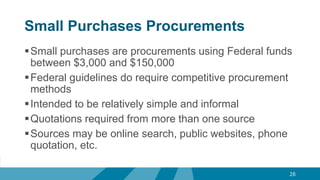

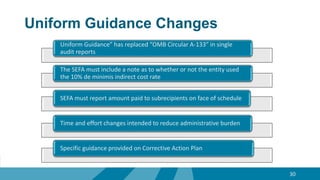

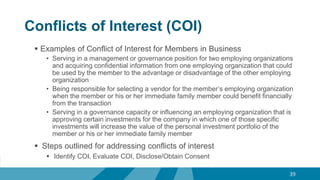

This document outlines updates from the Governmental Accounting Standards Board (GASB) regarding pension accounting, financial reporting for other post-employment benefits (OPEB) plans, tax abatement disclosures, and lease accounting among others. Key highlights include new requirements for recognizing employer and nonemployer contributions, fair value measurement definitions and categories, and the introduction of significant changes in auditing and procurement processes under the uniform guidance. The document also addresses changes in professional conduct standards for accountants, specifically regarding conflicts of interest and ethical responsibilities.