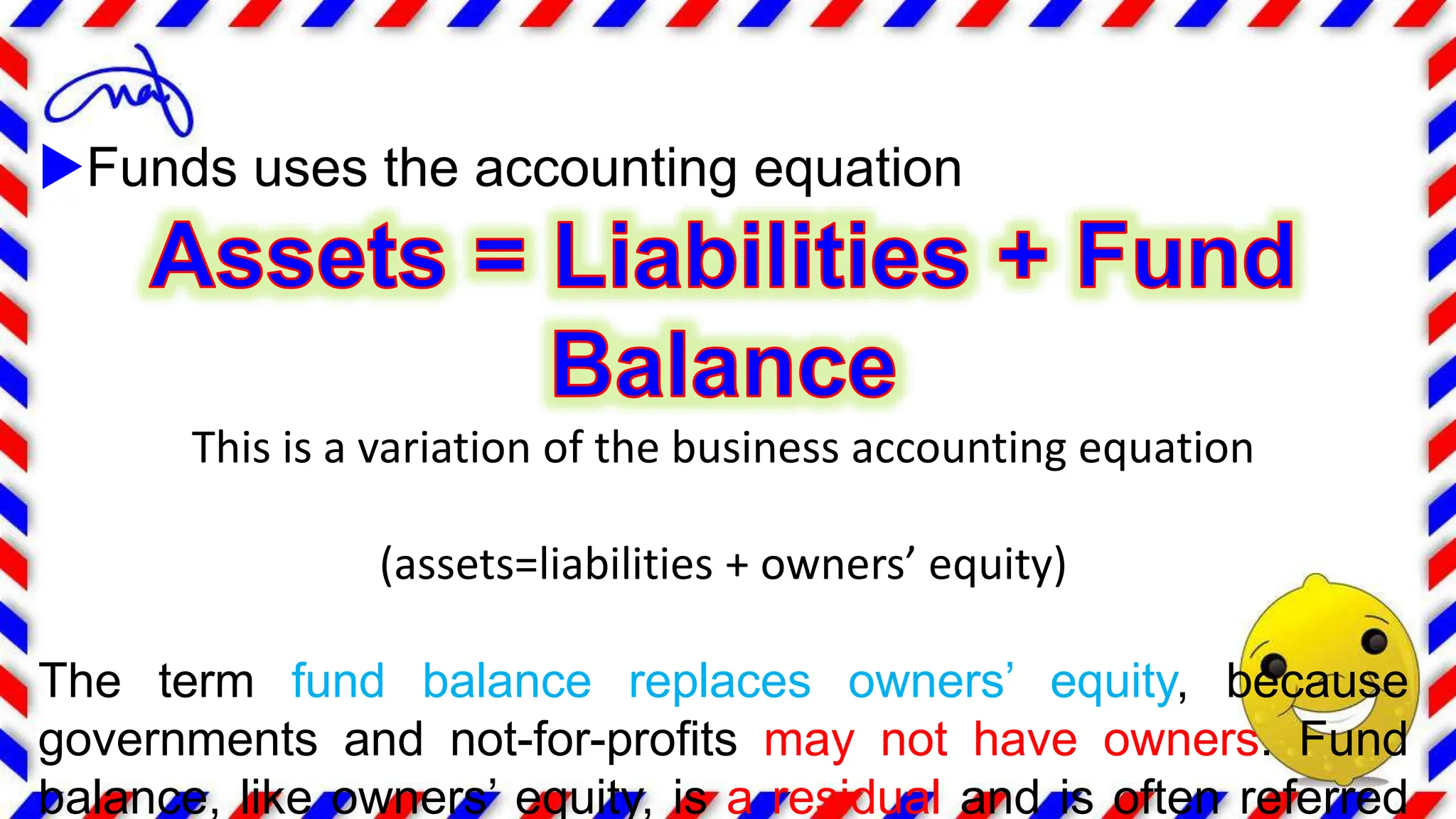

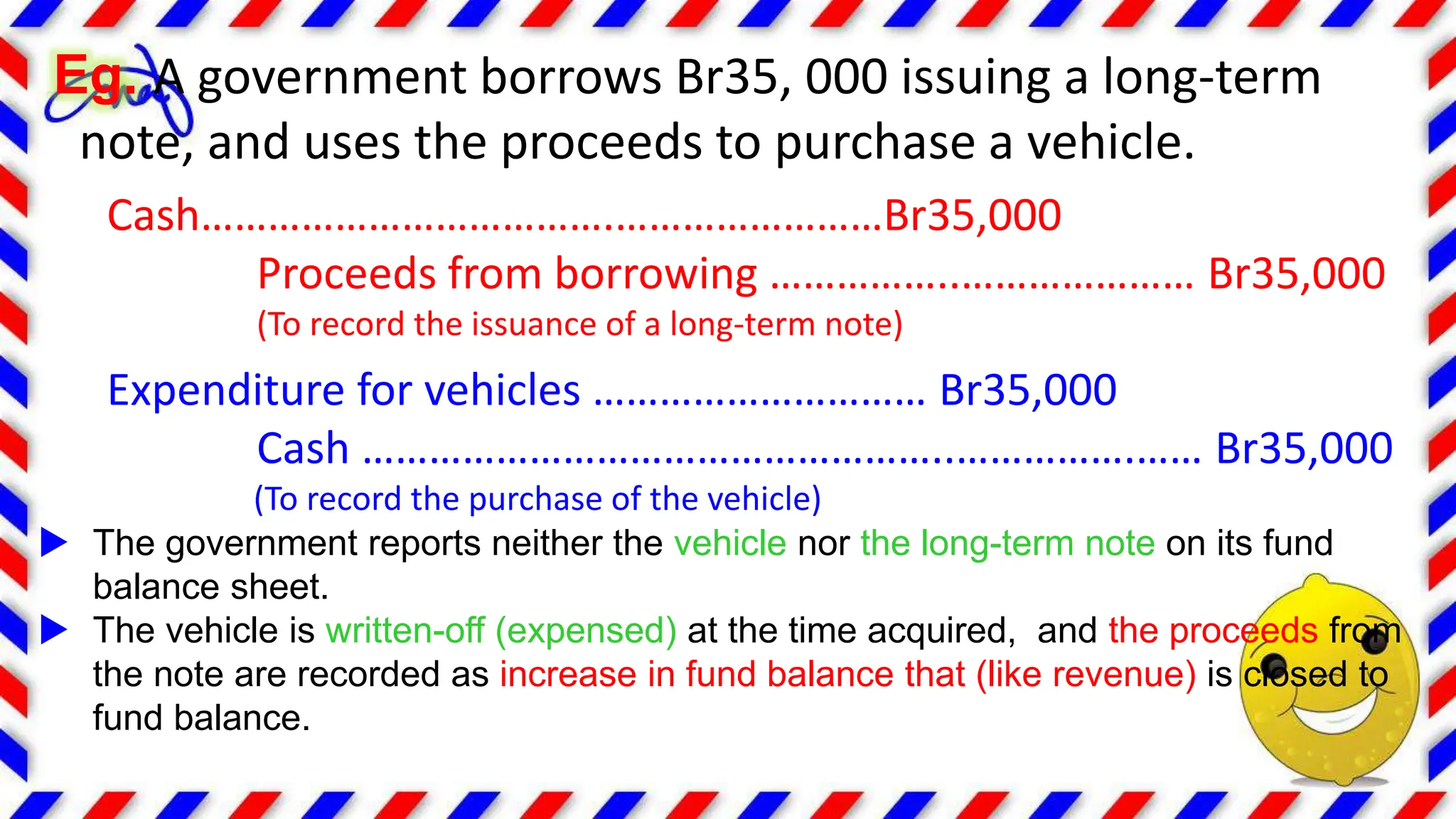

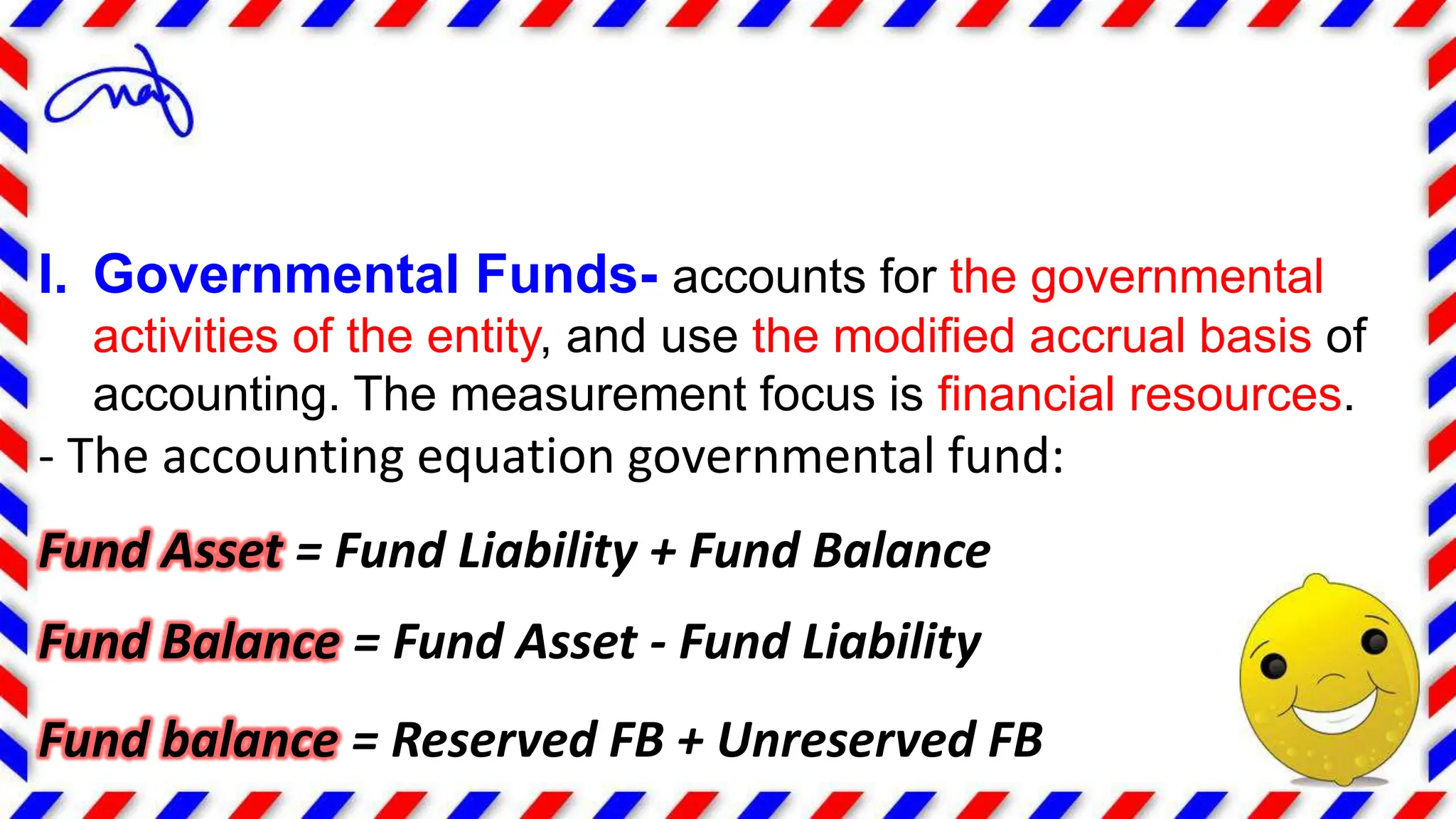

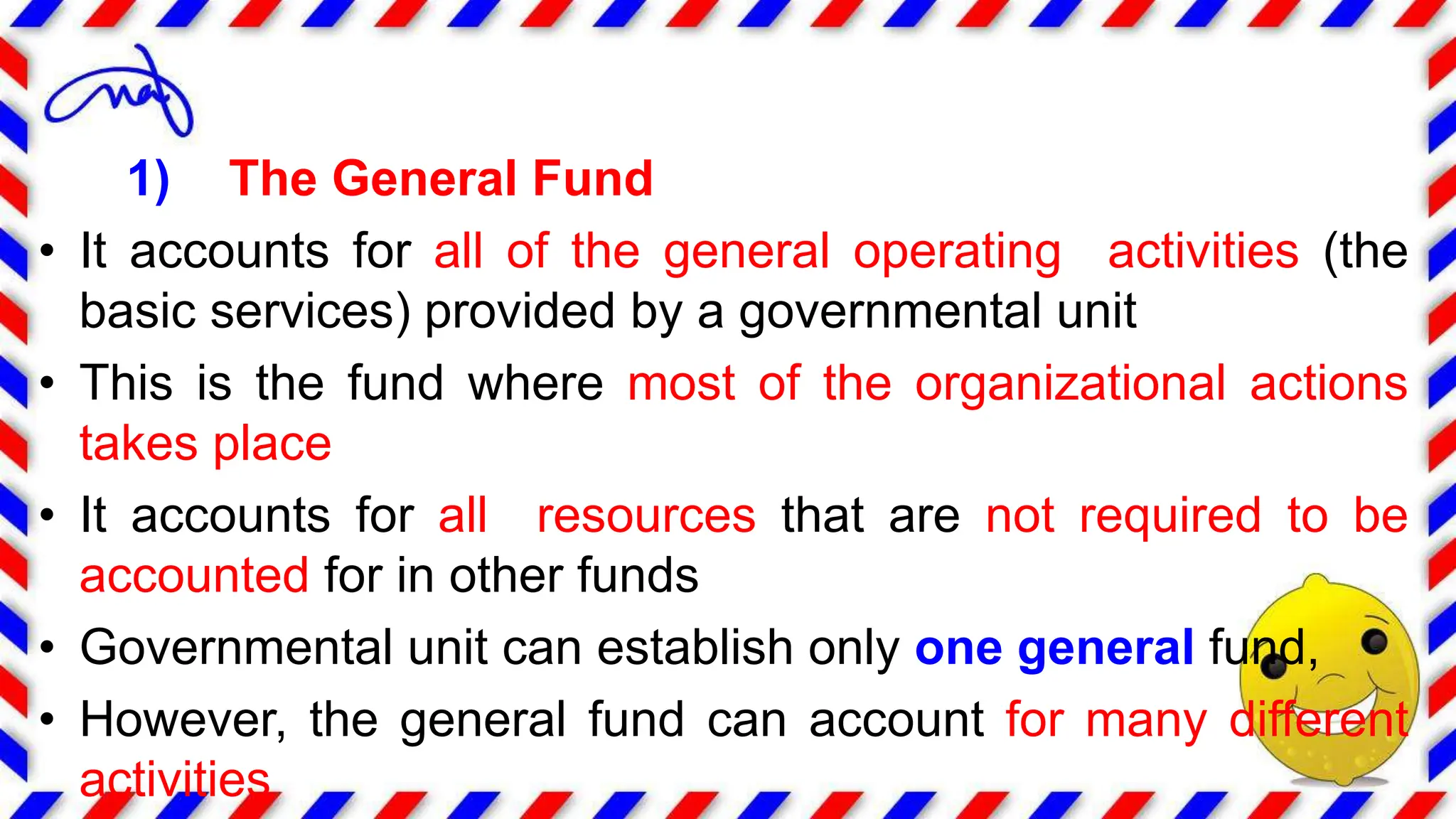

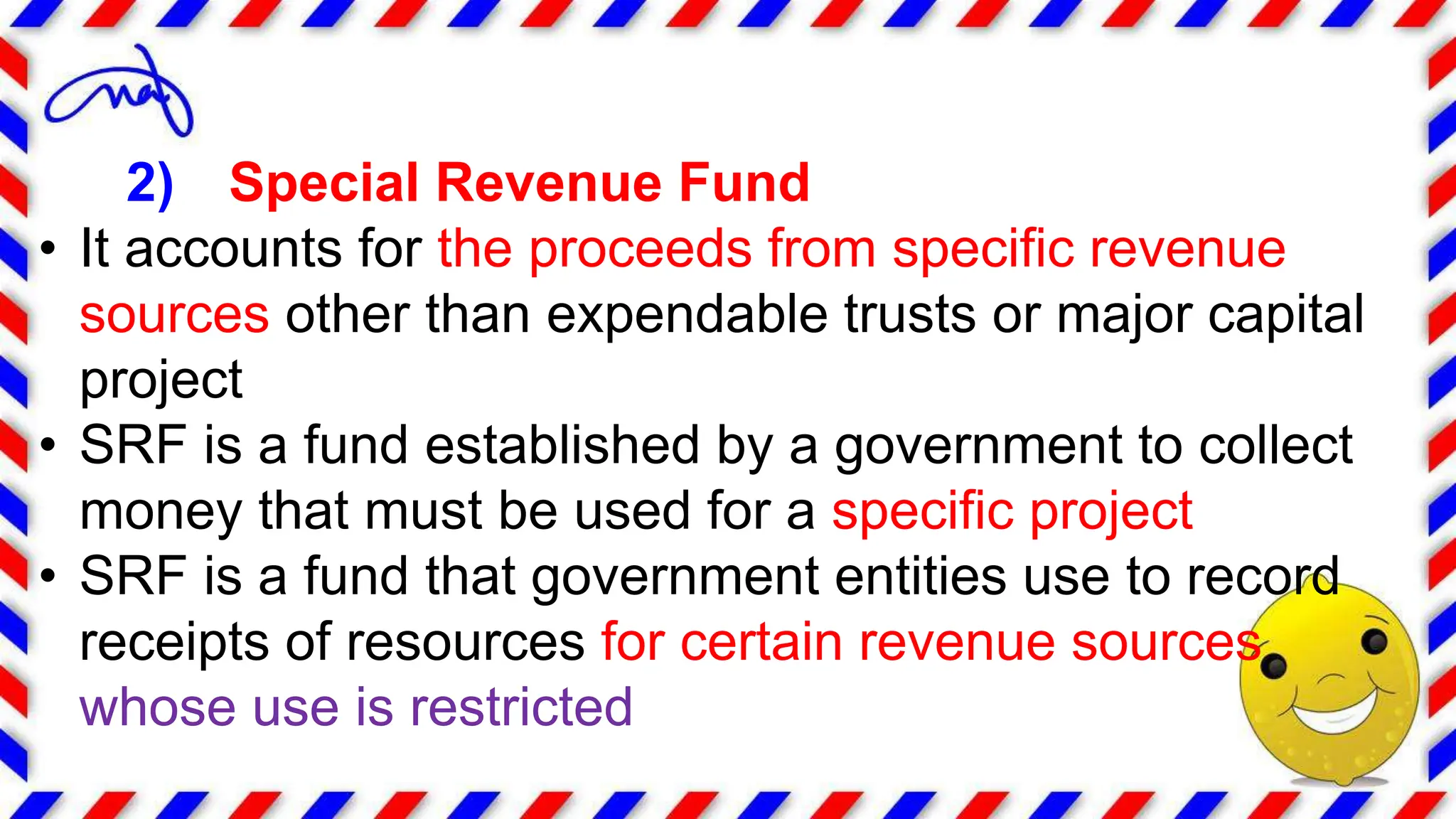

This document discusses the principles of accounting and financial reporting for governmental activities. It outlines three types of services governments provide - government, business, and fiduciary - and the corresponding principles for each. For governmental activities, fund accounting is used with the general fund, special revenue funds, capital projects funds, debt service funds, and permanent funds. Proprietary funds use accrual accounting and include enterprise and internal service funds. Fiduciary funds account for assets held in trust and include pension, investment, private purpose, and agency funds. The key principles discussed are fund accounting, the basis of accounting and measurement focus, and budgetary accounting.