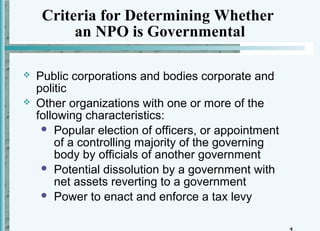

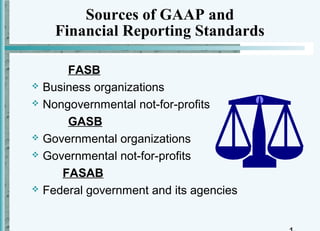

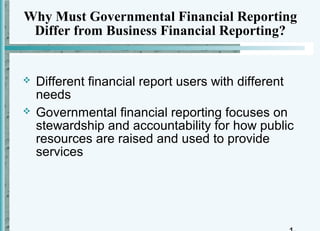

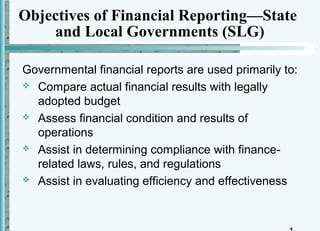

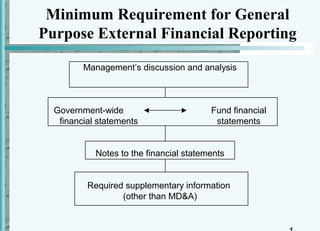

The document provides an overview of accounting and financial reporting for governmental and nonprofit entities. It discusses the key characteristics and objectives of financial reporting for these organizations, which differ from for-profit entities in their lack of profit motive and resource providers. The authoritative bodies that set standards for governmental and nonprofit accounting are also identified. An overview of the key elements of a comprehensive annual financial report for a state or local government is given, including the government-wide statements, fund statements, and statistical section.